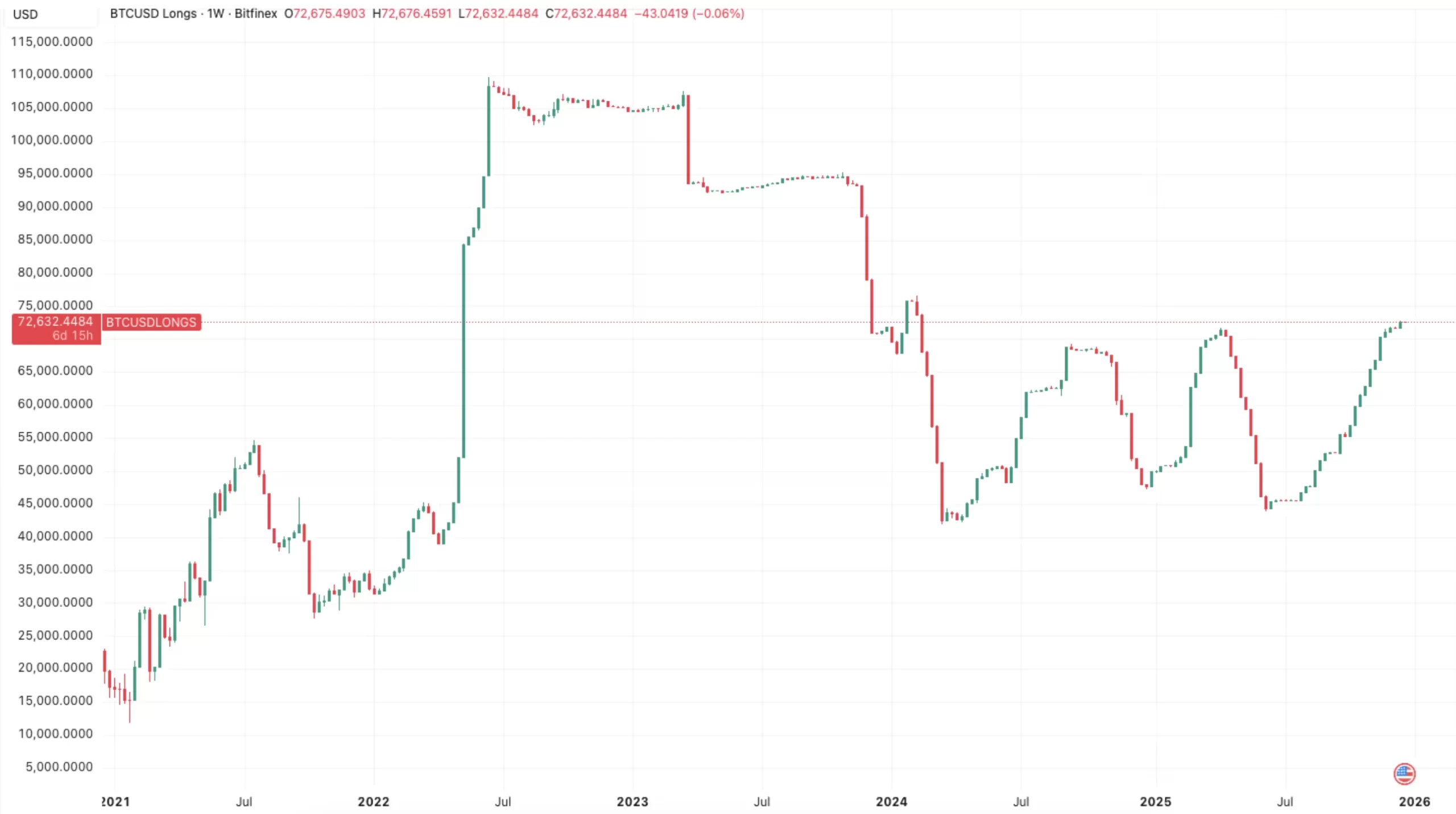

Bullish trading opened by borrowing on the Bitfinex exchange Bitcoin  $90,264.60 Its positions have increased rapidly in recent months. According to data from TradingView, the margin long position balance increased to approximately 72,700 BTC, reaching the highest level since February 2024. The climb from around 55,000 BTC since October showed that the desire to “buy on the dip” continued during the period when the price dropped from $ 126,000 to $ 89,000. While bottom prices approaching $80,000 were seen in some stock markets in November, the increase in the use of leverage produced a remarkable signal.

$90,264.60 Its positions have increased rapidly in recent months. According to data from TradingView, the margin long position balance increased to approximately 72,700 BTC, reaching the highest level since February 2024. The climb from around 55,000 BTC since October showed that the desire to “buy on the dip” continued during the period when the price dropped from $ 126,000 to $ 89,000. While bottom prices approaching $80,000 were seen in some stock markets in November, the increase in the use of leverage produced a remarkable signal.

Leveraged Longs are at the Top Again on Bitfinex

Data bitfinexIt points out that, as one of the oldest cryptocurrency exchanges, it continues to be an important reference point in leveraged transactions. Margin long positions reaching 72,700 BTC are similar to levels observed before the peak around $73,000 in March 2024.

Position increase approximately 17,700 units as of October BTCIt means an additional leveraged purchase of . This table reveals that even as the price of Bitcoin decreased from over $126,000 to $89,000, the risk appetite in the market did not disappear, and some investors continued to expect an increase through borrowing.

In the same period, Bitcoin’s tendency to decline for three consecutive months stands out as a separate data point. According to experts’ assessment, the continuous three-month withdrawal pattern was last seen during the bear market period in mid-2022. Current positioning paints a picture of increased leverage under similar pressure.

Reversal Indicator History Highlights Search for a Bottom

Margin on Bitfinex long position accumulation does not always historically mean “direct rise”. According to past examples, long position balances often peak when the market is struggling, then decline rapidly when a new uptrend begins to become evident. The relationship between the bottom areas and the unwinding of longs is followed as a reverse indicator.

in August 2024 yen carry trade The period during which Bitcoin bottomed at around $49,000 during the unraveling coincided with a moment when leveraged bullish positions declined sharply. A similar dynamic will occur in April 2025 when Donald Trump customs tariff It was also seen in the resulting sales wave. At that time, as the price approached around $75,000, the decline in margin long positions was interpreted as a sign that weak hands were leaving the market, and then the reaction rose.

In the current chart, the fact that long positions continue to increase indicates that the same “clearing” sign has not occurred yet. This increases the possibility that the price of Bitcoin has not yet found the definitive bottom level while the leverage accumulation on the Bitfinex side continues.