Bitcoin  $85,602.20 It’s having another terrible day and is just below $86k. Many analysts believe the ongoing closes are confirmation for a continuation of the decline. We already knew that this week would be bad for the cryptocurrency markets, so the drop was no surprise. Alright cryptocurrency oracle What goals did he address today? What are the predictions of different analysts for BTC and altcoins? Let’s take a quick look.

$85,602.20 It’s having another terrible day and is just below $86k. Many analysts believe the ongoing closes are confirmation for a continuation of the decline. We already knew that this week would be bad for the cryptocurrency markets, so the drop was no surprise. Alright cryptocurrency oracle What goals did he address today? What are the predictions of different analysts for BTC and altcoins? Let’s take a quick look.

Cryptocurrency Oracle Prediction

If BTC had formed a good top near $104 thousand, Roman Trading’s prediction would have come true. However, even the analyst who was named as the cryptocurrency prophet of the last 2 quarters, who was caught up in the bearish psychology, does not keep his prediction in favor of the bulls. Despite many attempts, BTC could not remain stable above $94,000.

In today’s evaluation cryptocurrency oracle He shared the chart below and wrote that we were advancing to 76 thousand dollars. While most cryptocurrencies are already in oversold conditions, such a thing could have devastating consequences. As we have been drawing attention to for days, a possible interest rate increase by Japan on Friday may trigger a loss of over 20%, like the previous ones. Probably his prediction is implicitly in this direction.

“It’s still going perfectly according to plan. Bear waves + price movements are pulling us down. My only problem right now is that the sales volume is not very high, so we will probably get another bounce around 84k. (He wrote in his analysis 5 hours later that this might not happen, and since BTC had a weak bounce, he may be right.) Even if we have a bounce, I believe we will reach 76k when the time comes.”

If $84,000 cannot be protected, Roman Trading may be right this week.

ADA, SOL and Altcoins

In his latest analysis, Jelle said that the current decline should now reverse compared to previous lows. ETF The stable appetite on the side encourages him and he thinks that these days are the last opportunity before the rise. Lark Davis expressed the warning we shared before the fall. Japan interest rate increase It constantly reminds us that it causes decline.

“Bitcoin lost over 20% in the last 3 interest rate hikes of the BOJ

March 2024 → -27%

July 2024 → -30

January 2025 → -31

We saw a 7% decline last week as investors took action to stem the decline. However, considering only Japan’s interest rate hikes would mean interpreting everything that is happening in the global economy too simplistically.

If you look deeper, the BOJ’s rate hike wasn’t the only reason for January’s crash. Trump took office and there was huge tariff uncertainty. In July 2024, the end of Japan’s carry trade surprised the entire market and many forced position closures occurred.

In March-April 2024, BTC reached its all-time high and a sales wave occurred due to the tension in the Middle East. Remember, markets don’t fear liquidity tightening, they fear uncertainty. “That’s why I think most of the BoJ’s FUD may be reflected in prices.”

Let’s see if he will be right.

