Hyperliquid (HYPE) extended its rebound in the latest session, climbing over 25% as trading activity across its HIP-3 derivatives markets surged to new highs and large wallets increased exposure. The move places HYPE among the strongest performers in the decentralized exchange segment, even as broader altcoin markets remain range-bound. The latest rally appears to be driven by a combination of real usage growth and renewed capital inflows rather than speculative momentum alone.

With both volume and on-chain data turning supportive, HYPE is beginning to trade like a structurally re-rated asset rather than a short-term rotation.

That shift is now raising a central question for the market: is this simply a reaction to elevated trading activity, or the early phase of a broader repricing cycle?

HIP-3 Metrics Activity Signal

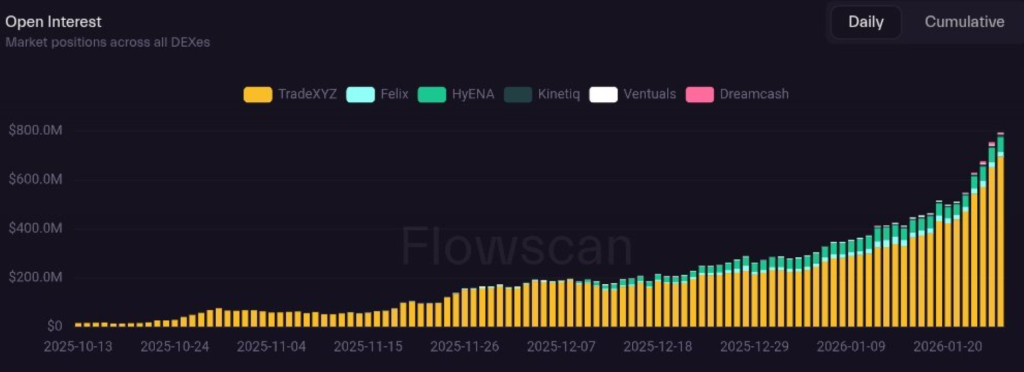

Since the rollout of HIP-3, open interest on Hyperliquid has climbed steadily from sub-$200 million levels to the $700–800 million range, marking one of the strongest participation expansions in the platform’s history. This kind of sustained build in outstanding positions typically reflects a shift in user behavior, where traders are no longer rotating capital opportunistically but instead deploying it with longer-term positioning in mind.

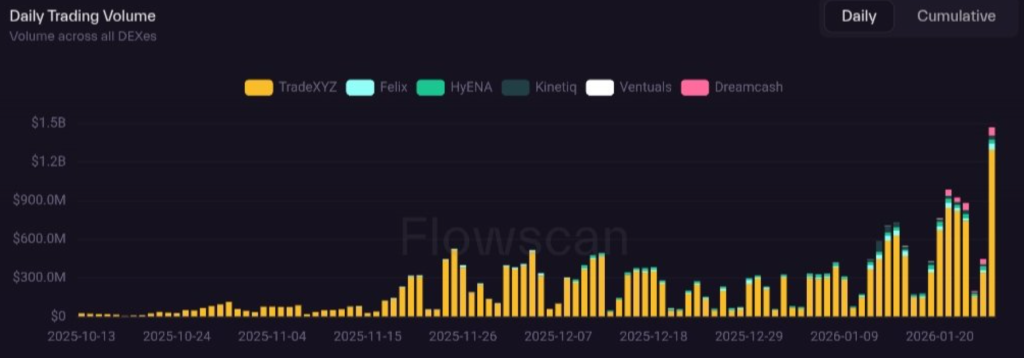

Alongside this, daily trading volume has accelerated sharply, pushing beyond the $1 billion threshold and holding elevated levels across multiple sessions. The persistence of volume is critical here. Rather than fading after a single catalyst, activity has remained consistently high, which points to deeper liquidity and broader market engagement across supported assets.

HIP-3 appears to be the core driver behind this shift. By improving capital efficiency and expanding asset support, the upgrade has materially changed how traders interact with Hyperliquid. Execution depth has improved, leverage utilization has increased, and liquidity provision has become more attractive for larger participants.

What Does Whale Activity Signals?

On-chain data shows that a large whale has begun distributing a long-held HYPE position after more than a year of accumulation and staking. According to data, the wallet originally spent $2.58 million USDC to acquire 295,917 HYPE at an average price of $8.74, before staking the entire position for roughly 14 months.

This week, the same wallet unstaked and sold the full allocation for $7.51 million USDC, locking in realized profit of approx. $4.92 million. At the cycle peak, the unrealized profit on the position had exceeded $15 million. This reflects healthy distribution, where long-term holders monetize gains while new capital absorbs supply.

HYPE Price Chart Shows Breakout: Major Rally Next?

HYPE price chart structure shows a multi-month falling channel breakout, signaling a shift from corrective behaviour into trend reversal. The breakout happened with elevated volume and rising open interest activity favors the bullish outlook. Currently, HYPE price has surpassed the 20-day and 50-day EMA and is heading toward the immediate $30 supply zone.

Once HYPE price clears the $30 hurdle, a major short-covering rally would push HYPE toward $42 followed by $50 in the near term. However, a rejection from the $30 level may lead to breakout retest of the $20-$24 zone ahead. Amidst the bullish sentiment, Hyperliquid’s current rally may gain more pace and continue to deliver outperformance in the coming sessions.

FAQs

HYPE is rallying due to surging HIP-3 trading volume, rising open interest, and increased whale participation driven by real platform usage growth.

HIP-3 improves capital efficiency and liquidity on Hyperliquid, attracting larger traders and boosting derivatives volume across supported markets.

Current data suggests real usage growth, as sustained volume and rising open interest point to longer-term positioning rather than short-term speculation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.