With the ongoing cycle, institutional investors have become the most important building block of cryptocurrency markets. Bitcoin  $87,013.63 DATs and ETFs were effective in pushing the price up from its historical peak. That’s why it’s important to follow what corporates are currently doing and which cryptocurrencies they are interested in.

$87,013.63 DATs and ETFs were effective in pushing the price up from its historical peak. That’s why it’s important to follow what corporates are currently doing and which cryptocurrencies they are interested in.

Cryptocurrency Report

Altcoin ETF With the approvals, the activity of institutional investors in crypto has become more important. Its market value is much lower than BTC and ETH altcoins Tens of millions of dollars of ETF inflows mean a lot. The capital inflow obtained by thousands of individual investors holding any altcoin occurs in a few days for the same altcoin in the ETF channel.

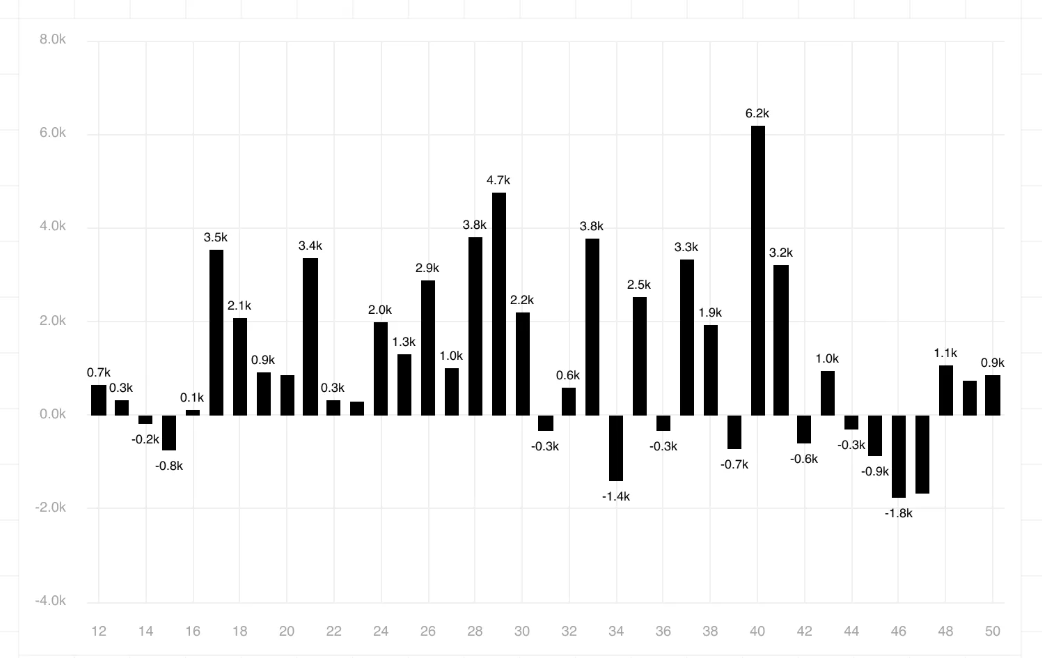

That’s why the weekly report prepared by CoinShares contains important details. Crypto asset investment products It recorded a total inflow of 864 million dollars last week. This marks the third week of generally moderate inflows. Although corporates remain cautious and do not buy as wildly as before, they are still optimistic and still enthusiastic.

“Despite the US Federal Reserve’s recent interest rate cut, price performance has remained weak, with mixed sentiment and unbalanced flows seen in the trading days following the cut.” – CoinShares

