Bitcoin (BTC) price is entering 2026 in a quiet phase, but the market underneath is far from inactive. After falling from the $110,000 area, the price has moved into a tight range. At the same time, large new buyers are steadily building positions, and trading activity is picking up again. This mix of calm price action and growing interest usually signals accumulation, not weakness. For traders, it suggests Bitcoin may be preparing for a bigger move rather than fading out.

Bitcoin Price Action: Compression, Not Breakdown

On the daily chart, Bitcoin is trading within a symmetrical triangle, formed after the rejection from the $110,000 region. Price is compressing between descending resistance and rising support near $88,000–$90,000, signaling declining volatility rather than panic selling.

Momentum indicators reinforce this view. The RSI (14) is stabilizing around the 50 level, showing balance after extended bearish momentum, while Chaikin Money Flow (CMF) remains slightly negative but flat, suggesting selling pressure is no longer accelerating. Historically, similar structures following strong trends have resolved with expansion rather than prolonged drift.

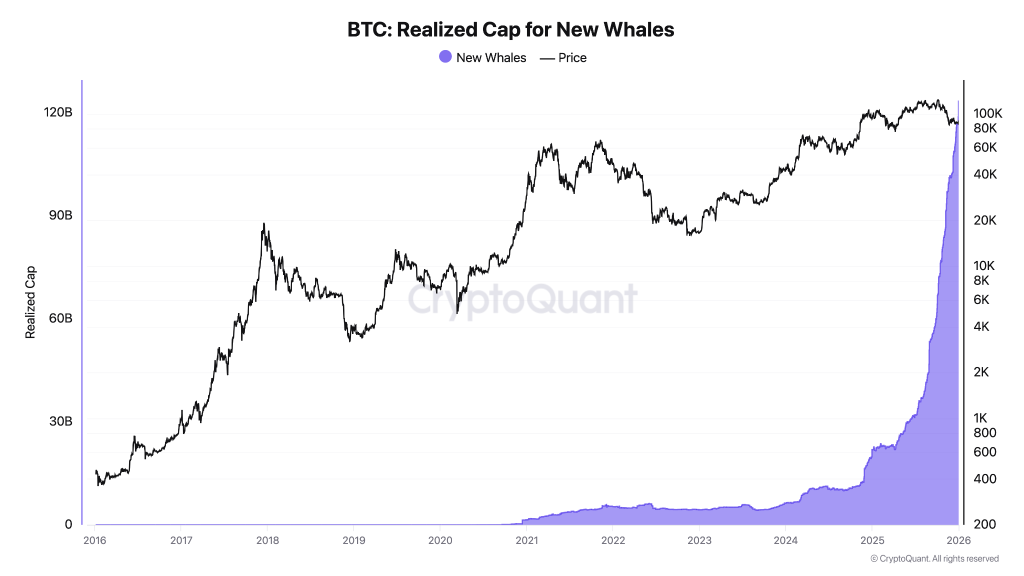

New Whales Are Absorbing Supply

One of the strongest signals supporting the current structure comes from on-chain data. The realized cap of new Bitcoin whales has surged to record highs, indicating that recently formed large holders are aggressively accumulating at elevated price levels.

This matters because it shows new capital entering the market, not old whales rotating out. In previous cycles, sharp increases in new whale realised cap during consolidation phases often aligned with trend continuation, as these participants tend to defend downside rather than exit quickly.

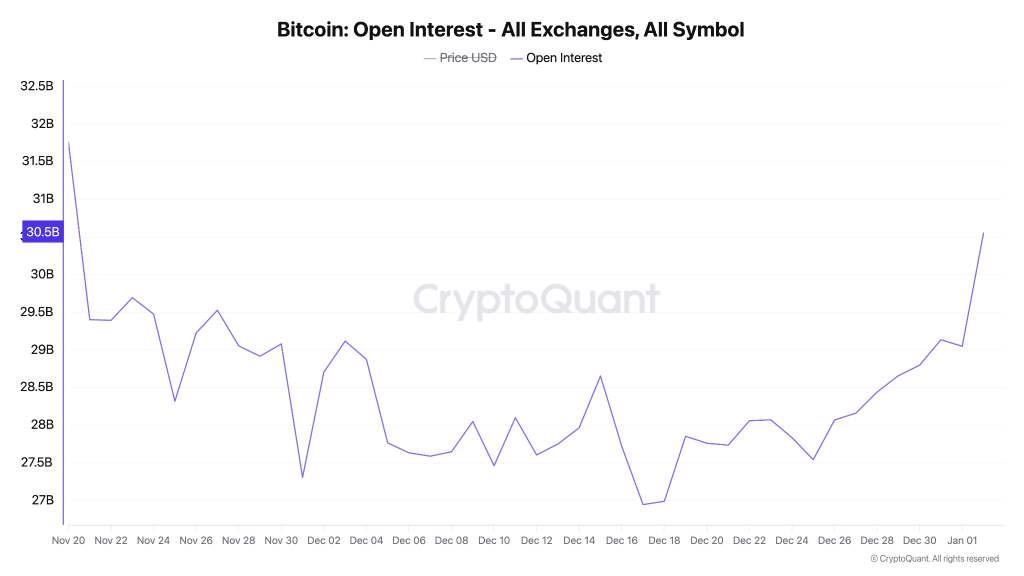

Open Interest Rises as Price Stays Flat

At the same time, Bitcoin open interest across all exchanges has rebounded sharply toward $30.5 billion, even as spot price remains trapped in a narrow range. This divergence suggests fresh positioning is building, rather than leverage being flushed out.

When open interest rises during price compression, it typically signals that traders are positioning for volatility expansion, not chasing direction blindly. This increases the probability of a sharp move once the price exits the current structure.

Key Levels Traders Are Watching

From a tactical perspective, the range is clearly defined:

- Immediate resistance: $90,400–$91,000: A breakout and acceptance above this zone would expose $98,000–$100,600, where prior demand sits.

- Critical support: $88,000: A loss of this level could trigger a liquidity sweep toward $83,000–$85,000, where stronger demand is expected.

Conclusion: Bitcoin Is Being Positioned, Not Sold

Bitcoin’s current consolidation is not showing signs of distribution. Rising new-whale accumulation, recovering open interest, and neutralising momentum all point toward absorption and positioning. While direction is still unresolved, the structure favors a decisive move rather than prolonged weakness. As long as the Bitcoin (BTC) price holds above key support, the market appears to be building energy for the next leg, not rolling over.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.