Although Bitcoin returned to 89 thousand dollars at the time of writing, investors are not very excited as we have experienced the same scenario many times. With the loss of two key areas, Bitcoin has been increasing its losses for months. With altcoins the situation is much worse. So how should the latest rise be handled?

Bitcoin Rise

Today at 22:00 Fed meeting minutes will be published and we will see the details behind the third interest rate cut of the year. Two Fed members opposed the cut, and most of the 19 members said further cuts should be avoided. The details we will see in the minutes regarding monetary easing may be supportive, but since clear messages have already been given about the rate of interest rate reductions, a serious change in sentiment is not foreseen at this point.

BTC price Although it returned to 89 thousand dollars after the US market opening, BTC, which has been closing under the bear flag support for more than 2 weeks, does not give any hope. We have seen $90,000 tested many times. Each time, the result remained unchanged as short-term investors turned this into a short selling opportunity.

As the king cryptocurrency approaches $90,000 again, it may be in the interest of investors to be wary of the same trap. The MSCI delist decision in January and the Supreme Court customs duty ruling keep concerns about the first 2 weeks alive. While investors are already worried about these 2 major developments, volumes are weak, US investors are sellers and altcoins are lingering in the bottom support areas.

This Is Not The Time To Buy Altcoins

cryptocurrency The biggest reason why investors experience huge losses is the desire to “catch the bottom and the top”. For this reason altcoins For years, we have listened to the stories of investors who bought to reduce costs and constantly increased their losses as they fell. In fact, many of us have experienced this painful process ourselves.

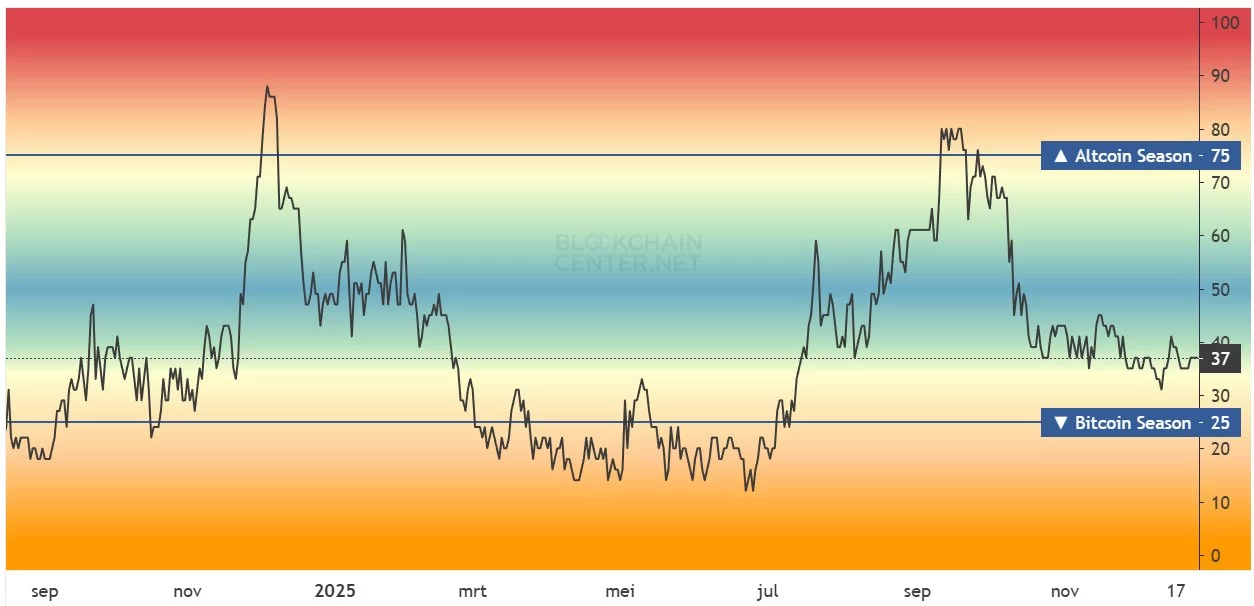

Instead, it may be a good strategy to keep up with the momentum and pursue more limited gains, rather than following the momentum and catching the bottom or top. The analyst nicknamed DaanCrypto reiterated his warning by sharing the chart below.

“Altcoins experienced a short-term outperformance twice in 12 months: in late 2024 and in September and October 2025.

Apart from this, BTC led the rises and performed best in the declines.

There are a few exceptions, of course, but right now we’re seeing even previous performance leaders starting to fall on hard times. All this shows you is that a buy-and-hold strategy is not a valid strategy for a large portfolio of altcoins. It has not been valid for years.

Altcoins can be great, but you have to be very selective and time it right when the environment for altcoins is at least somewhat good. “Often, it is easier to take advantage of the momentum in altcoins rather than trying to buy on the dip.”