Bitcoin rising and falling to 88 thousand dollars throughout the day  $88,097.44 Despite the price, volumes decreased significantly due to Sunday combined with the holiday week. As losses of up to 4% in altcoins become uncomfortably normal ETH He still hasn’t gotten his $3,000 back. But Sherpa thinks everything will be okay after a painful but short-lived nightmare.

$88,097.44 Despite the price, volumes decreased significantly due to Sunday combined with the holiday week. As losses of up to 4% in altcoins become uncomfortably normal ETH He still hasn’t gotten his $3,000 back. But Sherpa thinks everything will be okay after a painful but short-lived nightmare.

Sudden Collapse in Cryptocurrencies

Today’s current situation assessment by the analyst nicknamed Altcoin Sherpa was interesting. Few analysts can say we are at the bottom, and Sherpa did just that. Although he generally thinks that the bottom point has been reached, this year’s bottom level is 75 thousand dollars. of Bitcoin He believes that he can visit, even if it is for a short time.

“I think we have reached a local bottom BUT I would like to see one last wick below this bottom. A quick reach of the 75k level will be a great trigger for a long-term move and ‘bottom’. I think this is quite important.”

The common view these days is that Bitcoin will make a new bottom, at least close to 70-75 thousand dollars. Break in the bear flag, January’s negative news flow, lack of volume in cryptocurrencies and ETF The continuity of strong outflows in the channel encourages the bears.

Risky Assets May Begin to Rise

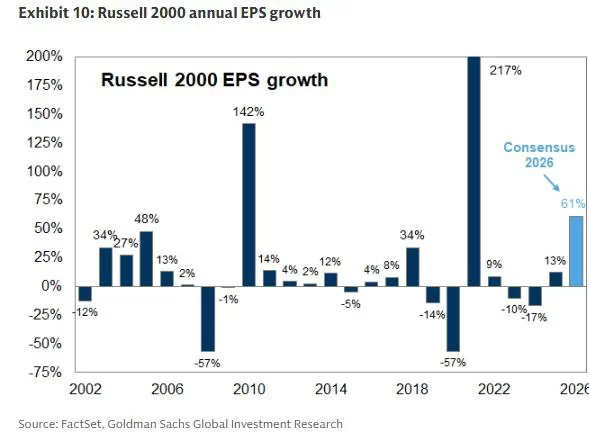

The Russell 2000 index is an important indicator for cryptocurrency bulls. The increase here indicates that the interest in risk assets has doubled, and Kyledoops predicts an increase for next year, unless we see big surprises. Since this situation generally points to the rise of cryptocurrencies, we can see that altcoins return to their old days as the lack of liquidity is resolved.

“Shares of small-cap companies are priced in anticipation of a big recovery.

Russell 2000 The (IWM) index is trading for an EPS growth expectation of 61%, one of the most aggressive forward expectations on record.

This creates a clear risk-return distribution:

- Earnings expectations have been sharply re-set

- assuming margin expansion

- growth is priced in without confirmation

If macroeconomic conditions remain stable, shares of small-cap companies have the potential to rise. “The next few quarters will determine whether this is a recovery or optimism that goes beyond reality.”