The sales that have been going on for the last 3 months were fed by both the negativity in the market and the 4-year cycle story. cryptocurrencies It was a terrible time for us, but 2025 is coming to an end. Next week today we will be counting down the last hours of the year. Moreover, some on-chain signals show that the sales bombardment of individual investors in cryptocurrencies has stopped.

Selling Pressure Reduces

CryptoQuant on-chain Analyst Darkfost reminded us of the broken on-chain signals following the Coinbase activity in November. Coinbase huge amount BTC While moving it, the metrics were upside down, and this caused even more fear among those who were reading the on-chain with blinders on. But this is getting better.

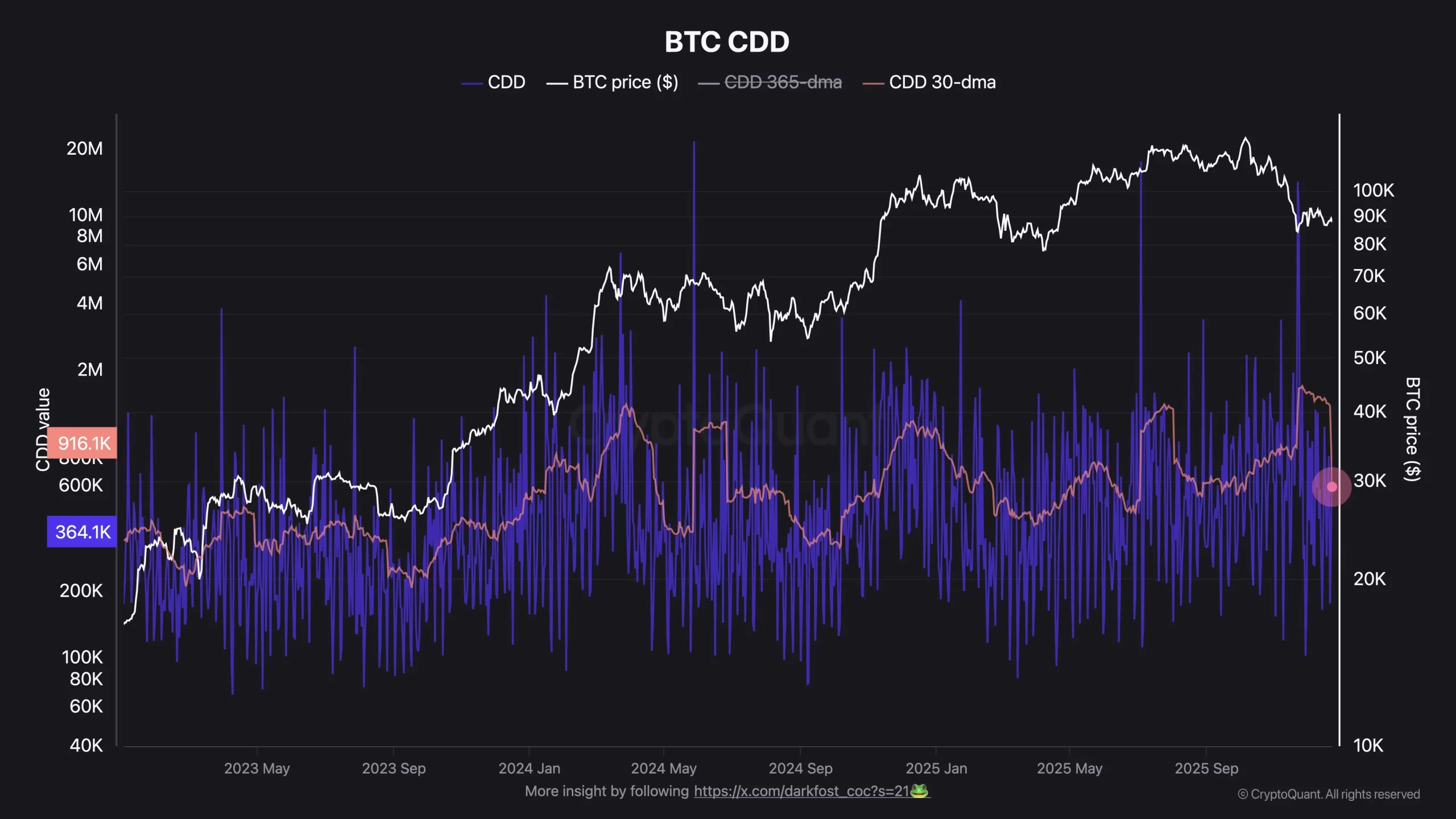

“More than a month has passed since Coinbase’s big BTC move. As a result, all average data are slowly returning to normal levels. Looking at the Coin Days Destroyed (CDD) data, we can clearly see a sharp decline following this event.”

The good news is that this decline has reached a level well below the previous peak. Beyond the on-chain disruption triggered by Coinbase, this indicates that short-term investor activity has stabilized. So the era of crazy sales is coming to an end.

“BTC movements are starting to appear less frequently, indicating that selling pressure from these participants is easing. For those unfamiliar with this indicator, CDD simply measures the number of days a UTXO is held before it is spent.

When long-held BTC starts to move, this usually means it is preparing to sell. This decline in CDD is a positive signal because LTHs still represent the largest potential source of selling pressure since they hold the largest share of total supply.

“The reduction in LTH selling pressure will help reassure the market and could contribute to a bottom formation if this trend continues.” -Darkfost

This news is quite good as we start the new year, because both the upcoming negative developments and the shocks we saw in the last quarter have already caused investors to burn out. So if there is to be a bottom, this is what we need to see now. Cryptocurrencies should now experience a slight increase.

Bitcoin (BTC)

Michael Poppe will wait until next week due to the loosening of liquidity in the order books and the holiday. Bitcoin  $87,777.17from He believes we should expect something. There are 2 important levels and the analyst, who drew attention to the fluctuation in the gold price, warned.

$87,777.17from He believes we should expect something. There are 2 important levels and the analyst, who drew attention to the fluctuation in the gold price, warned.

“from Bitcoin It is impossible to expect anything special. However, there is a good test at $86,500 and while this level is maintained, gold is declining and not accelerating.

All in all, a clear breakout above $88k and better times are ahead, and it looks like it’s only a matter of time before that happens.”

If we are going to see a sudden big movement in the coming days, this could be triggered by an important development. CryptoAppsy The news section of the application can make your work easier in this regard.