It’s a quiet weekend for Bitcoin and altcoins, volumes are weak but the coming days are pregnant with big developments. Since an increase in volatility is expected, the short-term bull flag highlighted by Martinez for SUI Coin becomes even more remarkable. We will discuss both the current situation of Bitcoin and the current predictions specifically for SUI Coin.

SUI Coin Technical Analysis

It is one of the promising altcoins that has not yet experienced its first real bull season. SUI Coin. Like AVAX and SOL cryptocurrencies After their launch, they had unique rallies in 2021. But SUI Tokens of new generation layer1-2 networks such as have never had such an opportunity. If 2026 will pave the way for the altcoin bull as expected, SUI Coin investors will also be happy.

Ali Martinez shared the bull flag above and mentioned that SUI Coin, which is consolidating for the uptrend, may form a rapid top soon. If $1.84 can be broken, the next target will be $2.29.

In order to start a strong rising series in altcoins, the excitement on the ETH chart must increase. Daan Crypto Trades shared the above chart in his January 18 evaluation and said;

“ETH Still trying to break this important resistance.

A clear break and close above the $3350 level will spark more upside. But until then, resistance will continue.”

Bitcoin (BTC)

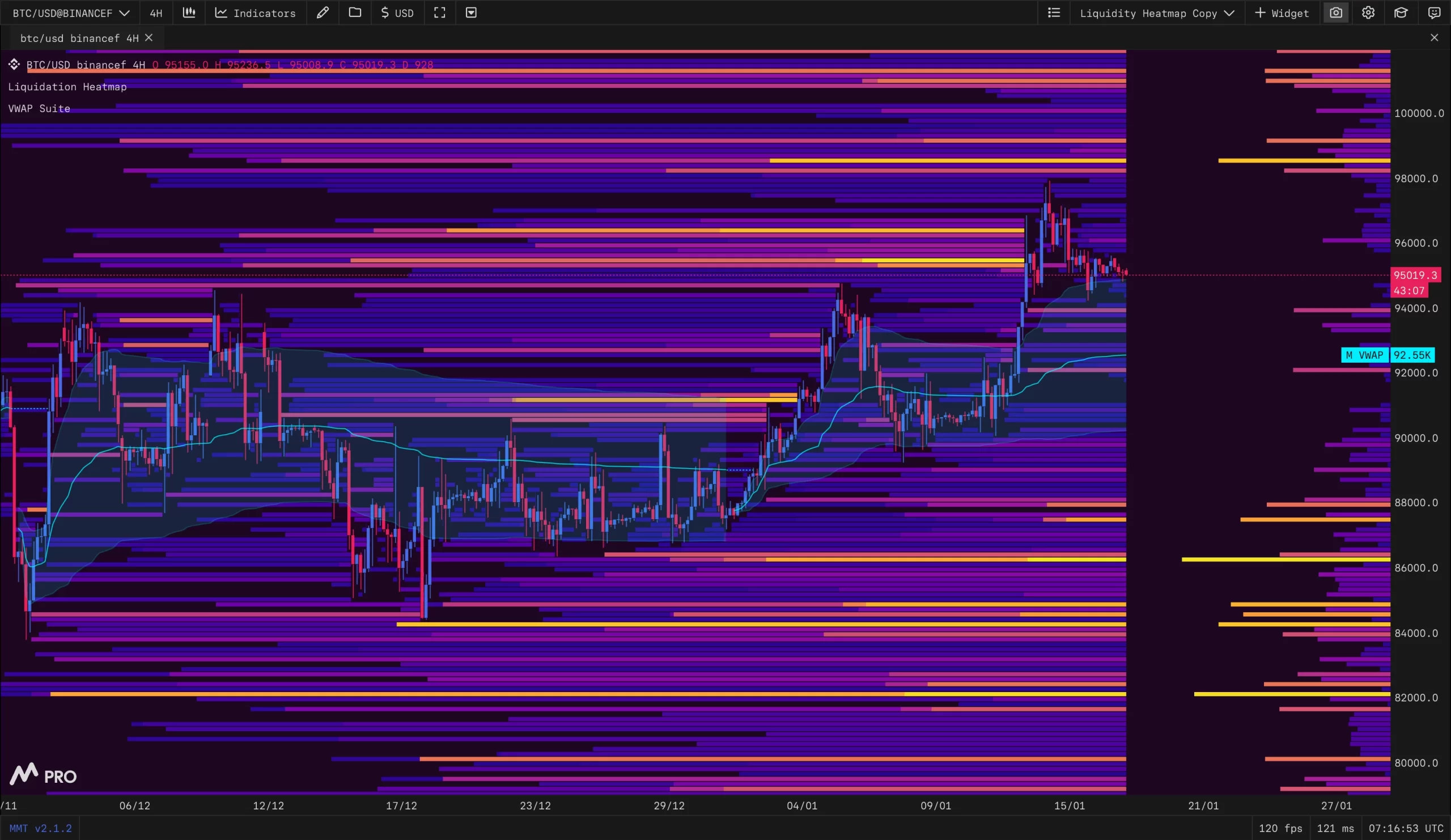

Columbus shared a quick review for Sunday. The following BTC The heatmap chart shows that liquidity is starting to accumulate above again. This usually means that another bullish attempt is approaching.

The analyst recommends testing the support level at $94,000 and taking a position after resetting the structure and testing the demand. If the support test is successful and the bulls remain strong, the possibility of a breakout will become stronger as the liquidity above continues to increase.

next week as well Fed’s We will see important developments such as the inflation indicator it monitors and the Japanese interest rate decision. At the same time, there may be a lot of trouble regarding tariffs. In other words, we are moving towards the days when major developments will have major consequences on the graphics. Therefore, the risk of strong volatility in both directions should be taken into consideration.