Bitcoin price lost the $94,000 support, causing losses of up to 5 percent in altcoins. The outlook for cryptocurrencies this week is negative as tensions increase on the macro front. Sherpa, who recently shared bullish expectations for HYPE Coin, admitted that he was wrong. So what are the current expectations?

HPYE Coin Forecast

On January 18, yesterday, Sherpa shared his bullish expectation for HYPE Coin. Aster and HYPE Coin are present in the new generation DEX space. Although competition in this space has recently intensified with the arrival of LIT, the overall market sentiment is not supportive. On the other hand, their potential is still strong because they earn good income.

“I was very wrong about this, I thought the relative strength of the hype over the last few days was a harbinger of something better but these coins have turbo-dropped along with the rest of the market. I’d rather buy LIT on the rise and won’t be trying to knifecatch any time soon.”

The analyst wrote that he gave up catching the falling knife LIT Coin He expects it to react faster in a possible return. BTC price Although volatility triggered deeper bottoms for LIT Coin during the launch period, many analysts, like Sherpa, expect a rapid rise in LIT Coin price. After such a long period of selling, we should see a move at least halfway to the main peak.

HYPE Coin is one of the promising altcoins and new generation coins. DEX It is the biggest player in its field, so seeing deeper bottoms will increase the appetite of investors who expect a rise in the medium and long term.

What is the Situation with Cryptocurrencies?

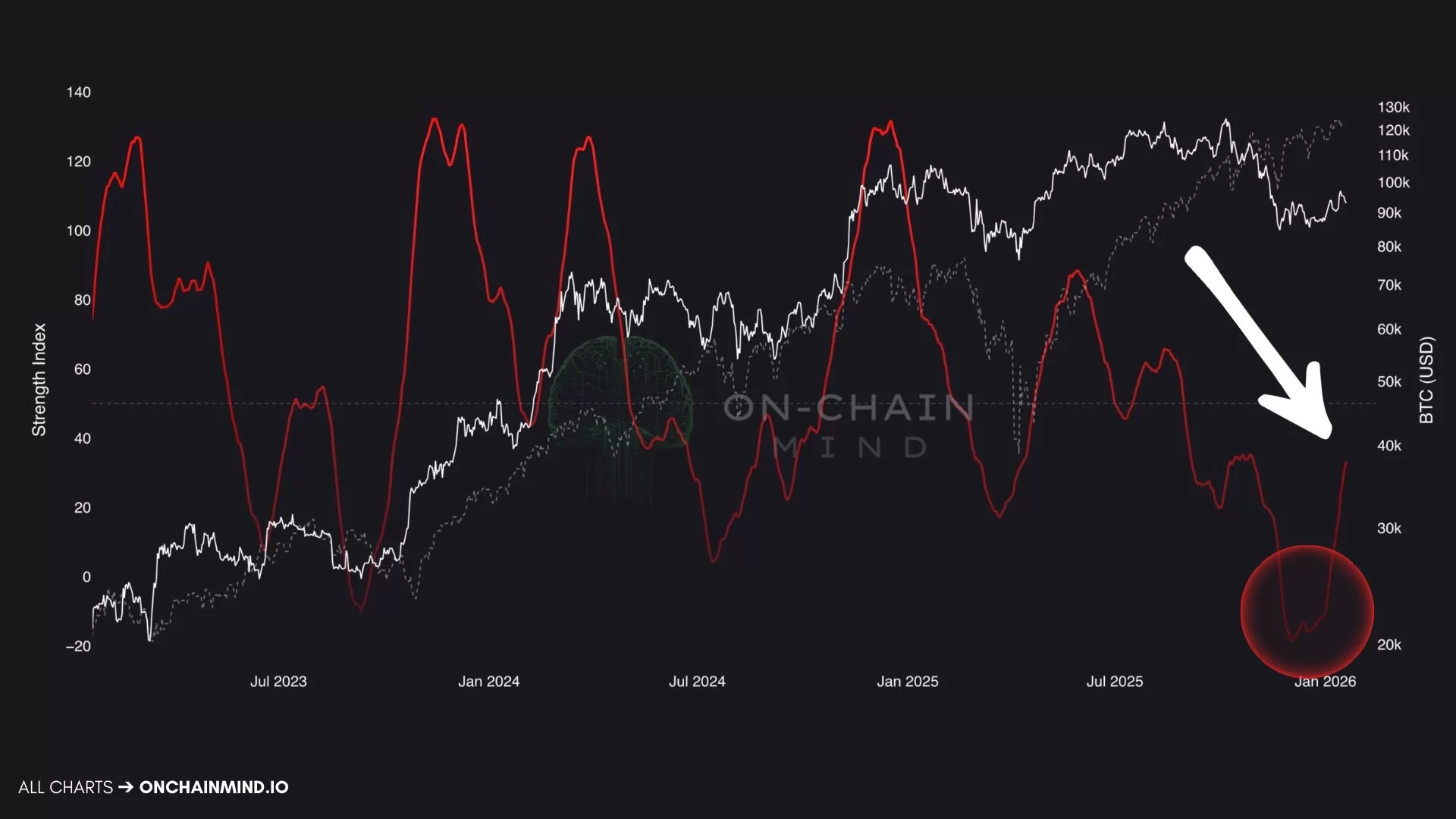

BTC It lagged stocks for months and is now gaining strength again relative to the SPX. Except for the recent decline, BTC has had good times this year. If the pressure on the macro front does not trigger a larger move below $90,000, it is possible that $98,000 will be broken and the return in risk markets will begin with BTC.

Jelle shared the chart below and wrote that we are heading for a strong jump in ETH price. By breaking the downtrend against BTC, ETH can end the negative divergence period that has been going on for years.

Cryptocurrency ETFs, which saw weekly inflows of $2.17 billion, had their best week since October last week. ETH and SOL were also in demand. Blockchain stocks recorded inflows of $72.6 million, along with crypto. The data coming today will show whether the course has changed on the corporate side in the short term.