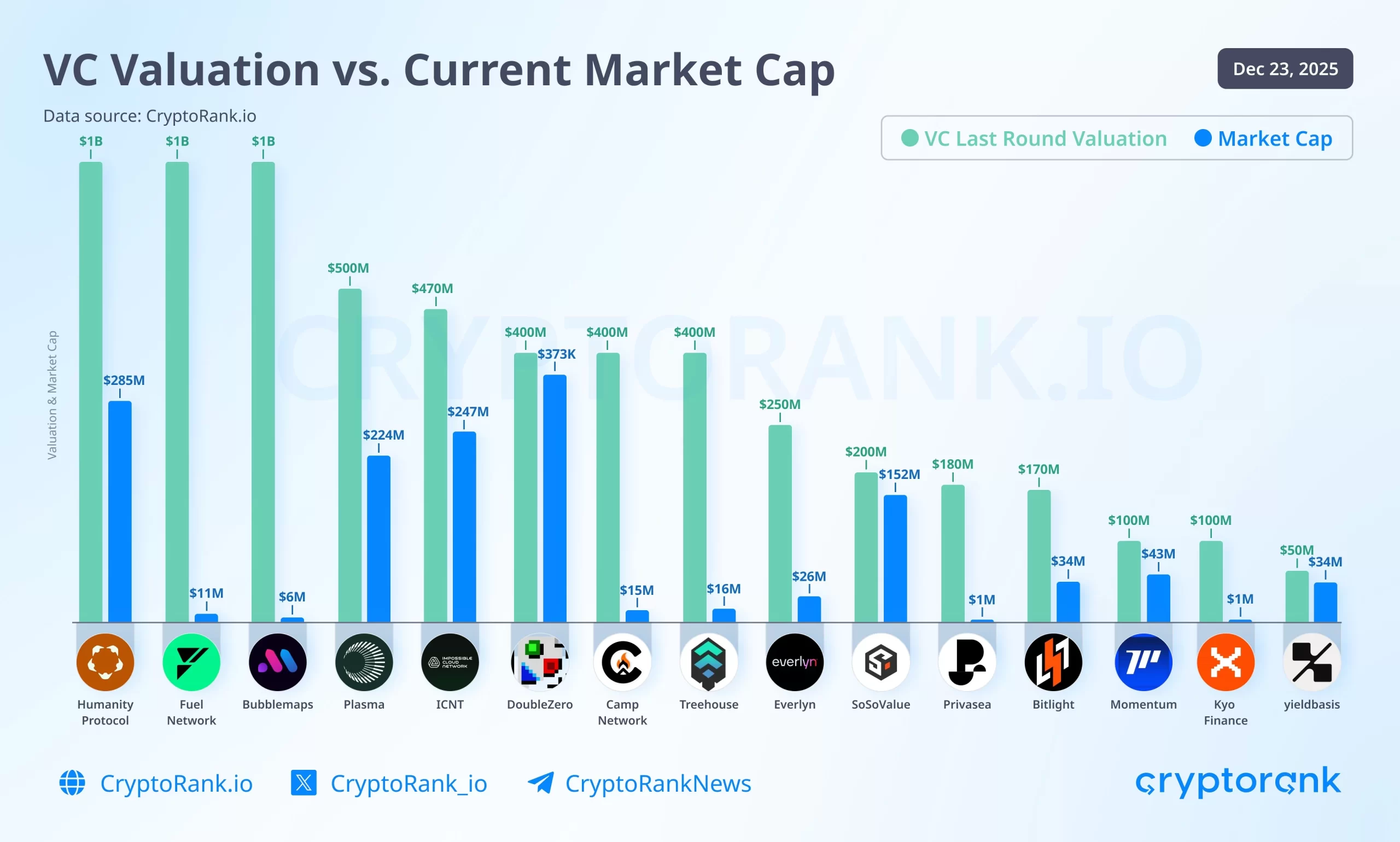

CryptoRank‘s “ dated 23 December 2025VC Valuation vs. Current Market Cap” study reveals that the difference between the last investment round valuations and current market values of some venture capital altcoins, briefly VCcoin projects, released during the year has decreased to remarkable levels. According to the data set. VCThe aggressive valuations given by ‘s are not in line with the current pricing of the market in most projects. The comparison in the image shows that labels created in periods when capital inflows are strong are quickly questioned when sentiment weakens. From the investor’s perspective, the chart points to a period in which valuation discipline has become more decisive than narrative.

The Gap Between VC Valuation and Market Cap Is Widening

Altcoin according to CryptoRank data Humanity ProtocolWhile it was valued at $1 billion in its first investment round, its current market value is at $285 million. Fuel Network Despite the same $1 billion first round valuation on the side, its market value dropped to $11 million. bubblemaps The market value of 6 million dollars stands out against the valuation of 1 billion dollars. plasma While it has a market value of $224 million against a valuation band of $500 million, ICNT It has a market cap of $247 million against a valuation of $470 million.

There are also examples in the chart that are relatively closer. For example altcoin DoubleZerostands out with a market value of $373 million against a valuation of $400 million. SoSoValue It sits at $152 million compared to a $200 million valuation.

On the other hand, altcoins are in those experiencing more severe divergence. Camp Network ($15 million market cap against $400 million valuation), Treehouse (16 million against 400 million), privacy (1 million versus 180 million) and Kyo Finance (1 million versus 100 million) stands out. bitlight (34 million against 170 million), momentum (100 million versus 43 million) and yieldbasis (34 million against 50 million) is also on the list.

When the Narrative Effect Weakens, the Market Switches to Repricing

According to CryptoRank’s assessment, during bull runs and narrative-driven excitement, VC projects may tend to price more expensively and aggressive valuation tags are put into effect. When investor sentiment drops or the narrative loses momentum, the market tests previous optimistic levels downward, seeking a more realistic balance in most projects. The table in the image is one of the highlights of the year. altcoin He explains that even his projects were repositioned on a market scale in a short time.

In the same context, at moments when the investment approach narrative reaches its peak, it becomes important to weigh risks according to different outcomes, instead of relying on a single scenario. Instances where the gap between valuation and market value widens are a reminder that price depends not only on the story, but also on market conditions and continuity of interest.