Bitcoin price turned downwards after the US data and fell below 89 thousand dollars. Data confirming that the Fed will not reduce interest rates at the desired rate in 2026 show that even a 50bp annual reduction is at risk. Even though the Fed chairman will change after May, the probability that we will not see a reduction at least in the first two quarters of the year has increased. So what does Pantera Capital expect from 2026?

2026 Cryptocurrency Predictions

The report prepared by Pantera Capital includes 2026 expectations. cryptocurrency Analysts who expect consolidation for treasury companies this year think that a few major players will continue to collect BTC and ETH while others will remain on the sidelines. ETHZilla Last year, when we sold ETH to buy back shares, we mentioned that the risks talked about these days had now arisen.

If 2026 does not create suitable conditions for cryptocurrencies, those other than large reserve companies may disappear from the crypto market, just like pruning a tree. biggest ether Moving on from the example of treasury company BitMine, we saw that the company made many acquisitions in January. However, rival ETH reserve companies have not announced any purchases.

While BitMine has received 92,511 ETH year-to-date, it currently has 4.2 million ETH reserves. It holds 3.48% of the total ETH supply. Apart from BitMine, the only exception is Hong Kong-based investment firm Trend Research. This company announced its $126 million ETH purchase in January, but no other ETH company has announced a purchase.

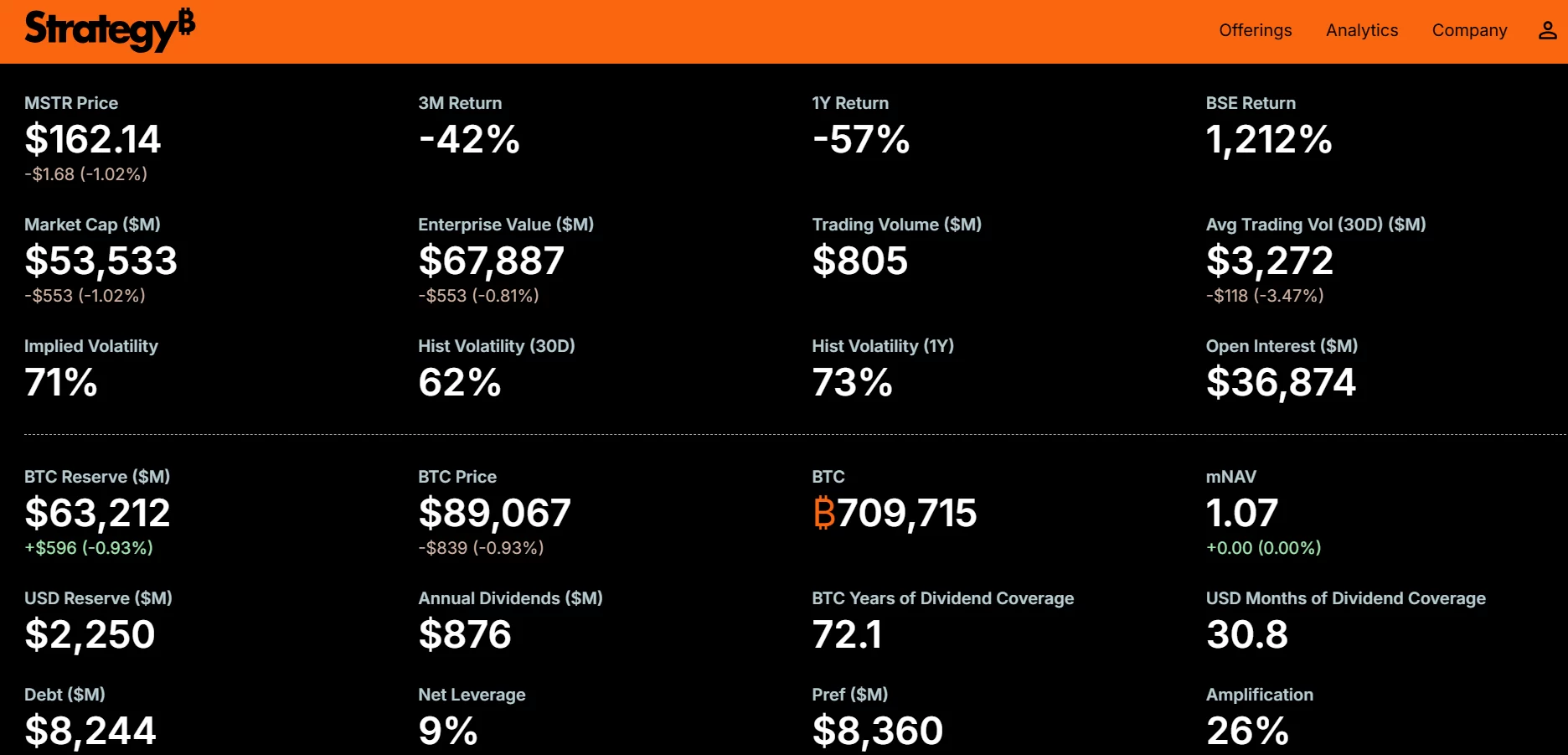

Strategy purchased 22,306 BTC last week for approximately $2.13 billion. It now holds 5.4% of the ETH supply as its total assets exceed 709 thousand BTC. But their rivals are silent.

One of the reasons why Pantera analysts predicted doomsday in crypto reserve companies may be the classification change decision by MSCI, which we may see before the end of the year. The largest index company announced in January that it could classify cryptocurrency reserve companies as funds and exclude them from many indices. However, they announced that they postponed it. Despite the postponement, they included the detail in the information text that “cryptocurrency reserve companies act as funds and should be treated as such.”

What About Cryptocurrencies?

2026 has already started with a busy agenda and Supreme Court If the tariffs are canceled, the negativity may increase. In order for risk appetite to revive, cryptocurrencies must be in a favorable mood. This may be possible in an environment where interest rates decrease and macro and geopolitical risks are balanced.

However, if we see pruning in crypto reserve companies as Pantera Capital expects, if the Fed cuts interest rates much more slowly as predicted today, and if Trump continues his nonsense, what we will see in cryptocurrencies may be deeper bottoms in 2026.