As the crypto markets enter the weekend, volatility is slowly rising. The Bitcoin price is consolidating above the pivotal support zone after absorbing the short-term sellers, and XRP continues to maintain its stability. After weeks of volatility and forced liquidations, several large-cap altcoins are now trading in zones that historically coincide with late-stage sell pressure, not the start of fresh downtrends. Chainlink (LINK), Sei (SEI), and Sui (SUI) are all flashing similar signals on higher timeframes.

Momentum Is Compressing, Not Collapsing

Recent volatility has pushed several large-cap altcoins into deeply compressed momentum zones, but the structure does not resemble the start of a fresh breakdown. Instead of accelerating lower, price action is stabilizing as selling pressure fades and longer-term holders step in near key support levels.

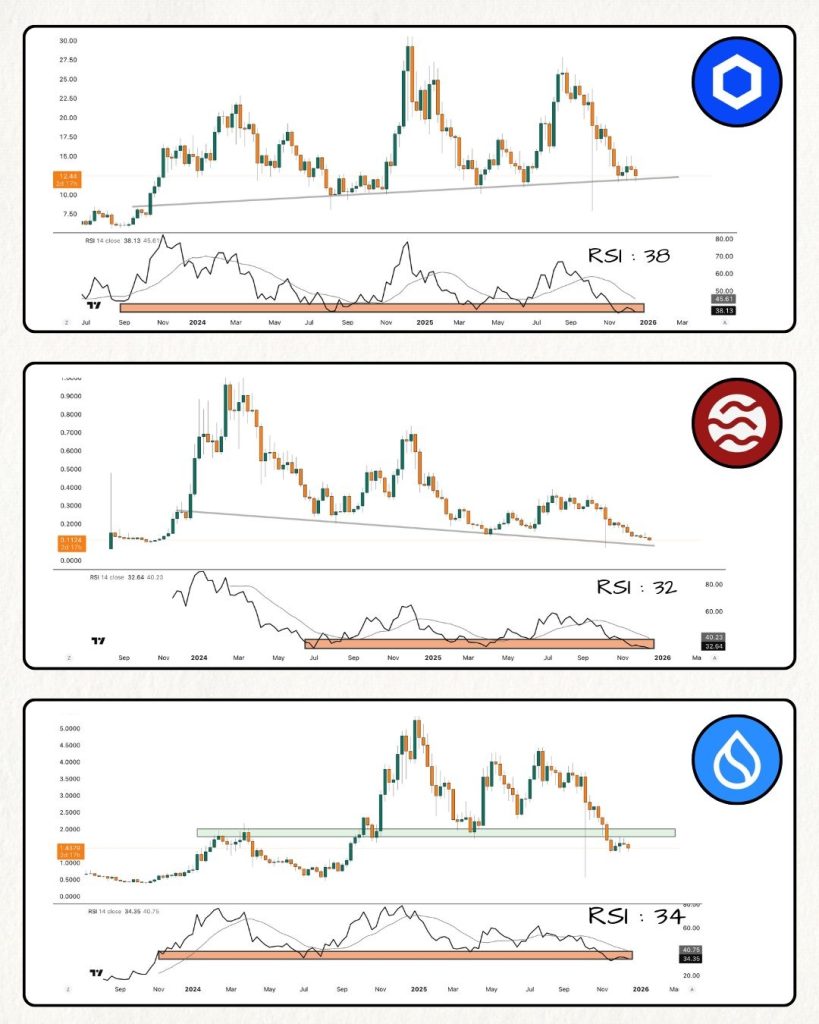

On the weekly timeframe, all three assets are trading with RSI readings in the low-to-mid 30s:

- LINK: Weekly RSI near 38

- SEI: Weekly RSI around 32

- SUI: Weekly RSI close to 34

Historically, these momentum levels tend to appear after prolonged selling, when downside acceleration slows, and marginal sellers are largely exhausted. Importantly, RSI is not signalling strong bullish momentum yet—but it is showing that there is little left to sell aggressively at current levels.

This distinction matters. Bear markets usually begin with momentum expanding lower, not compressing near long-term support.

Supply Is Absorbing—Why This Matters Going Forward

Price action across LINK, SEI, and SUI shows a clear shift from distribution to stabilisation. Despite recent volatility, none of these assets has broken decisively below their higher-timeframe support zones. Pullbacks attract steady demand, suggesting the long-term holders will absorb the remaining supply, rather than panic sellers.

This behaviour is inconsistent with the early stages of a bear market, where support typically gives way under sustained pressure. Instead, fading sell intensity points to a base forming, improving the odds of recovery attempts over further aggressive downside. While 2026 outcomes will still depend on macro conditions and leadership from Bitcoin and Ethereum, the current structure favours consolidation and upside exploration rather than continued distribution.

The Bottom Line!

The current signals across LINK, SEI, and SUI point less toward an exhausting trend and more toward distribution. With momentum compressed, key supports holding, and sell pressure fading, the probability favors stabilization and recovery. A gradual grind higher or range expansion appears more likely than a sharp breakout, as markets remain sensitive to macro cues and Bitcoin’s direction.

Looking into early 2026, outcomes will be shaped by liquidity conditions and broader risk appetite. If macro stability improves and Bitcoin holds structure, these large-cap altcoins are positioned to recover meaningfully from current levels, even if a full return to all-time highs remains a longer-term process rather than an immediate outcome.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.