We are entering the last full week of December and cryptocurrencies We had a difficult quarter for . Bitcoin  $88,630.65 Its price constantly moved to hunt for liquidity, and investors lost billions of dollars. Although volatility was strong, it generally favored the bears. However, short-term negative developments are behind us and the holiday week may go a little better.

$88,630.65 Its price constantly moved to hunt for liquidity, and investors lost billions of dollars. Although volatility was strong, it generally favored the bears. However, short-term negative developments are behind us and the holiday week may go a little better.

Important Developments of the Week

Today as well as every Sunday cryptocurrency We will discuss the important developments awaiting investors. Important developments still await us, both on the macroeconomic front and in cryptocurrencies. Although we will see much bigger developments in January, the important developments of next week are as follows, with day and time details.

Monday, December 22

- 11:00-16:00 Statements of European Central Bank Officials

Tuesday, December 23

- 16:30 US GDP (Expected: 3.2% Previous: 3.8%)

- 16:30 USA P.C.E. (Expected: 2.9% Previous: 2.6%)

- 17:15 US Industrial Production Monthly (Expected and Previous: 0.1%)

- 18:00 US CB Consumer Confidence Index (Expected: 92 Previous: 88.7)

- Undeads Games (UDS) Unlock (1.46% of Supply)

- SOON (SOON) (5.97%)

Wednesday, December 24

- 02:50 BoJ Meeting Minutes

- 16:30 US Initial Unemployment Claims (Expected: 222.5K Previous: 224K)

- SoSoValue (SOSO) Unlocking (1.59%)

Thursday, December 25

- US Markets Holiday

- plasma (XPL) Unlocking (4.52%)

- Humanity (H) (4.79%)

- Uniswap Unification Voting Will Be Resulted (for burning up to 100 million UNI)

Friday, December 26

- Biggest Bitcoin Option Close of the Year

Sunday, December 28

- Jupiter (JUP) Unlocking (1.73%)

Things to Consider in Cryptocurrencies

There is an annual Bitcoin option closing on Friday. Volatility will likely increase as we move into Friday as a total of $23.8 billion worth of options will close. The volume may shrink due to the holiday week, but even though Japan is unsafe due to the bypass of the interest rate decision and the closure, the positive inflation report should cause an increase at some point. If it doesn’t rise and try above 88 thousand dollars last time.

The last days of the year are not expected to be very pleasant for cryptocurrencies because as we get closer to January, MSCI’s cryptocurrency reserve company The possible delist decision regarding its shares and the potential cancellation of the Supreme Court Customs Tariff will again gather dark clouds in cryptocurrencies.

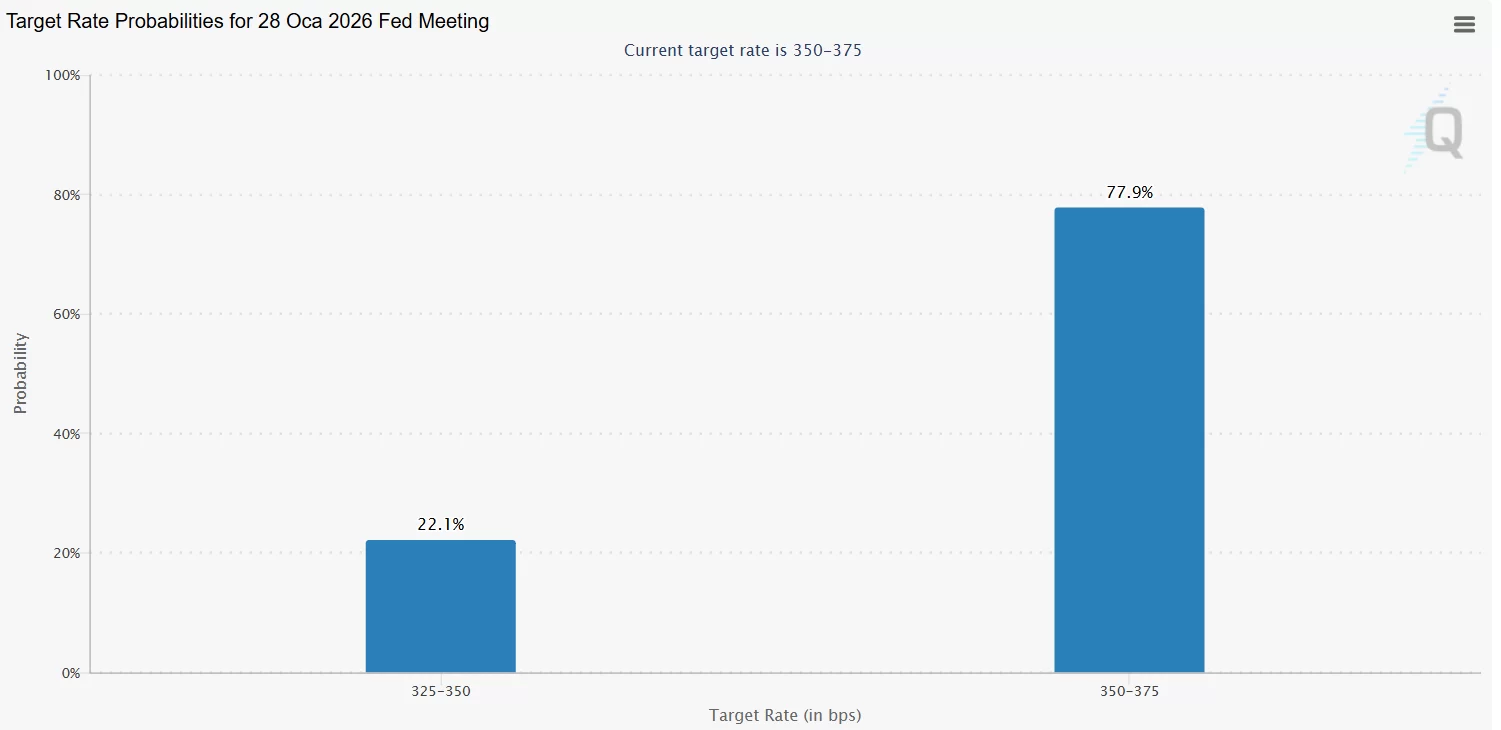

The discount expectation for the January interest rate decision, which will be announced in 38 days, is still below 25%.