Bitcoin It started the week below $90,000. As the cryptocurrency market cautiously heads into a busy macroeconomic week where US inflation data will be released, investors await data that will set the tone for the rest of December. for now Ethereum Around $3,100, BNB $890 and solana It is trading at $132. The weakening in the market reflects the cold weather following last week’s “hawkish interest rate cut” and the ongoing stagnation in derivative markets.

Macro Agenda Will Shape December

end of 2025 FOMC After the meetings, all eyes turned to US data. Retail sales, unemployment applications, CPI, PCE and Fed members’ speeches will be announced in a short time. BRN Research Director Timothy Egypt“Markets are now pricing the data that will confirm the interest rate cut, not the interest rate cut itself. Inflation“An upside surprise would strengthen the ‘hawkish discount’ narrative, while soft data could revive risk appetite,” he said.

The Fed’s cautious messages despite the 25 basis point interest rate cut also weakened the expectations for a year-end “Christmas rally”. Bitcoin, interest rate decisionAfter this, it has difficulty holding on to resistance zones. According to experts, the current price movement shows that markets have taken a cautious position based on data.

Leverage Reduced, Miners Withdrew

While approximately $298 million of positions were liquidated in the last 24 hours, 80 percent of this was long transactions. Although these liquidations reduced speculative leverage, they did not create upward momentum. On the other hand Bitcoin network‘s hashrate dropped by 8 percent due to mining disruptions in China’s Xinjiang region. Historically, such supply contractions are among the factors that support price stability in the future.

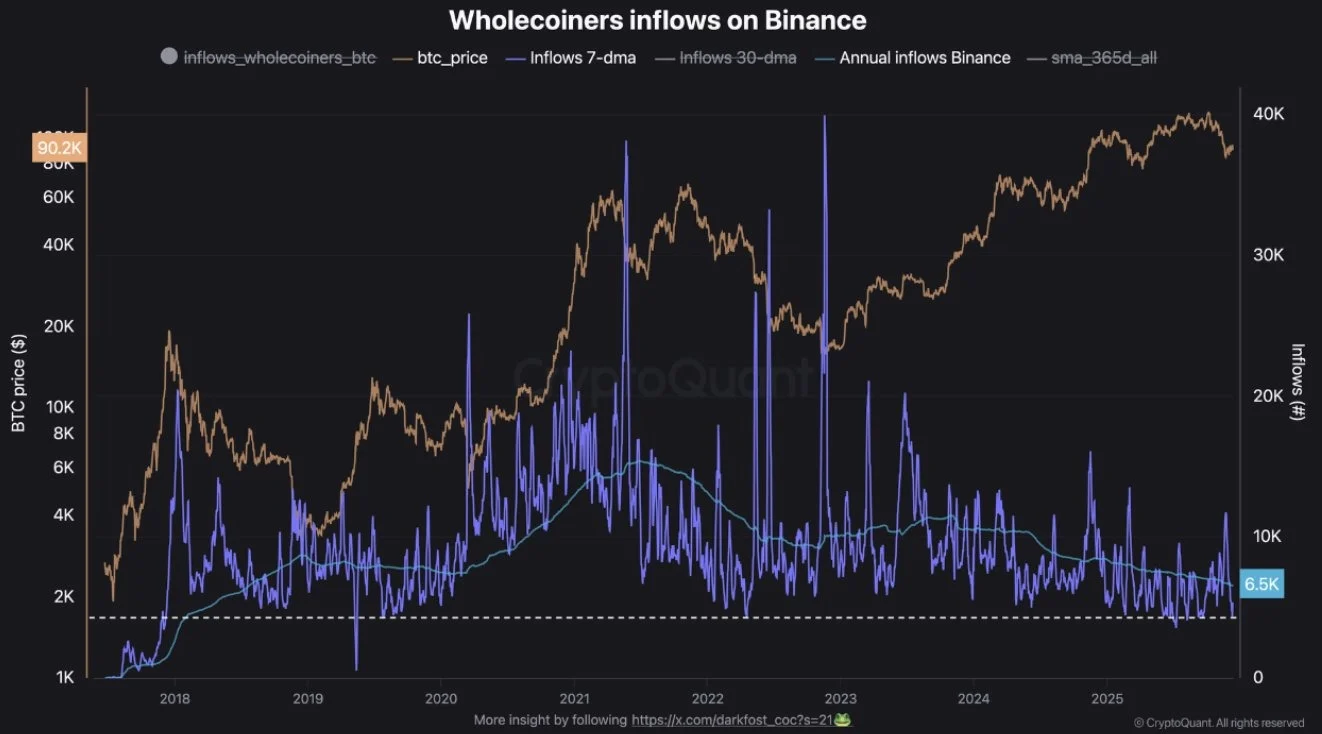

Intra-blockchain data also shows that the selling tendency of large investors has decreased. According to CryptoQuant data, 1 to Binance BTC The number of entries and above is at its lowest level since 2018. Misir said, “Large wallet movements have almost stopped. Selling pressure is decreasing.”

The current forecast published by Standard Chartered last week also reflects the indecision in the markets. The bank lowered its target for Bitcoin by the end of 2025 from $200,000 to $100,000. It postponed its long-term goal of $500,000 to 2030. Analysts emphasize that the direction in December will be completely shaped by inflation data, and that protecting capital in this process is more important than taking risks.