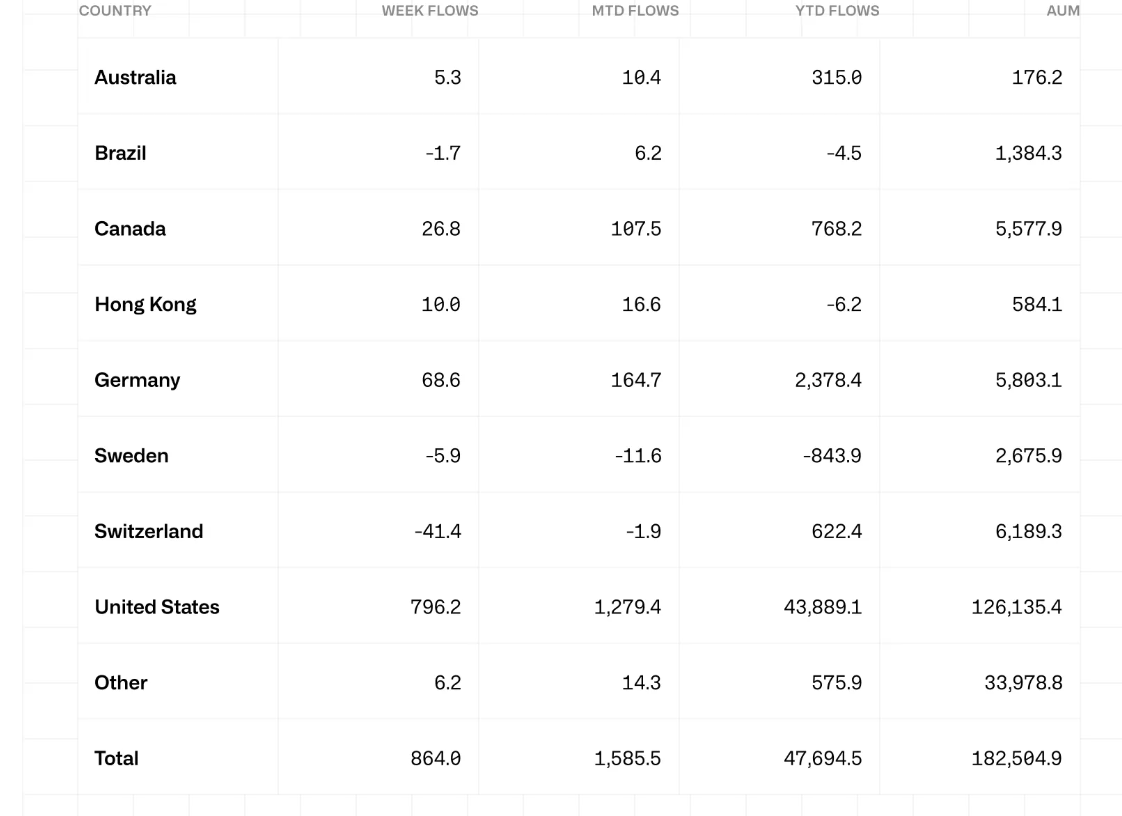

Most of the entries again came from the USA. While the USA ranked first with an inflow of 796 million dollars, Germany and Canada followed with 68.8 and 26.8 million dollars, respectively. These three countries accounted for 98.6% of arrivals throughout the year.

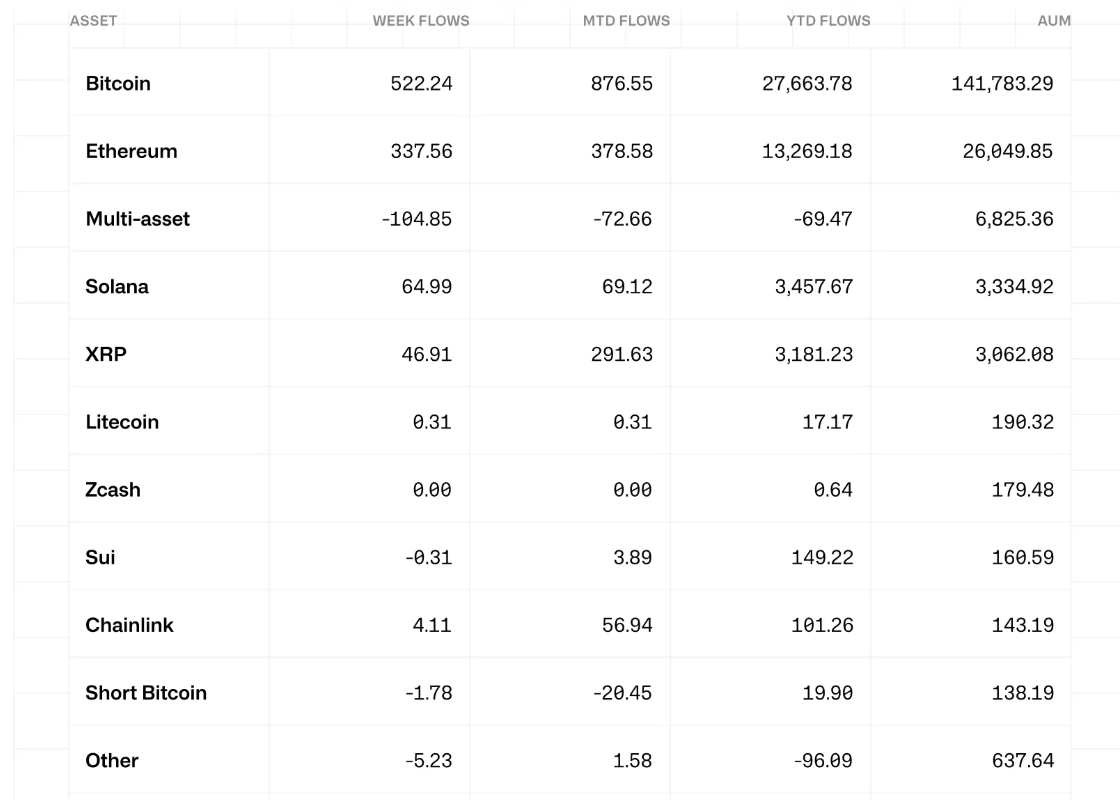

There was an outflow of $1.8 million from Short BTC products. The stable escape here is nice. BTC recorded inflows of $27.7 million through 2025, remaining below last year’s $41 billion.

Altcoins and Institutions

As outflows from BTC short selling products continue, we still have a strong reason to be hopeful for the future of cryptocurrencies. ETH inflows continue and total annual net inflows reached $13.3 billion. While Solana inflows reached a total of 3.5 billion dollars throughout the year, it gives us an idea about the debate about which is the third largest cryptocurrency. Solana is attracting more attention from institutional capital.

Chainlink  $12.85 (LINK) It has attracted quite a lot of inflows since launch compared to its market cap. AAVE saw inflows of $6.9 million and hyperliquid It disappointed with sales of $14.1 million.

$12.85 (LINK) It has attracted quite a lot of inflows since launch compared to its market cap. AAVE saw inflows of $6.9 million and hyperliquid It disappointed with sales of $14.1 million.