Gold and BTC usually move together, but this has changed greatly in the last 2 years. In the words of BlackRock CEO, Bitcoin is an asset that “prices risk”. As the risk increases, the commodity rises, Bitcoin takes a hit, and we have seen that Bitcoin falls short in inflation as well.

Bitcoin 2026 Bottom Target

Supply shortage story causes rally in silver and gold today Bitcoin Despite institutional demand, it is weak. Everyone has been talking for years that supply will exceed demand due to halving. We mentioned that after 2021, “supply shortage” with strong demand from ETF and treasury companies will push Bitcoin to new heights in an environment where the dollar is weak.

Large companies and ETFs are now much bigger than stock markets BTC it keeps. Strategy alone holds more than 700,000 of the assets with a maximum supply of 21 million. Moreover, a significant portion of this supply is dead, from Satoshi’s holdings to forgotten wallets, millions of BTC will never even enter circulation.

Bitcoin, which has failed to protect against inflation, is now weak in a risk environment, despite the Fed constantly lowering interest rates, albeit with a delay. Geopolitical risks end, the tariff war begins, then another development pulls Bitcoin down again. Probably historical data Will the predicted decline year story come true for 2026? Time will tell.

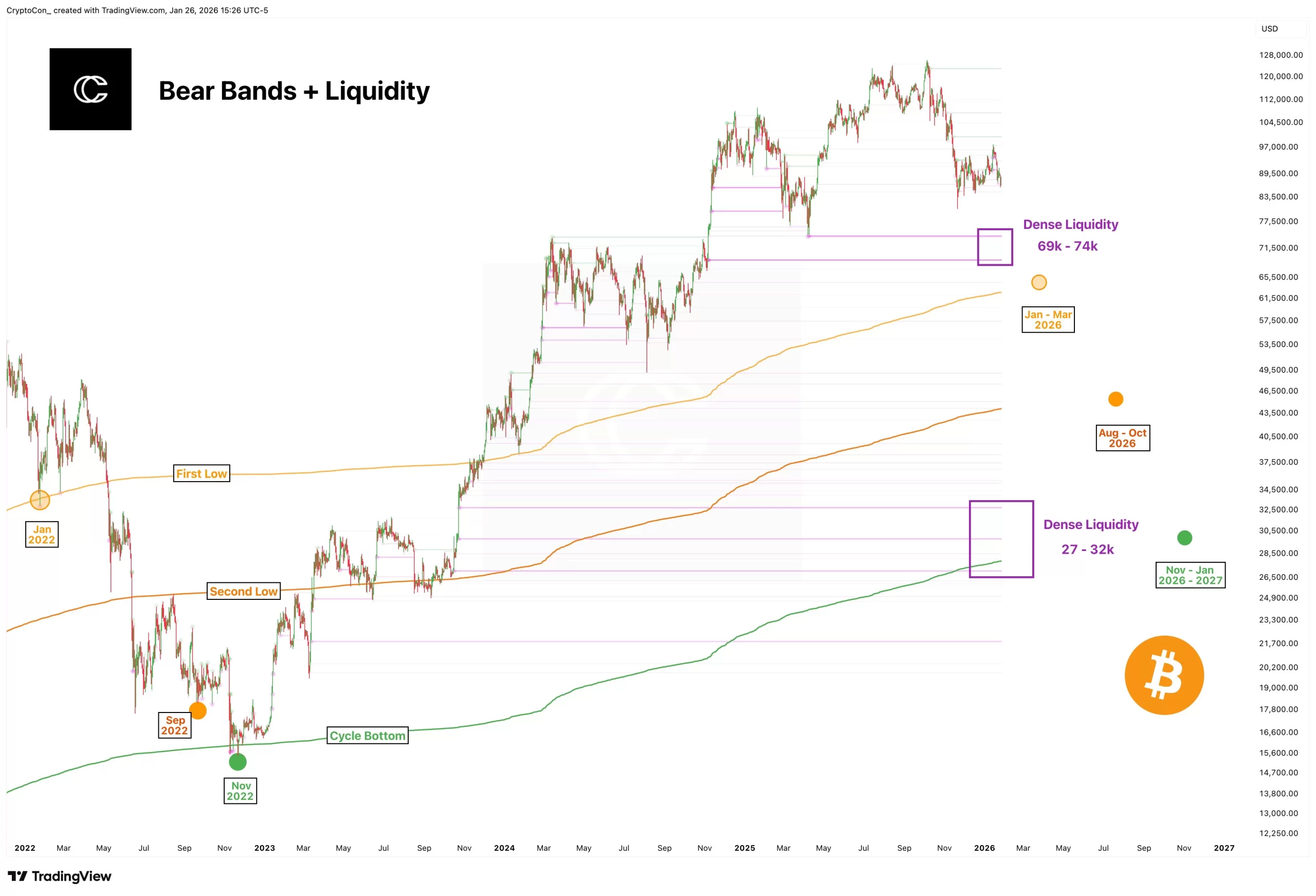

The analyst with the pseudonym CryptoCon shared the chart below, noting some pockets of intense liquidity aligned closely with Bear Bands. This chart points to possible first bottoms and cycle bottoms for BTC.

