Bitcoin  $87,966.72price of While it is struggling to gather strength below its recent peak, veteran analyst Peter Brandt claimed that the current market cycle is not yet over. According to Brandt, the cycle structure spanning years leaves room for a sharper pullback before a permanent bottom is formed. The analyst suggested that the next major bull peak could occur around September 2029, pointing to volatile and disturbing pricing in the short term. Argument, BitcoinIt has reignited the question of whether the weakness in is presenting an opportunity or a warning to altcoins.

$87,966.72price of While it is struggling to gather strength below its recent peak, veteran analyst Peter Brandt claimed that the current market cycle is not yet over. According to Brandt, the cycle structure spanning years leaves room for a sharper pullback before a permanent bottom is formed. The analyst suggested that the next major bull peak could occur around September 2029, pointing to volatile and disturbing pricing in the short term. Argument, BitcoinIt has reignited the question of whether the weakness in is presenting an opportunity or a warning to altcoins.

According to Brandt, there is no peace until the bottom is reached

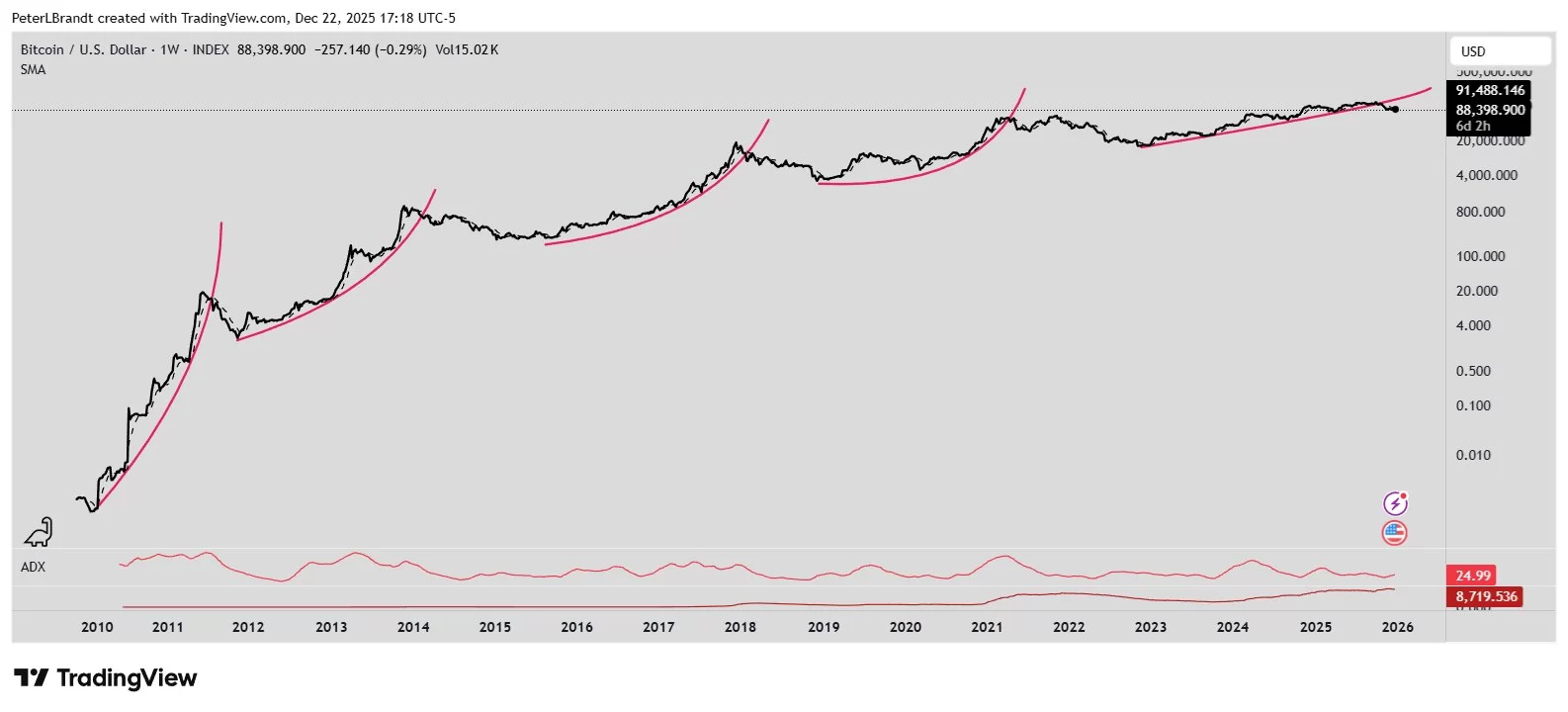

Peter BrandtEmphasizing that the cycles in Bitcoin’s long-term charts are completed in years, not months, he stated that the current structure seems unfinished. brought. According to the analyst, the fact that the price remains significantly below the last peak and the strong momentum does not return may indicate that a deeper clearing process in the market has not yet ended.

Brandt’s cautious stance is based on Bitcoin’s repetitive behavior over the last 15 years. This behavior is in the form of sharp corrections following large parabolic rises, which wipe out excessive leverage and speculation, and then form the basis for a new cycle. This historical pattern causes analysts to keep “worse-case” scenarios on the table.

In more extreme hypotheses, Brandt loop bottom He stated that it could point to the middle of the 20,000 dollar band for the price, and that the risk of falling below 60 thousand dollars should not be ignored if the selling pressure accelerates.

What Awaits the Altcoin Front?

Bitcoin’s trend below critical psychological levels and signals of softening in market share have led some investors to the possibility of capital rotation. In past cycles, when Bitcoin remained in a horizontal band altcoinSince a relative performance increase can be seen in certain segments of ‘s, the expectation of a similar picture is on the agenda again. Ethereum  $2,956.19, DeFi, tokenization and is frequently cited as a potential beneficiary due to its central position in corporate trials. Selected in a scenario where Bitcoin remains directionless altcoin projectsIt is said that may come to the fore.

$2,956.19, DeFi, tokenization and is frequently cited as a potential beneficiary due to its central position in corporate trials. Selected in a scenario where Bitcoin remains directionless altcoin projectsIt is said that may come to the fore.

Analyst on the other hand Benjamin CowenHe underlined that a broad-based altcoin rally may not come unless macro and monetary conditions are favorable. According to Cowen, investors lingering for a long time in weak altcoins in anticipation of the season led to the postponement of unfulfilled expectations in 2024 and 2025 to 2026. The analyst added that long-term wealth building is more about holding strong, quality assets than chasing speculative narratives.

for now altcoin market There is no clear consensus on the front. Asset managers like Bitwise think Bitcoin, Ethereum, and Solana could hit new highs in 2026 if liquidity conditions become favorable. Arthur Hayes Experts such as define the concept of altcoin season not as a one-time event, but as a continuous process that progresses with the change of narratives and the displacement of capital flows in waves.