Bitcoin dropped to $85,314  $87,270.31 Its price reflects the concerns of risk-averse investors. In altcoins Losses are much larger and many have fallen to important support levels. Of course, good things are happening too, for example Coinbase announced that it will launch the stock trading feature. However in cryptocurrencies Negativity prevails for the rest of December and January. So what does the cryptocurrency oracle think?

$87,270.31 Its price reflects the concerns of risk-averse investors. In altcoins Losses are much larger and many have fallen to important support levels. Of course, good things are happening too, for example Coinbase announced that it will launch the stock trading feature. However in cryptocurrencies Negativity prevails for the rest of December and January. So what does the cryptocurrency oracle think?

Cryptocurrency Oracle Prediction

There were negativity that we had been drawing attention to for weeks, and we had mentioned that this week might not be a good one for investors as it hosted many important developments. It was not surprising after the warnings we last shared on Sunday. BTC It dropped from $90,000 to $85,000, and even for a few minutes in the last 24 hours, BTC reached $90,000.

Roman Trading, nicknamed the crypto oracle who has voiced his decline expectations more loudly for the last 2 quarters and predicted the declines correctly, shared the current charts a few hours ago. He wrote the following about the 90 thousand dollar trap;

“Remember that every bounce in BTC will turn into a sell-off. Don’t fall into the trap of these fools. They never know what will happen.”

