BTC price It exceeded $97,000 after the US market opening and reached levels not seen since November. The Supreme Court tariff decision was expected to come today, but this was postponed to next week. It is not certain that the decision will be announced next week, but since the White House announced that they expect an announcement in January, predictions are that the decision will come as soon as possible. Alright Fed statements In what direction?

Fed Statements

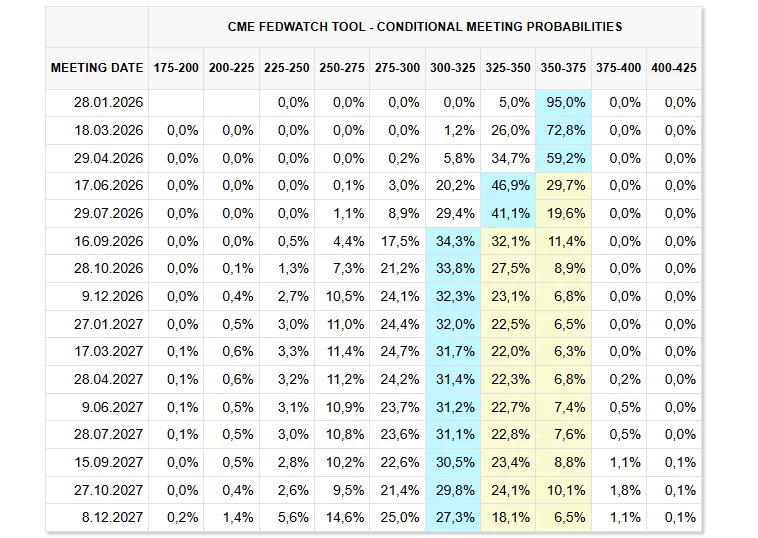

Fed member Miran made important statements in the past few minutes. Trump’s Miran, who is the representative at the Fed, argues that interest rates should be reduced and in his statements he always mentions “why reductions are necessary”. Following last week’s strong employment figures, it became clear that the Fed would skip the reduction in its January interest rate decision.

The highlights of Miran’s statements are as follows:

“deregulation It should put downward pressure on prices, which is another reason for us. The central bank is expected to reduce interest rates.

Deregulation leads to a positive supply and productivity shock, adding more capacity to the economy and easing price pressures.

If central banks do not offset the impact of deregulation, policy becomes too tight and growth is unnecessarily restrained. About 30% of regulations could be removed by 2030, reducing inflation by about half a percentage point per year. “Last year’s deregulation was significant and is expected to continue.”

Trump said tariffs, deregulation and immigration policy would reduce inflation. We have previously explained, in pages and pages, what Trump’s economic policy aims at and how he will work on it. Even though PPI is negative today, inflation remaining below 3% in the coming period may relieve the Fed and help it reduce interest rates to a more neutral level.

However, in the short term, at least for the first quarter, Miran’s thesis will not be able to convince the majority of Fed members for reductions, so the rate of interest rate reductions will continue to be slow.