Yesterday, the NYSE launched blockchain-based tokenized stock and ETF markets. This move by the New York Stock Exchange represents an important milestone for the RWA field, which is expected to reach a trillion-dollar size. The $80 trillion US stock market will move on-chain.

Chainlink (LINK) and RWA

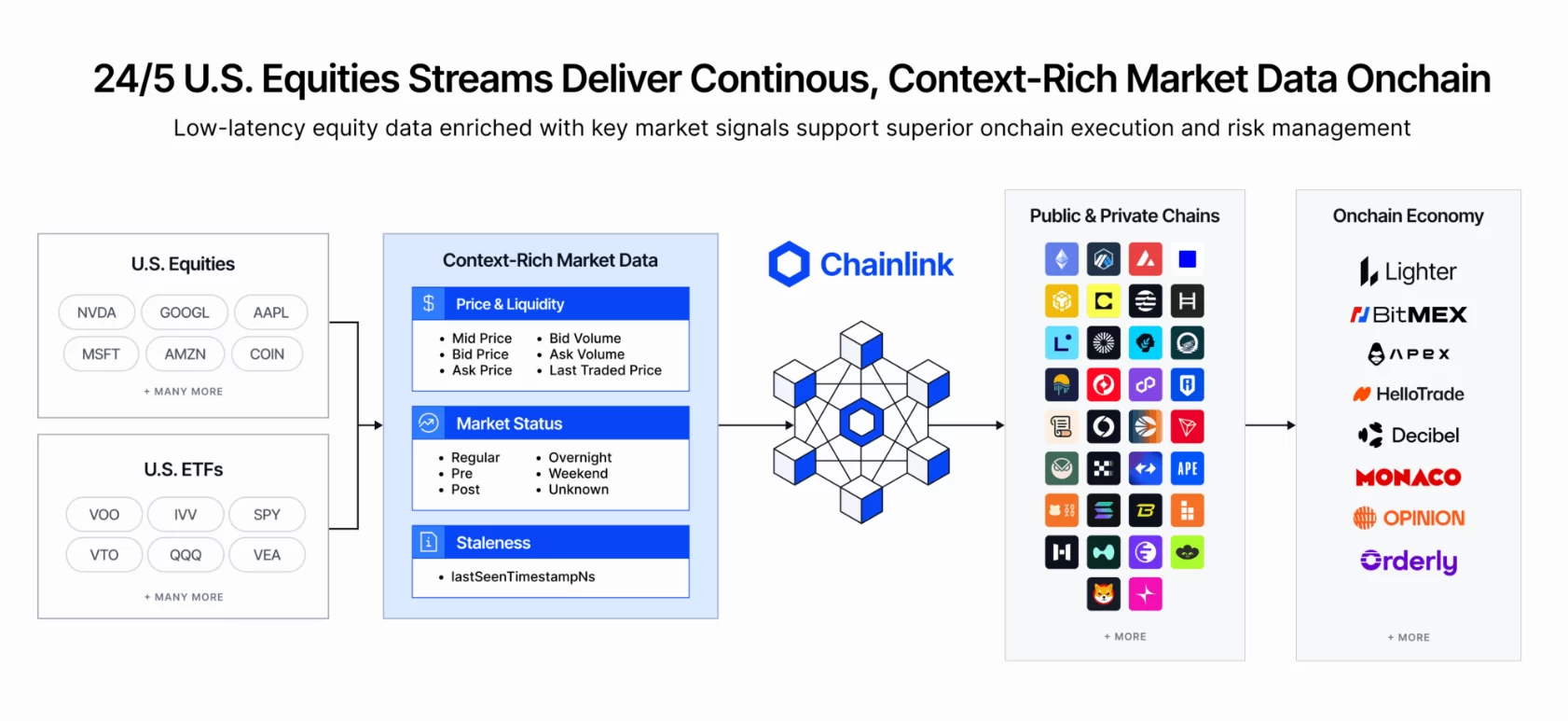

For years Chainlink We explain why it is one of the most important players in the crypto world. Chainlink, which has a virtual monopoly on Blockchain-based Oracle services, works with the world’s largest financial companies. Serving traditional financial giants such as Swift, which are almost the only players in the field, Chainlink offers fast and secure data feeds for US stocks and ETFs.

The new product announced today is 24 hours US stocks And ETFs will provide market data for. Stock exchanges, decentralized platforms and financial companies will be able to provide services by utilizing these feeds.

“We are excited to announce the launch of Chainlink 24/5 US Equities Streams, an extension of Chainlink Data Streams that provides fast and secure market data for US equities and ETFs across all trading sessions.

Streamed live on more than 40 networks, Data Streams enable protocols to create on-chain stock markets including stock perps, prediction markets, and more that operate beyond standard US trading hours. This is a significant step towards unlocking on-chain always-on, enterprise-grade equity markets.

For the first time, DeFi brings the ~$80 trillion US stock market to onchain, providing secure access to US equity market data, including after-hours and overnight sessions.

For traders, Chainlink enables your favorite stocks and ETFs to now be available onchain 24/5, opening up a wide range of onchain use cases including trading, lending, and more.” – Chainlink

The largest exchanges such as Lighter (the second largest perp dex by volume) and BitMEX (inventor of crypto perps) as well as ApeX, HelloTrade, Decibel, Monaco, Opinion Labs and Orderly Network use this solution for their perp RWA markets.

Chainlink’s role in the RWA space will thus strengthen when NYSE launches its own blockchain-based exchange.

LINK Coin Price

So, what about LINK Coin, the token of Chainlink, which opens the $80 trillion market to crypto and works with the world’s largest stock exchanges and financial companies? LINK Coin ETFs rose yesterday, according to SoSoValue data. NYSE Despite its good news, it did not see entry. LINK Coin, which saw an inflow of approximately half a million dollars on January 15, has only reached a cumulative net inflow of 66 million dollars to date. There are 2 ETFs for now and Bitwise Grayscale’s GLKN attracted inflows of about $64 million while its ETF remained virtually inactive.

LINK Coin price BTC is about to reach the $12 support due to its decline, and this weakness seems to continue as long as EU-US tensions continue. We may see bottom tests extending to $8.1 in possible oversells.