The Bitcoin (BTC) price today is under increasing pressure, as several factors suggest a possible sharp correction. While the short-term price movement remains unclear, the overall market structure appears weak. Veteran trader Peter Brandt recently said BTC Price could still drop towards the $58,000–$62,000 range.

Bitcoin Bull Run Already Over

One of the biggest concerns comes from Bitcoin’s four-year market cycle. Historically, Bitcoin bull markets peak around 530 days after a halving event. Using this model, the current cycle’s top may have formed around early October, close to Bitcoin’s recent all-time high near $125,000.

If this pattern holds, Bitcoin could already be nearly 100 days into a new bear market. Previous bear phases have lasted close to one year, meaning selling pressure could continue well into 2026.

How Low Can Bitcoin Price Go in a Worst-Case Scenario?

Bitcoin’s past bear markets show sharp declines:

- 2014–2015: nearly 90%

- 2018: around 84%

- 2022: about 77%

Although volatility has reduced over time, a 70–80% drop from the cycle peak remains historically possible. From the $125,000 high, this would place Bitcoin near $37,000 in an extreme scenario.

This price action would resemble the 2021 cycle, where Bitcoin first dropped sharply, moved sideways for months, and then saw another major collapse before finding a bottom.

200-Week Moving Average in Focus

A key long-term support level for Bitcoin is the 200-week moving average. In every major bear market, Bitcoin has either touched or briefly dropped below this level before stabilizing.

At present, the 200-week moving average sits near $57,000, which already represents a 55% decline from the recent peak. If broader markets weaken, Bitcoin could revisit this zone.

Bear Flag Breakdown Raises Near-Term Risk

On the daily chart, Bitcoin appears to be forming a bear flag pattern. This typically occurs when the price consolidates upward after a sharp drop, before continuing lower.

If this pattern breaks down, analysts warn Bitcoin could quickly slide toward $70,000 or below, increasing downside momentum.

Weekly Support Still Holding For Now

Despite bearish risks, Bitcoin has not fully broken down yet. On the weekly chart, BTC is holding support around $91,000.

As long as this level remains intact, Bitcoin may attempt another move higher. However, a clear loss of this support could send the price toward $86,000, opening the door to deeper losses.

Satoshi-Era Whale Movement Adds Pressure

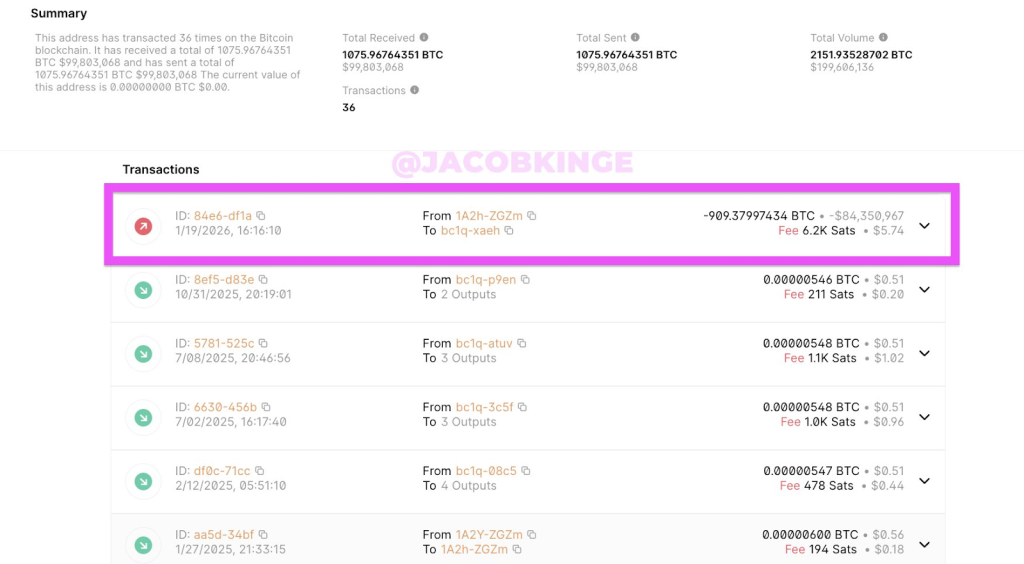

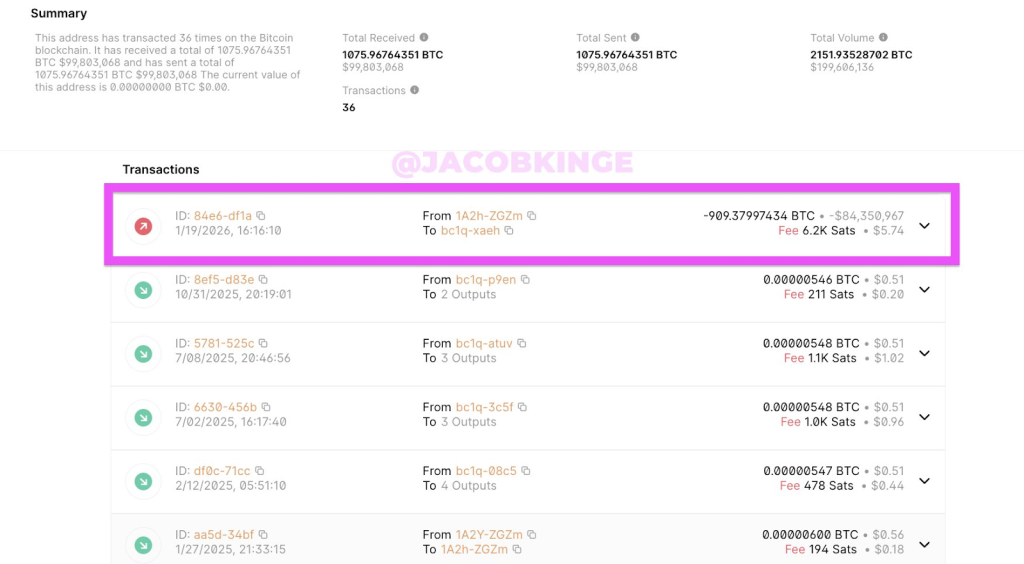

According to @JacobKinge, Market concern increased after a Satoshi-era Bitcoin wallet moved 909.38 BTC after more than a decade of inactivity.

The coins were originally acquired when Bitcoin traded near $7 and are now worth approximately $85 million. Analysts believe the transfer could be linked to off-chain settlements or synthetic selling, which can weigh on price without appearing as direct spot market sales.

The event also highlights that early Bitcoin holdings were likely split across many dormant wallets, making large distributions difficult to track.

Macro Risks Remain a Key Factor

Bitcoin remains closely tied to traditional markets during risk-off periods. In past cycles, a 15–20% correction in the Nasdaq has often led to a 30–40% drop in Bitcoin.

Even a standard equity market correction could push BTC back toward the $57,000 support zone, or lower.

Ethereum and Altcoins Could See Deeper Losses

If Bitcoin enters a prolonged bear market, altcoins are expected to fall harder.

Historically, Ethereum has dropped 80–90% during bear cycles. A similar decline would push ETH toward the $1,000 level. Many altcoins, already down heavily, could still lose another 50–80% as liquidity dries up.

FAQs

Even with ETFs and institutional investors, Bitcoin’s liquidity remains sentiment-driven. Large players often reduce risk simultaneously, amplifying downturns during broader market stress.

Lower prices can squeeze miner profitability, forcing weaker operators to shut down. This typically leads to consolidation, but the network has historically remained secure.

Sustained weekly closes below long-term supports, declining on-chain activity, and shrinking derivatives open interest often signal a broader market reset is underway.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.