The first bottom will likely be between $69,000 and $74,000. The bottom of the cycle is between 27 thousand dollars and 32 thousand dollars. Since the rule of preserving the previous peak as support is violated in 2022, deeper bottoms below 69 thousand dollars can be expressed by analysts. Roman Trading is more merciful in this regard and predicts that the bottom of the cycle will be around 56 thousand dollars.

What Happens If Stocks Fall?

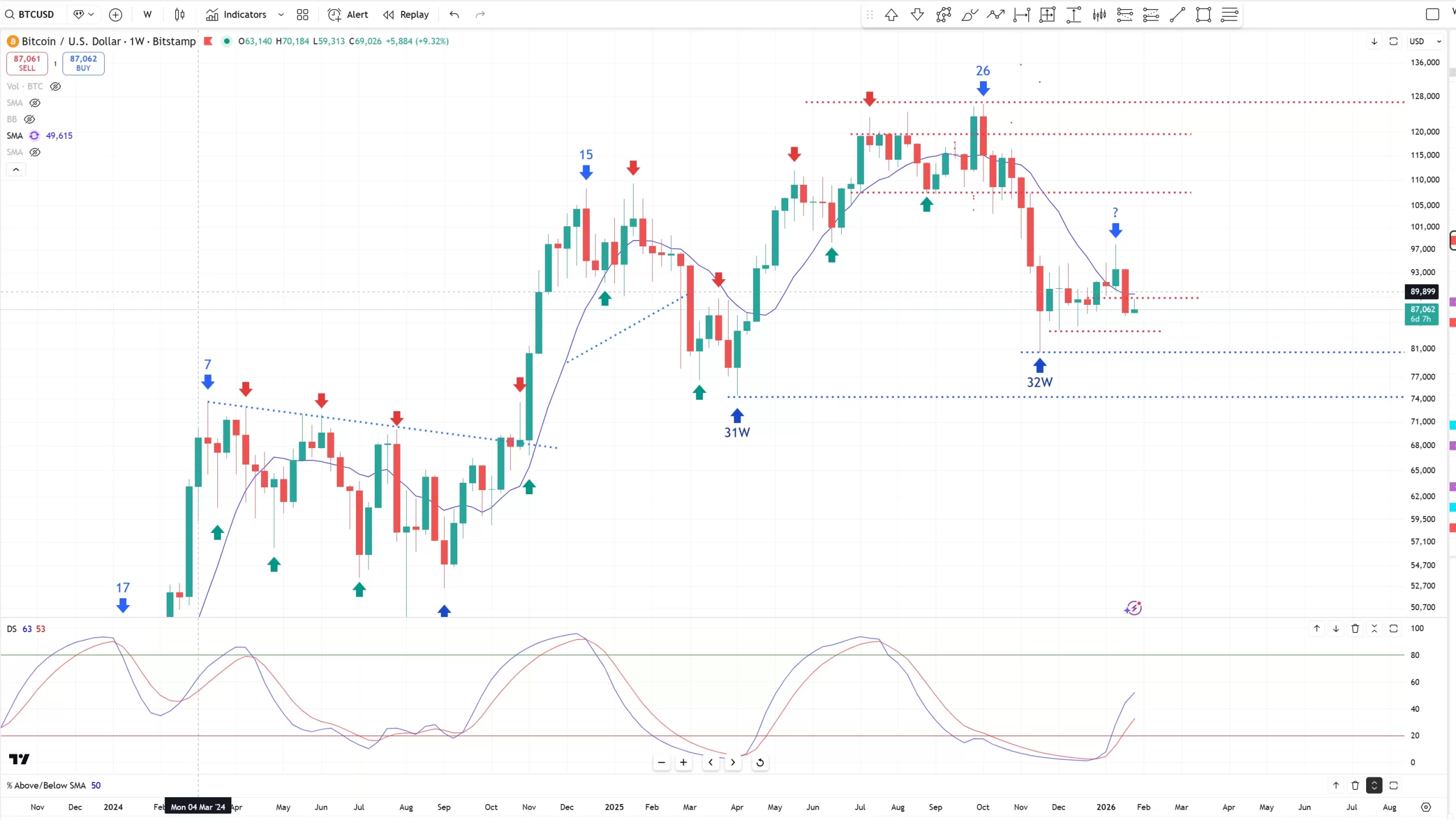

Roman Trading recently drew attention to this issue. Today Bob Loukas discussed the same topic. Stocks are near the top but have stalled the rise. Gold is rising and stocks are at risk of starting a larger downtrend. While the stocks were rising, BTC did not do what was expected, it fell when it was falling. But what happens if the decline accelerates? Roman Trading says it will start at 56 thousand dollars.

Bob wrote:

“In November, sentiment reset and after the bottom Bitcoin for week 10. In a bull market this was a BTD event and would be pushing ATHs higher like stocks now.

An extremely weak and inadequate response to date. It has nothing to do with gold.

If stocks break through ATHs here, this chart will likely generate some excitement for bulls. Unless stocks somehow make it…”