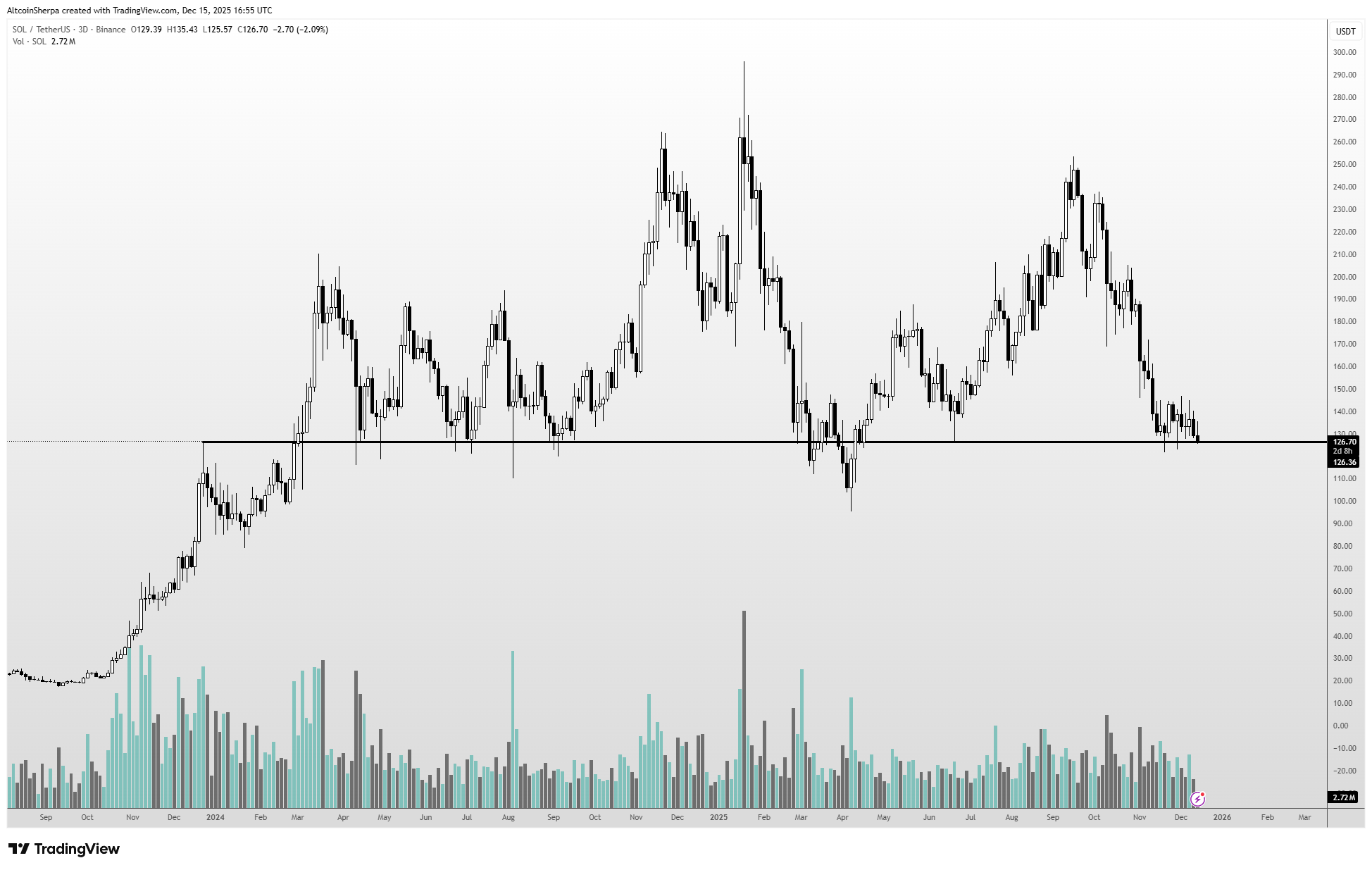

Analyst with the pseudonym Altcoin Sherpa who shared the Solana chart in SOL Coin He wrote that he expects a rapid decline to $100 if the $120 support is lost. The altcoin is now at $124.

