Just when Bitcoin was saying it was okay, cryptocurrencies turned their direction downwards again. Although we had been pricing in January FUDs throughout December, things changed when we learned that the Supreme Court tariff decision would be announced on Friday, earlier than expected. On-chain alarms warn investors.

Cryptocurrency Alerts

On-chain analyst anlcnc1 had pointed out the average cost level of $98,800 hours ago. BTC price In order to extend the rally, short-termers had to return to the cost zone. But news about the Supreme Court turned things around and BTC price STH is moving to lower bottoms, not to the cost zone.

This key region is an important point for short-term investors to become more enthusiastic and join the rise. Additionally, unless it is broken permanently, every rise will continue to be interpreted as an impending decline.

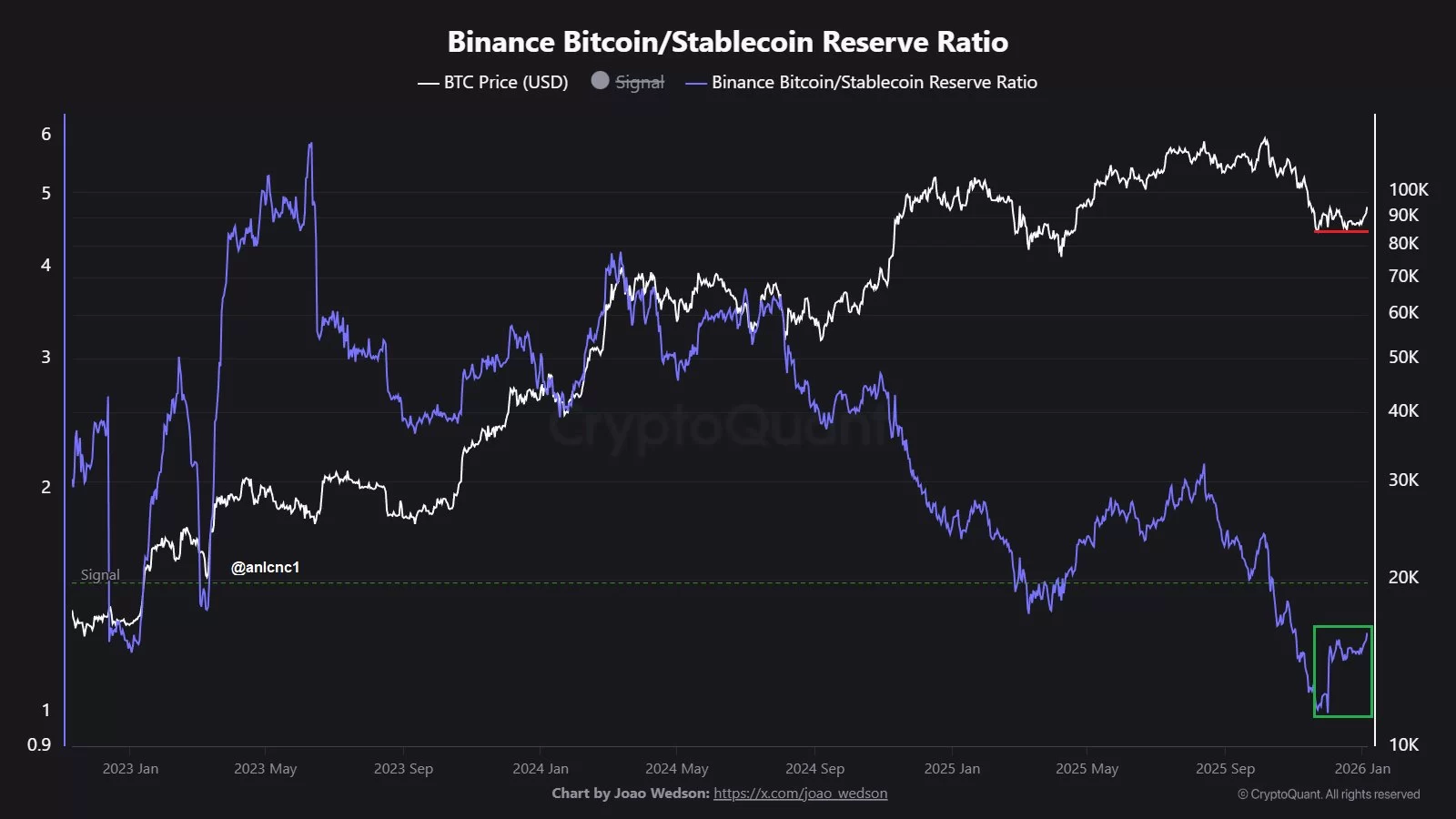

Binance BTC/Stablecoin Reserve Ratio has also started to turn back, although it has also recovered. While the continuation of the BTC price rise will help the signal here support the rise, things are turning around.

