Cryptocurrency-based investment products attracted renewed attention in global markets with the strongest weekly fund inflow since October 2025. According to the weekly report published by CoinShares, there was a total net inflow of $2.17 billion into cryptocurrency-based investment products over the past week. Although geopolitical tensions and policy uncertainty weakened the perception on the last trading day of the week, the general picture showed that corporate demand continued. Fund flows led by Bitcoin, accompanied by Ethereum, Solana and many altcoins, revealed that investor appetite has spread to a broad base.

Record Levels in Weekly Fund Flows

The net fund inflow of $2.17 billion recorded last week stood out as the highest total since the week of October 10, 2025. While fin inflows accelerated in the first days of the week, the pace slowed down on Friday with an outflow of 378 million dollars. The withdrawal was shaped by the simultaneous impact of diplomatic tensions centered on Greenland, new tariff threats and uncertainties regarding monetary policy.

In regional distribution, the USA was by far the leader and the inflow of 2.05 billion dollars came from here. In Europe, Germany ($63.9 million) and Switzerland ($41.6 million) stood out, while Canada ($12.3 million) and the Netherlands ($6 million) also made a positive contribution to inflows. The width of the distribution showed that risk appetite was not confined to a single region.

On the policy front, the discussions on the CLARITY Act, which were brought up in the US Senate Banking Committee, were closely watched, especially due to the possibility of limiting the stablecoins that offer returns. However, weekly cumulative inflows indicated that regulatory rhetoric did not suppress demand in the short term.

Demand for Altcoins Increased Led by Bitcoin

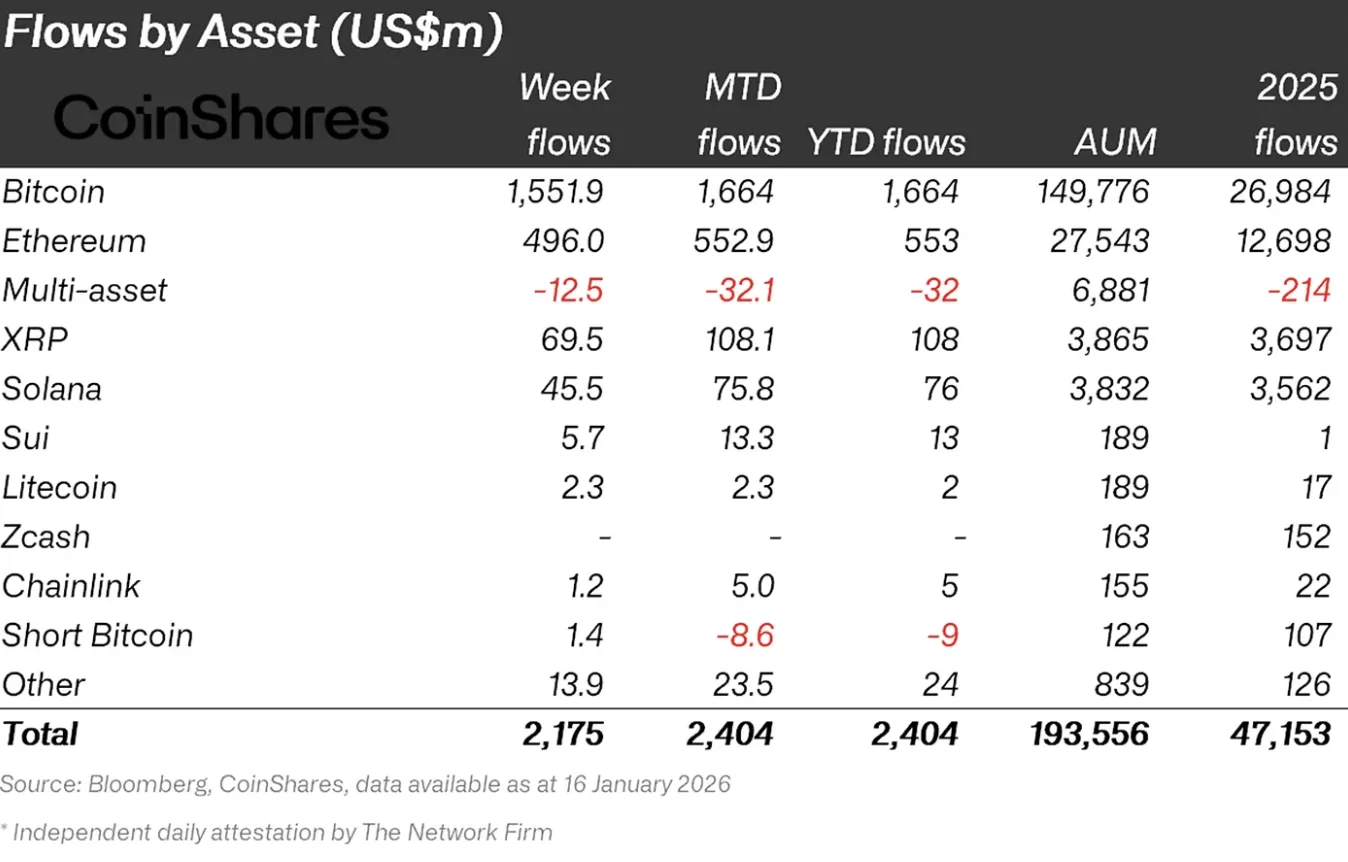

On an asset basis, Bitcoin made its mark on the week with an inflow of $1.55 billion. Despite the regulatory controversy, Ethereum ($496 million) and Solana ($45.5 million) also made strong contributions. The fact that fund flows were not limited to main assets only reflected the liveliness of the portfolio diversification trend.

While XRP ($69.5 million) led the way on the altcoin side, significant inflows were also seen in altcoin projects such as Sui ($5.7 million), Lido ($3.7 million), Hedera ($2.6 million) and Litecoin ($2.3 million). The resulting picture points to a selective but widespread demand from the investor window.

The equity side of the cryptocurrency ecosystem also had a strong week. Shares of blockchain-focused companies attracted net inflows of $72.6 million. While investment interest spread throughout the ecosystem remains despite the fluctuation in market perception, it is emphasized that expectations that Kevin Hassett will remain in his current position affect the monetary policy outlook.