With the Bitcoin price hovering within a tight range, the Ethereum price is also displaying a similar trend. For over few weeks, the price has been trading close to the $3000 mark, leaving traders unsure about the next major move. Although the spot market has been maintaining calmness, the derivative markets are preparing to increase the volatility. The options data suggest traders are not positioning for an immediate breakout or breakdown, which hints towards an extended consolidation within the current range.

Now the question arises-When will the ETH price break out from the structure between $3000 and $3200?

The Market Is Gearing up for Later, But Not for Now

Ethereum options activity is increasingly concentrated in late-2025 and 2026 expiries, while short-dated contracts remain relatively quiet. This shift usually signals rollover behavior, where traders extend exposure instead of betting on immediate price moves.

Historically, similar patterns have appeared during periods of market uncertainty, such as mid-2023 and early 2024, when ETH spent weeks consolidating before trending later.

Recent options data shows a clear increase in activity in late-2025 and 2026 expiries, while near-term contracts remain relatively light. This usually indicates rollover activity rather than fresh short-term bets. When traders expect a sharp price move, demand for short-dated options typically rises. That is not happening with the Ethereum price right now.

This positioning suggests traders are comfortable holding exposure for the longer term but see limited urgency in the near future. In simple terms, the market is preparing for later, not for now.

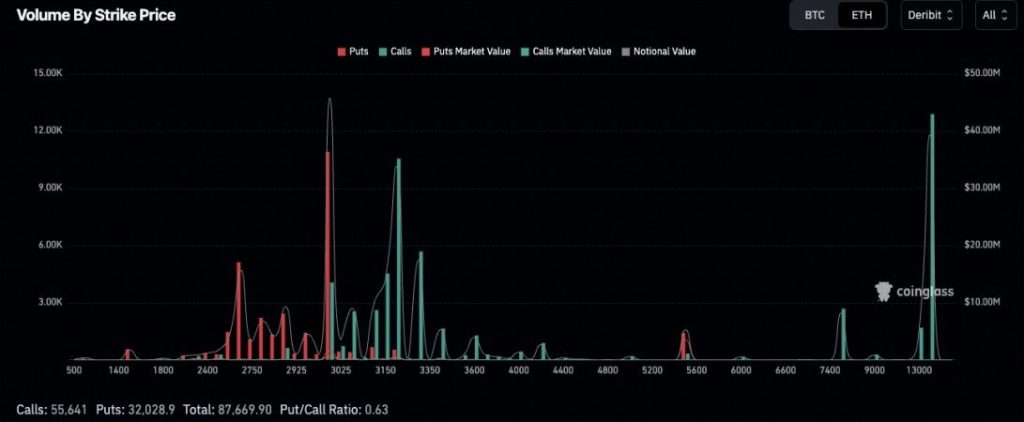

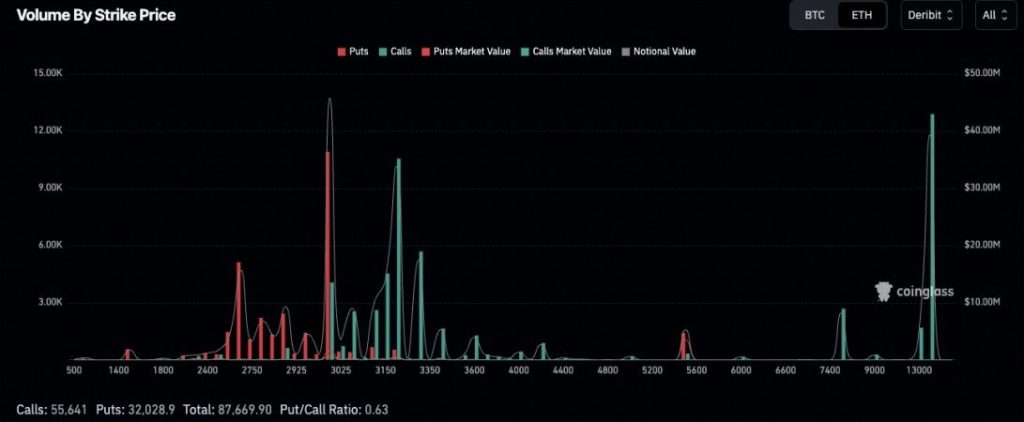

Strike Price Data Points to a Defined Trading Range

The distribution of options by strike price adds more context. Most call interest is concentrated between $3,000 and $3,300, while put positioning remains modest. The current put-to-call ratio of around 0.63 shows a bullish bias, but not extreme optimism.

Because of this positioning, the $3,000–$3,200 zone has become a natural trading range. The $3,000 level acts as a psychological support and a major options strike, while $3,200 marks the area where call interest starts to thin. This creates a “pinning” effect, where price tends to stay trapped between these levels unless fresh demand enters the market.

What Could Break Ethereum Price Out of This Range?

Ethereum is currently compressing between rising support near $2,900 and resistance around $3,200–$3,250. This price structure suggests pressure is building, not that the trend has already changed. A bullish breakout requires ETH to reclaim $3,200 and hold above it with strong spot volume.

The ETH price has been maintaining an ascending structure since mid-November and bouncing off the ascending support. Bears have been restricting the rally below $3000 for a few days, while the volume has dropped notably. The volume compression usually results in a stronger breakout, and if this materialises, a rise to $3,200 could be imminent. However, breaking out from the resistance zone between $3225 and $3300 could require more buying volume.

Conclusion

Ethereum is not stuck—it is being deliberately positioned. Options traders are pushing risk into 2026, signalling confidence in higher prices later, but little urgency right now. That positioning aligns with the current price behaviour, where ETH continues to respect the $3,000 floor while failing to attract follow-through above $3,200. Until short-dated options activity and spot volume return, the ETH price is more likely to trade sideways than trend aggressively.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.