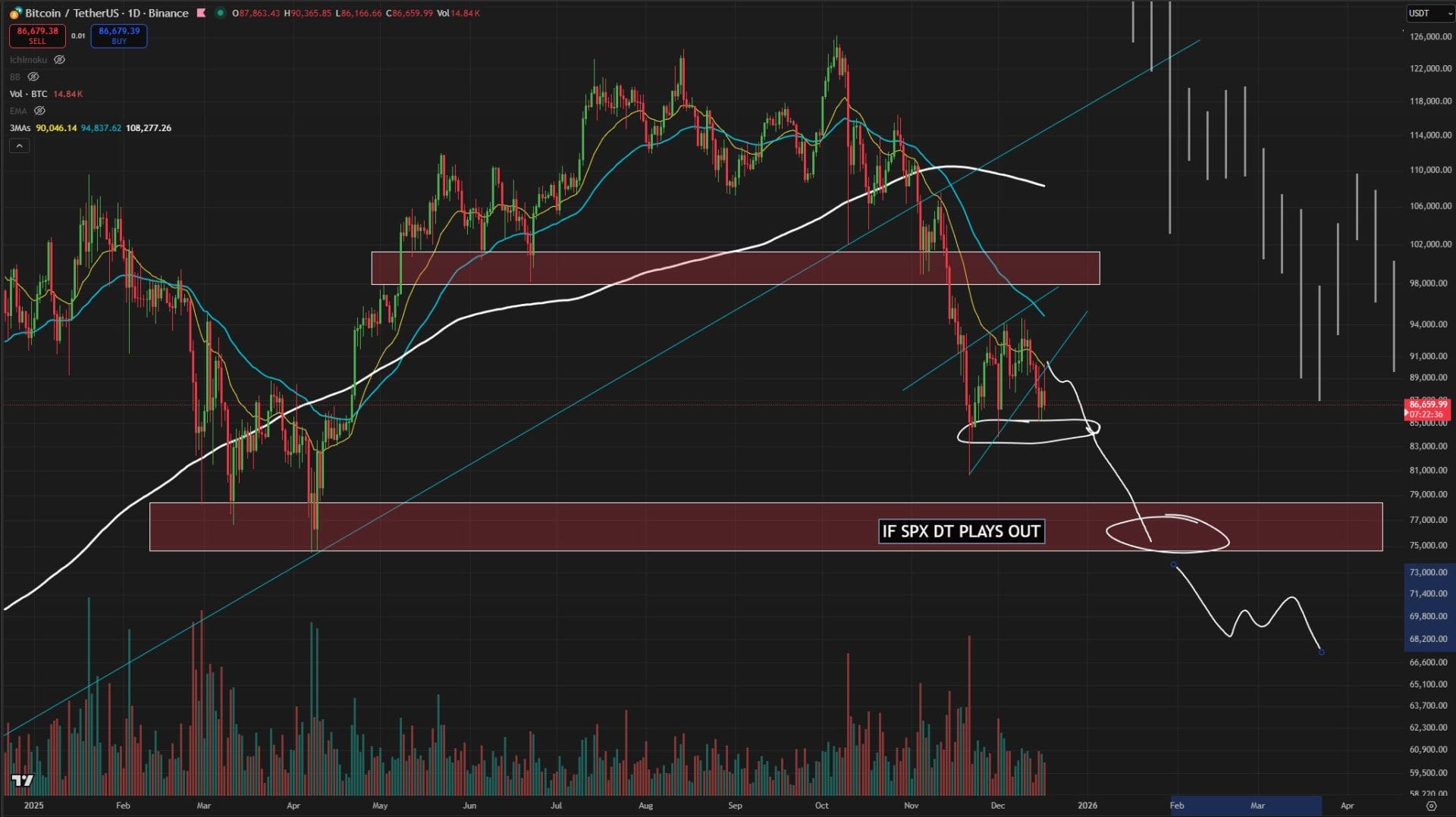

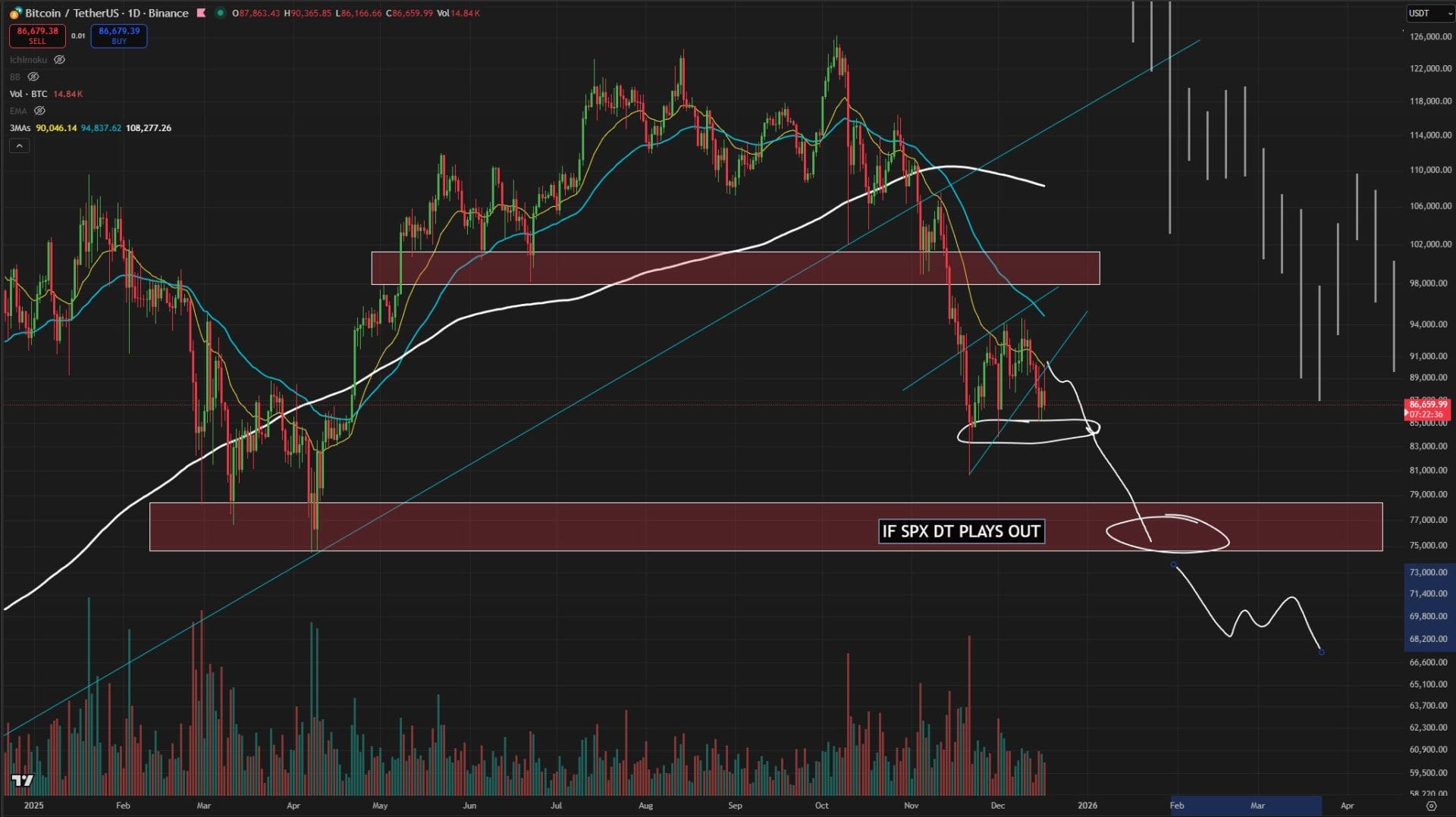

The analyst who shared the daily chart above mentioned in his last detailed assessment that the target is below 76 thousand dollars.

“We got the bounce we were looking for at the 84k level, which ended with an excellent retest of our bear flag +20MA.

They will continue to tell you that every bounce is a bottom and the bull market is coming. Not so. “76 thousand and below are next.”

Japan Interest Rate Decision and Inflation

The Bank of Japan will probably increase interest rates by 25bp at 07:30 Türkiye time on Friday. If you consider that interest rates are 0.5%, you can better understand how big a 25bp increase is. People take that money and invest it in bonds, stocks, and cryptocurrencies because Japan lends money at near-zero interest. hundreds of billions of dollars carry trade It circulates in global markets for However, what we see as the US lowers interest rates and Japan increases them is that the carry trade begins to break down. This means a decline due to decreasing cheap money for risk markets.