“Binance BTC/Stablecoin Reserve Ratio

The ratio is currently at 1.28. An increase in the ratio above 1.50 will make the image much more positive. In summary; “Stablecoin > Bitcoin transitions continue from historically low levels.”

The on-chain analyst with the pseudonym Anlcnc1 made this warning before the decline started.

$95,000 Significant Obstacle

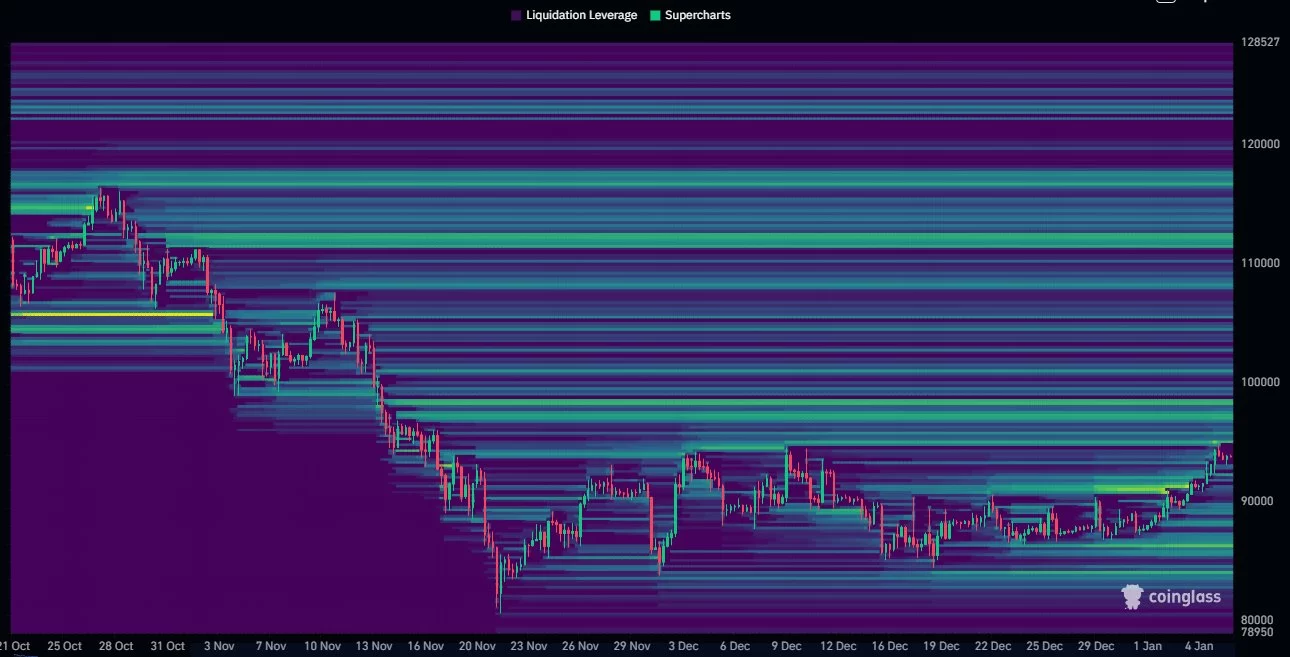

BTC It was already struggling with strong sales at $95 thousand, and the reversal of the news flow was the spice of this. At the time of writing, BTC dropped to $ 91,500 and its daily loss approached $ 3 thousand. Sales are even faster in altcoins. Looking at the heat map, DaanCrypto pointed out the strong liquidation potential up to $98 thousand. As the price turns down, liquidation motivation may target the liquidity cluster growing towards $85,000.

The agenda in the coming days will be as follows;

- Leading employment data for January 7.

- January 9 Comprehensive US employment report for December.

- 9 January Supreme Court Customs Tariff decision.

- Next week’s US inflation report.

- Announcement of the decision by MSCI to exclude cryptocurrency reserve companies from indices and classify them as funds by January 15.

So we will see high volatility and for now the volatility is not in favor of the bulls.