at the end of 2020 Strategy’s The story that the company (the company name in those days was MicroStrategy) started to popularize was the definition of “cryptocurrency reserve company”. Saylor to recover from former Bitcoin foes and his company BTC He thought it would be a good idea to start saving. Afterwards, he realized that he had done well with the 2021 bull market and saved much more. So what’s the agenda today?

Cryptocurrency Reserve Companies and MSCI

The process, which started with MSTR at the end of 2020, entered its next phase with the birth of ETH reserve companies in the middle of last year. Then BNB, SOL, HYPE, XRP and many more cryptocurrency We saw that reserve companies started to operate. The only advantage of these companies is that they are traded on the stock exchange, and for example, a company that produces car software could earn 5 million dollars a year, but it could earn much more by creating an altcoin reserve and increasing its shares rapidly.

In other words, instead of generating profits from their field of activity, publicly traded companies turned into proxy cryptocurrency ETFs, attracting investors and selling billions of dollars of shares and increasing their reserves.

If you remember, in 2021 MSTR We were talking about (ticker MicroStrategy) being a proxy BTC ETF. In those days, there was no spot BTC ETF approval, even the futures ETF approval came at the end of 2021, we saw ATH and so on. The company at the top of the stock indices today said, “Cryptocurrency reserve companies do not operate in their fields of activity and do not make profits from it, instead they act like funds and earn profits like funds.” This evaluation announced by MSCI caused MSTR shares to fall rapidly starting from December. That’s why MSTR MNAV dropped below 1 just the other day, because MSCI was expected to announce a delist decision against reserve companies until January 15.

What would be the outcome of this decision? Automatically excluded from many investment baskets by fund classification, crypto reserve companies would see billions of dollars in passive investment outflows, and their shares would take a hit.

Understanding the MSCI Decision

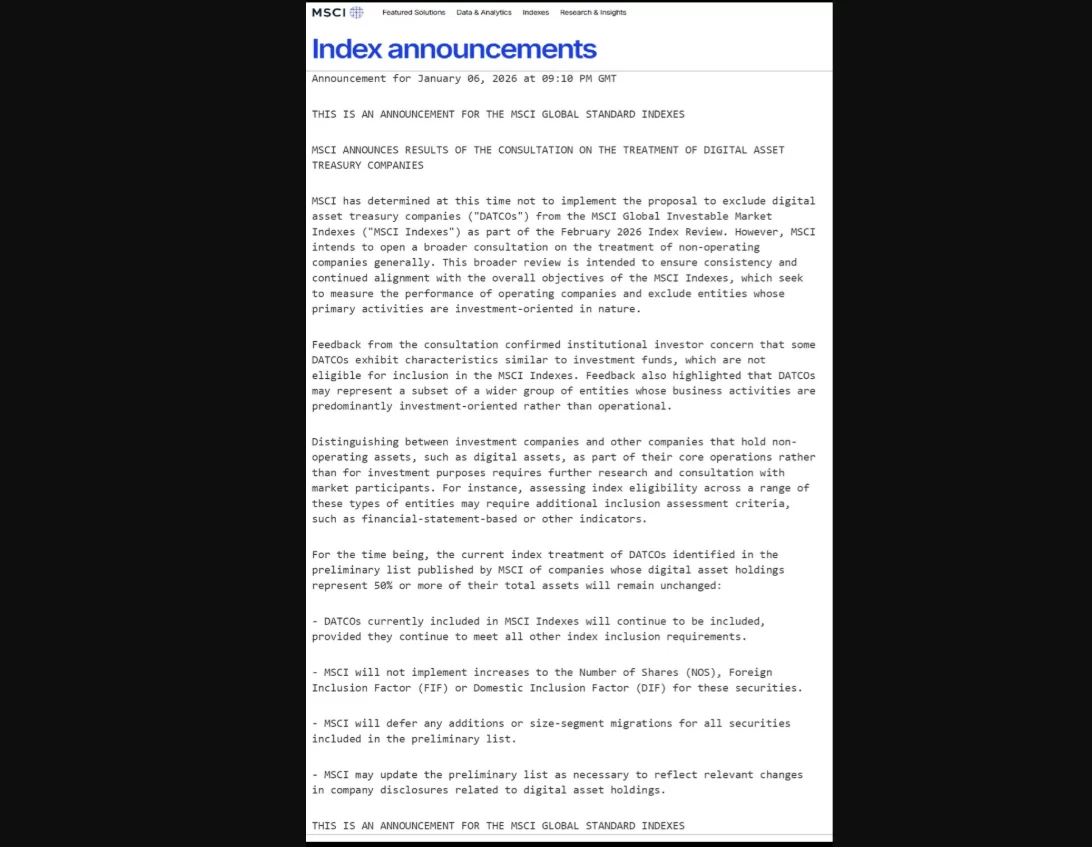

Yesterday, MSCI announced that it has given up its delist decision for now. We saw MSTR shares rise in after-market trading as Delist was already priced in and MNAV rebounded. But Darkfost says yesterday’s decision should be understood correctly.

“MSCI decided not to remove digital asset treasury companies from its Global Standard Indices in its February 2026 review.

Everyone will talk about this today and probably misinterpret what is said, so we are sharing the official statement here. But this is not a green light or a final statement.

Key points:

DATCOs currently included will remain in the indices if they still meet the standard criteria.

Even if the market value increases, there will be no increase in the index weight.

There will be no size upgrading (no transition between small, medium and large-cap companies).

MSCI may update the list according to new statements.

A broader consultation process will begin on non-operating companies.

This means that DATs are tolerated but limited.

MSCI considers some of these to be investment vehicles, not operating companies. In the short term, this is good news as it means there will be no forced selling due to an immediate delist. However, in the long term, the risk of exclusion or special treatment still exists.”

So the latest news is good but not the best and just saves the day. Since MSCI risk will continue in the medium and long term, the positive pricing of yesterday’s decision did not take long. Considering the negativity brought by Friday’s Supreme Court tariff decision, it is possible that we will see an environment where sellers are dominant in cryptocurrencies in a few days.