The balance of power on the derivatives front in the cryptocurrency market has been reshaped. In terms of open position size in Bitcoin futures Binancesurpassed the US-based CME and reached the top. The change comes at a time when successive outflows from U.S.-traded spot Bitcoin ETFs indicate weakening institutional investor interest. Bitcoin’s price, on the other hand, remains close to lower bands in long-term price models, accompanied by increasing volatility.

Binance Outperforms CME in Bitcoin Futures

Leadership in the global cryptocurrency derivatives market has changed hands. CoinGlass According to data, the open position of Bitcoin futures on Binance increased to 129,080 BTC, reaching a size of approximately 11.28 billion dollars. CME GroupHe left behind. On the CME side, the open position amount decreased to 9.81 billion dollars with 112,340 BTC. This figure fell below $10 billion for the first time since the beginning of 2024. Data reveals that the market’s center of gravity is shifting from corporate-focused US platforms to global exchanges with more individual participation.

The decline in CME started before the sharp correction in the cryptocurrency market in early October. The appeal of the “basis trade” strategy, which takes advantage of the premium between the price of Bitcoin and futures contracts, has rapidly diminished. From spot market BTC While the return rate of institutional investors who bought and sold in futures transactions decreased, the unwinding of open positions accelerated. Velo data shows that the annualized basis rate fell from 15 percent to approximately 3 percent.

On the other hand, although open positions in Binance decreased after October, they gave a signal of recovery in December. Market participants state that the influence of individual investors, who consider price pullbacks as buying opportunities, is increasing. This trend has made the divergence between institutional and individual investor behavior more visible.

Outflows from Spot Bitcoin ETFs Continue

traded in the USA spot Bitcoin ETFSelling pressure continues on the ‘s side. ETFs recorded a net outflow of $19.3 million on the first trading day of the week, marking the seventh consecutive day of negative flows, according to data from Farside Investors. BlackRock’s iShares Bitcoin ETF had $7.9 million in investor outflows in IBIT, while Fidelity’s FBTC ETF diverged with $5.7 million in inflows. Corporate dissolutions also attracted attention in ARK 21Shares ARKB and Invesco Galaxy BTCO.

Behind the sales in ETFs are the more cautious price expectations expressed by experts and the tax loss realization strategies implemented as the year-end approaches. The reduction of positions by institutional investors is parallel to the decrease in the CME weight on the futures side.

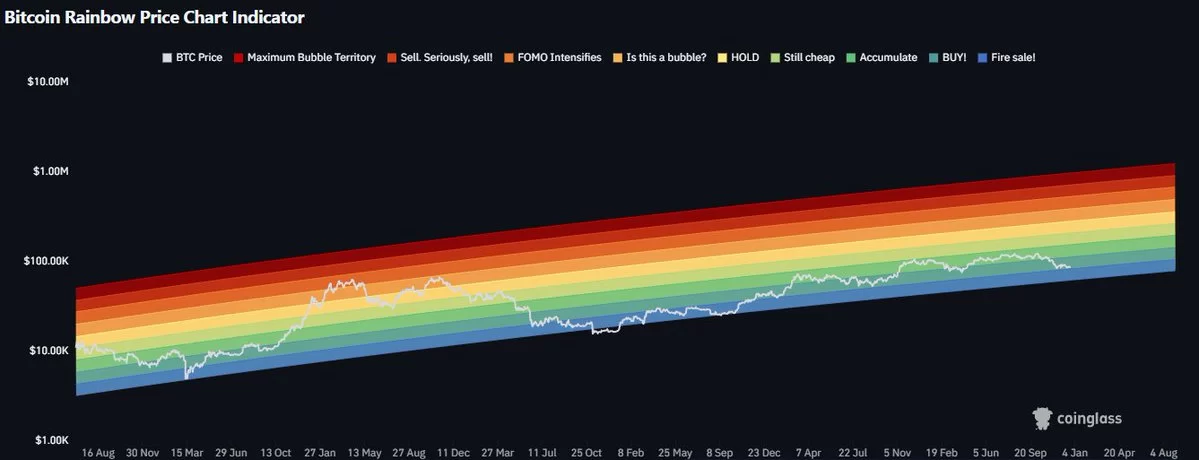

The price of Bitcoin lost more than 2 percent in the last 24 hours and stabilized around $87,200. While the $86,717–$90,299 range was tested in intraday transactions, the 40 percent increase in trading volume shows that the market is still alive. Analyst Dan Crypto TradesHe emphasized that Bitcoin is approaching the lower band in the regression and rainbow chart models, and that this region has historically corresponded to the $ 60,000–80,000 range. CoinGlass The data points to instability in the derivatives market. While the total futures open position decreased by over 5 percent in the last 24 hours, the decline accelerated in CME and a short-term recovery was observed in Binance.