Leading institutions and analysts throughout 2025 Bitcoin  $88,346.73 When price predictions are discussed, it is seen that the biggest deviation is concentrated in the ambitious targets in the range of 200,000-250,000 dollars. Scenarios expressed in early 2025 missed the target on the price side, as rallies were frequently interrupted by volatility and deleveraging.

$88,346.73 When price predictions are discussed, it is seen that the biggest deviation is concentrated in the ambitious targets in the range of 200,000-250,000 dollars. Scenarios expressed in early 2025 missed the target on the price side, as rallies were frequently interrupted by volatility and deleveraging.

Massive Misses on $200,000–$250,000 Targets

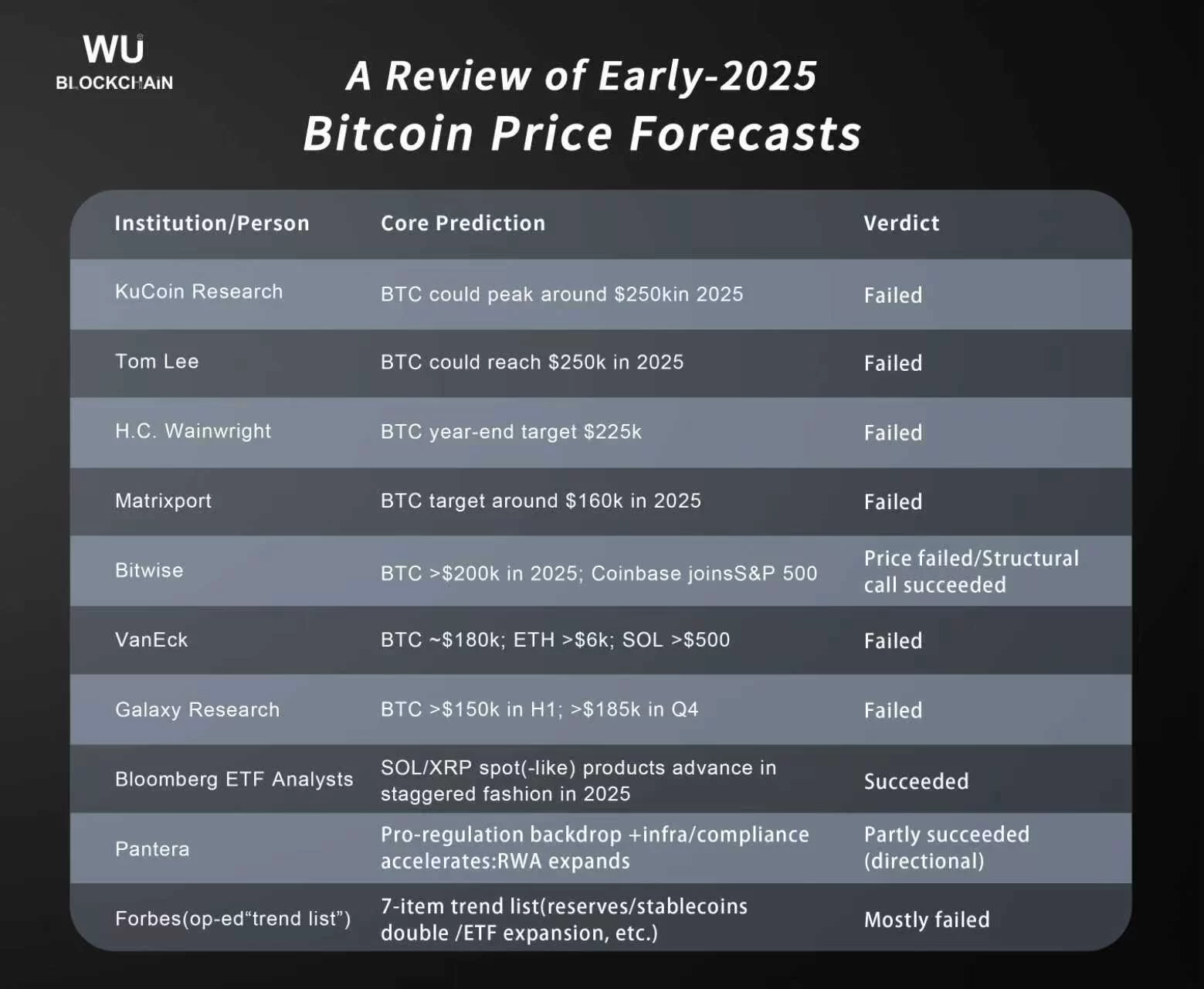

Wu Blockchain compiled The foresight examples in the list show that the highest goals were repeatedly written off as failures. For example KuCoin Researchpredicts that Bitcoin could peak at around $250,000 in 2025. Tom Lee He also argued that $250,000 could be reached in 2025, and both predictions did not come true. H. C. Wainwright gave a target of $225,000 for the end of the year, matrixport He shared a target of around $160,000 in 2025. Both of these predictions failed due to the difference between expectation and outcome.

VanEcktarget around $180,000 in Bitcoin for 2025, also Ethereum  $2,983.89 for over $6,000 and solana He pointed out that it was over $500. Three predictions did not come true, and as a result, it received a “failure” rating. Galaxy ResearchHe expected Bitcoin to exceed $150,000 in the first half of the year and above $185,000 in the fourth quarter. The company’s prediction was recorded as unsuccessful again.

$2,983.89 for over $6,000 and solana He pointed out that it was over $500. Three predictions did not come true, and as a result, it received a “failure” rating. Galaxy ResearchHe expected Bitcoin to exceed $150,000 in the first half of the year and above $185,000 in the fourth quarter. The company’s prediction was recorded as unsuccessful again.

The Right Narrative Doesn’t Mean the Right Price

On the other hand, there are exceptions in the list. BitwiseWhile arguing that Bitcoin will rise above $200,000 in 2025, he also predicted Coinbase’s participation in the S&P 500. While the price prediction part failed, the structural call received a successful grade. Bloomberg ETF analysts He stated that in 2025, SOL/XRP spot-like products will make gradual progress, and the prediction was successful.

Pantera The emphasis on the side was that the pro-regulatory background and infrastructure/compliance acceleration would support RWA expansion. As a matter of fact, the company’s expectation received a partially successful (directional) rating. Forbes’ 7-item trend list (in the form of a column) focused on topics such as the growth of reserves/stablecoins and ETF expansion, but mostly received a failing grade.

The overall picture makes clear the lesson of 2025 for corporate forecasts. Even if the long-term story goes well, price output can follow a completely different path depending on short-term shocks and leverage dynamics. Precise targets for the price level quickly lose meaning when the risk regime changes.