This week has been an extremely busy period for cryptocurrencies and the last big report of the day was just announced. Although the employment report points to an upward trend for cryptocurrencies, BTC fell below $87,000. PMI data came below expectations. So what does the just announced PMI report mean for cryptocurrencies?

PMI and Bitcoin

We talked about what awaits us in the weekly calendar announcement on Sunday. Today employment data That’s out of the way and we’re now focused on the report on inflation. Leading PMI data reflecting the state of the economy was just announced. PMI data coming in below expectations cryptocurrencies We mentioned that it would be positive for And yes, the numbers were below expectations, and combined with the 4.6% unemployment rate, helped the BTC price return to $87,600.

- US S&P Manufacturing PMI Leading Announced: 51.8 (Forecast 52.1, Previous 52.2)

- US S&P Utility PMI Leading Announced: 52.9 (Forecast 54, Previous 54.1)

It is unclear whether this is permanent, and concerns about Friday’s interest rate decision still remain. However, short-term recoveries are something we can always see. If BTC can stay strong, we may see a short test of $90,000 due to the latest data.

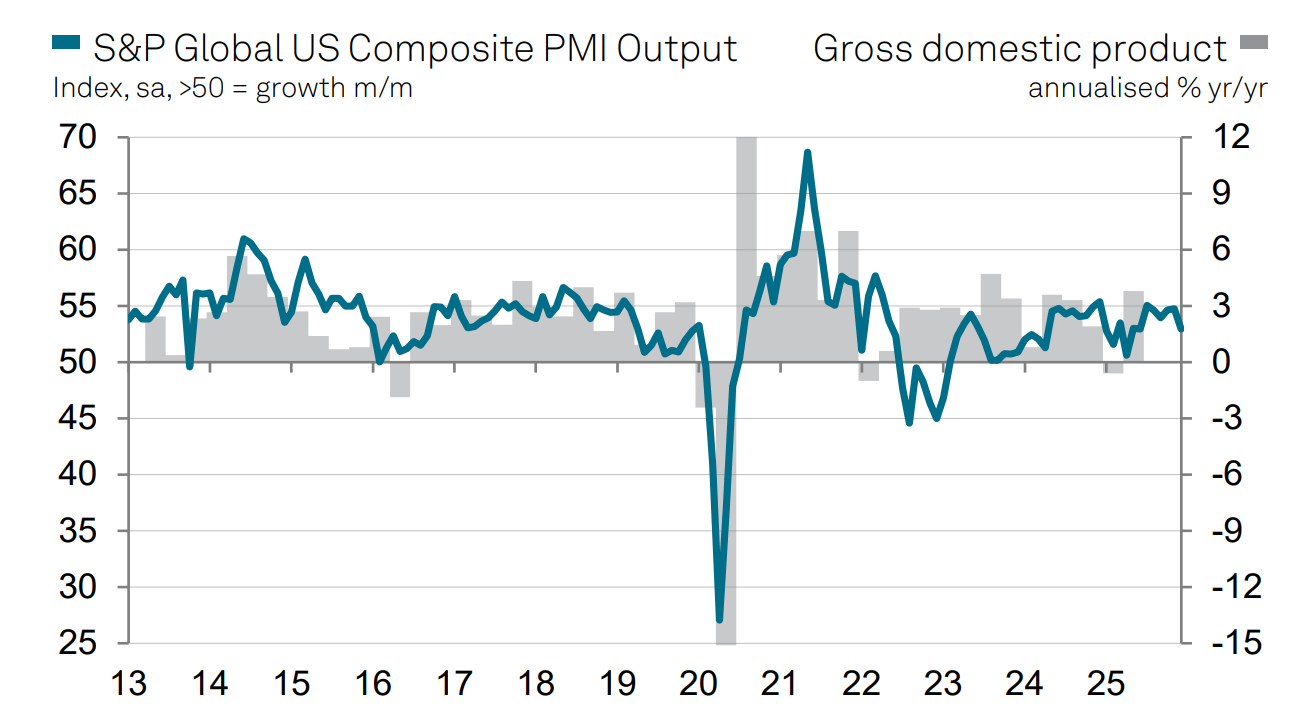

Current PMI data We are talking about leading figures, that is, numbers that have a strong potential for deviation before the main report. Today’s report shows that the recent economic growth momentum is weakening in any case Fed’s January may help make the interest rate decision in favor of the bulls.

S&P Global Market Intelligence Chief Economic Expert Chris Williamson said the following about the report;

“Growth has been slowing for two months, although survey data forecasts annual GDP growth of around 2.5% in the fourth quarter. Economic activity could weaken further as we head into 2026, with new sales falling particularly sharply ahead of the holiday season. “Signs of weakness are also broad-based; Factory orders fell for the first time in a year, while the flow of work into the broad services economy came to a near halt. While manufacturers continue to increase production, declining sales point to unsustainable production levels that must be reduced unless demand revives in the new year.

The services sector experienced one of the slowest months of sales growth since 2023.

Companies have also lost some confidence in the future and restricted their recruitment in December in line with the more challenging business environment. The biggest concern is rising costs. Inflation has jumped to its highest level since November 2022, leading to one of the sharpest sales price increases in the last three years. Price increases are again attributed to customs duties. This increase, which first affected the manufacturing sector, has now spread to the service sector, further expanding the affordability problem.”

And yes, inflation concerns in the report’s details undermine the appetite triggered by the expected six figures in crypto.