After the latest drop, Bitcoin price consolidates around $87,000, within a narrow range that is now pressing against multi-week resistance. The star token usually accumulates before undergoing the next price action, and hence, the ongoing price compression is believed to transform into a gigantic breakout. While the macro narrative has soured and unemployment is rising, with liquidity expectations shifting, several high-timeframe technical signals are tightening. Historically, this type of macro-technical overlap has preceded a decisive BTC breakout.

BTC Price Consolidating Within a Critical Zone

The BTC price lost the pivotal support zone around $88,600 during the recent pullback and has been compressing below the key resistance since then. The price is forming a sequence of higher lows below the range of $87,500 and $88,300, while volatility bleeds out. This type of squeeze historically revolves in the direction of the primary trend, still firmly upward.

Observing the above chart, it would be clear that breaking the newly formed resistance zone between $87,500 and $88,000 is essential to open the doors beyond $90,000. However, it could further test yet another important barrier at $89,000, which has been a strong trend reversal zone since the start of the month. Therefore, a close above $88,500 to $89,000 would open the path to $90,000 to $92,000 based on previous liquidity pockets and untested price inefficiencies.

On-Chain Positioning Points Toward Accumulation, Not Exhaustion

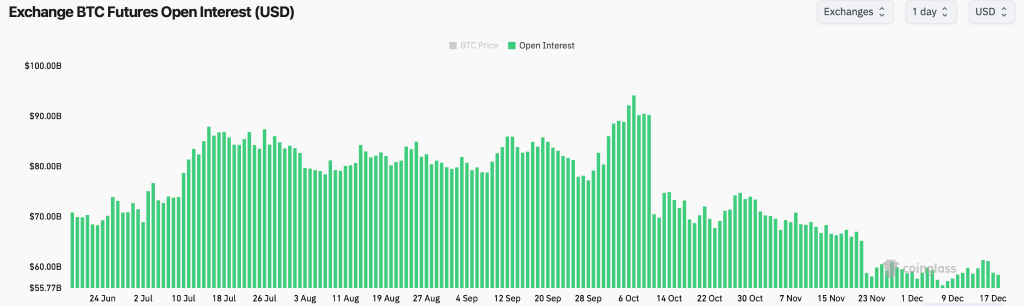

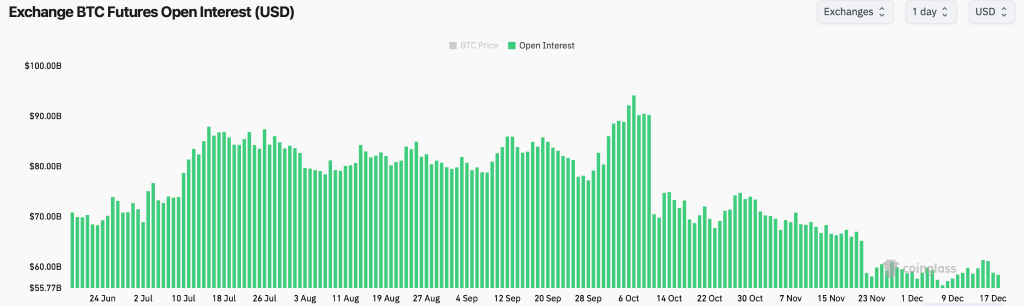

On-chain data continues to signal strength beneath Bitcoin’s price action. While BTC trades just below major resistance, wallet behaviour, long-term holder supply, and derivative positioning all indicate steady accumulation rather than distribution. Futures open interest is elevated around ~$60 billion (not collapsing), while funding rates remain neutral—suggesting traders aren’t panicking out of longs.

Bitcoin’s futures open interest has stayed elevated rather than crashing, indicating steady engagement rather than forced deleveraging—a common sign of capitulation. Funding rates have hovered near neutral, reflecting balanced leverage rather than extreme short-term blow-offs. Collectively, this pattern aligns with accumulation behaviour on-chain, not exhaustion.

The Bottom Line-What’s Next for the Bitcoin Price Rally?

Bitcoin’s tightening price structure is forming against a macro backdrop that is quietly becoming more supportive. Rising unemployment has historically increased expectations of liquidity support, and while policy shifts are not immediate, risk assets tend to move ahead of them. Importantly, this is occurring while leverage remains controlled, ETF flows have stabilised, and on-chain data shows little evidence of broad distribution.

From here, the market has two clear paths. A decisive break above $88,300 would likely trigger a liquidity-driven expansion toward $90,000–$92,000, confirming that the current compression has resolved higher. A rejection, on the other hand, could sweep support near $85,600, but unless $84,300 breaks on a daily close, such a move would resemble a reset rather than a trend reversal.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.