Bloomberg has shared a major announcement, and it’s a pretty big one, raising hopes for 2026. Fed member Miran started his eagerly awaited speech after the latest inflation report. Let’s take a quick look at the details.

JPMorgan and the Fed

According to the latest Bloomberg report JPMorgan to corporate customers next year. cryptocurrency trading services plans to give. This is a big thing because it was one of the institutions most distant from cryptocurrencies and was carrying out blockchain studies through its own private network. But recently Chainlink  $12.72 They experimented with transactions on public networks in partnership with . In other words, the traditional financial world embraces Ethereum

$12.72 They experimented with transactions on public networks in partnership with . In other words, the traditional financial world embraces Ethereum  $3,030.63 They are aware that they have to work together with networks such as

$3,030.63 They are aware that they have to work together with networks such as

Charles Schwab will also launch cryptocurrency trading services by 2026, and Vanguard announced this to its customers just a few weeks ago. crypto ETFs gave access to . So adoption channels are expanding. After last week’s inflation report, which contained incomplete data due to the lockdown and therefore sounded great, Miran said the following;

- There were some anomalies in last week’s inflation data resulting from the government shutdown.

- The housing CPI has been slightly skewed by the shutdown.

- Over the last few months, we have obtained data that aligns with my world view.

- The latest data should push people towards a dovish attitude.

- If people do not update their opinions, it negatively affects the image of the institution.

- I don’t see a recession in the near term.

- If we do not adjust policy downwards, we face an increased risk of recession.

- Next year’s tax refunds should provide some stimulus.

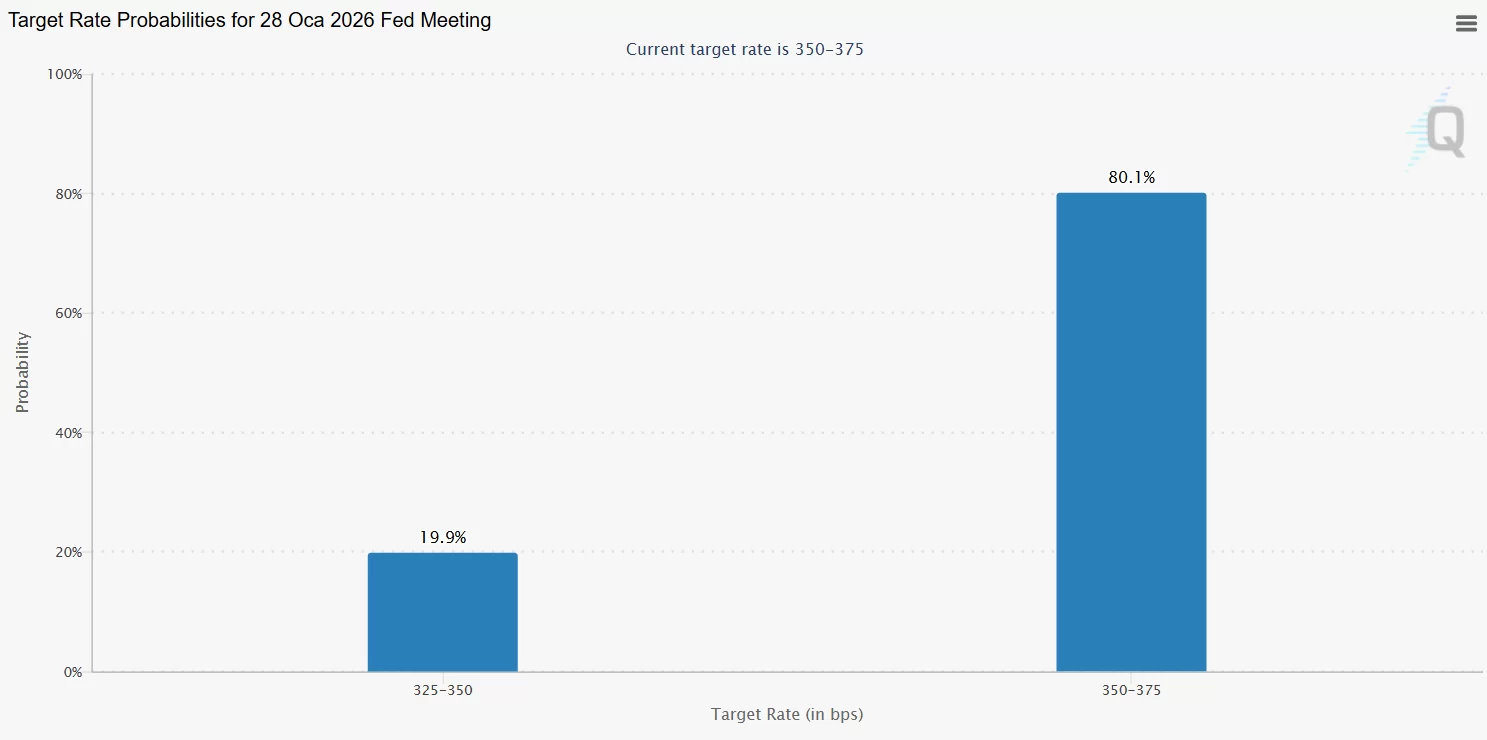

- I haven’t decided yet whether I’ll vote for a 25 or 50 basis point cut.

While BTC is falling below 90 thousand dollars, there is less than 1 hour left for the US market opening and the interest rate cut expectation is still weakening.