Previous interest rate decisions had caused a decline in cryptocurrencies. This historical data alone is enough for cryptocurrencies to fall in fear as Friday’s decision approaches. Moreover, in January, the Supreme Court canceled the Tariff and cryptocurrency reserve Major negative developments such as companies being classified as funds by MSCI await us. So, we are entering the holiday week in a bad way, and while January will start off badly due to the news flow, the best time for BTC to lose 80 thousand dollars is the coming days. That’s why Roman Trading and other bearish analysts are hopeful.

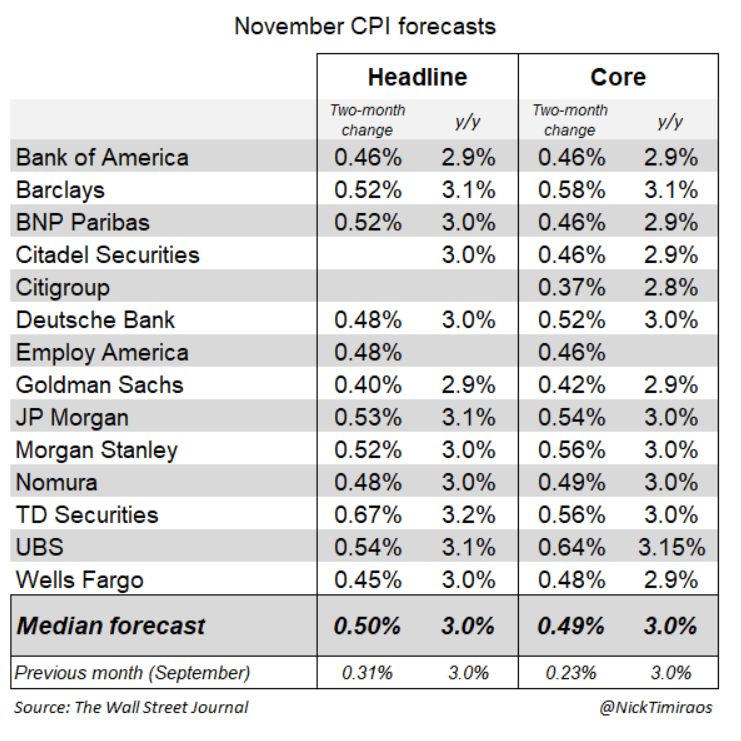

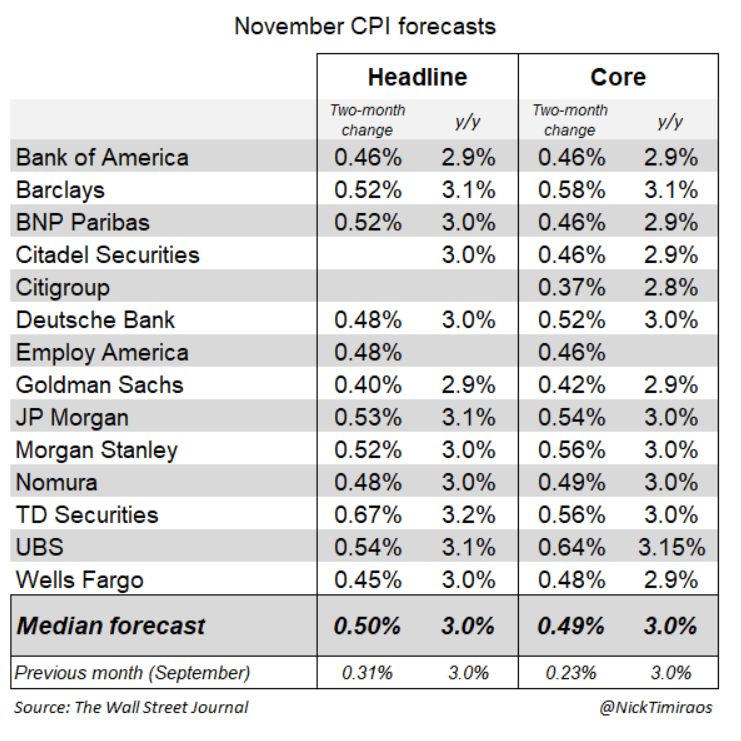

1 hour before US market open today US inflation data will be announced. The consensus expectation is 3.1% and core CPI is expected to remain stable. The European Central Bank will announce its interest rate decision at the same time and the expectation is that it will remain constant. They have already completed their reductions, and while the Fed is too late, they are now talking about the possibility of tightening. The chart above shows different financial institutions’ US CPI expectations.

It’s important to keep your news feed up to date these days because the big consequences of big developments affect everyone. CryptoAppsy news section can make your job easier.