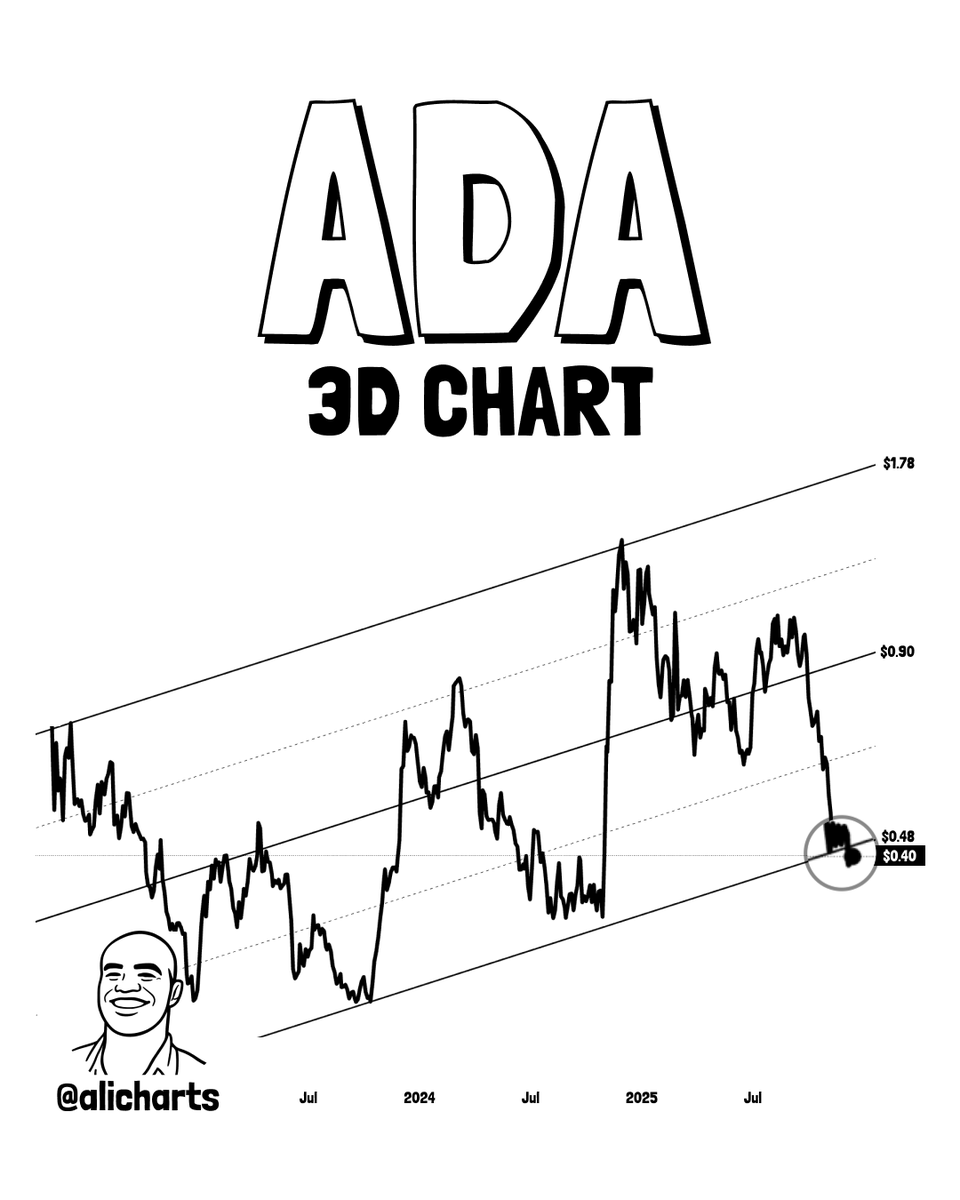

Ali Martinez Cardano (ADA)  $0.3809 He is interested in and a downward break in the ascending channel makes him nervous. If $0.48 cannot be gained as support, ADA Coin could drop to $0.24.

$0.3809 He is interested in and a downward break in the ascending channel makes him nervous. If $0.48 cannot be gained as support, ADA Coin could drop to $0.24.

For altcoins and Bitcoin, DaanCrypto highlights the change in global liquidity. While it’s promising, we’ve been hearing the same stories all year long, so it’s not very motivating.

“BTC Global Liquidity is on the rise again. Bitcoin has stopped its decline but has not yet fully followed this new upward trend in liquidity.

Generally speaking, Bitcoin tends to track this metric quite well. I think the reason for the big divergence and underperformance here is that there are still a lot of 4-year cycle sales with tax loss harvesting through the end of the year.

I think Bitcoin will get its first chance to show that it can truly break the old 4-year cycle in the first quarter of next year. But until then, we must weather the storm and navigate the next period of low liquidity and volume.”