The king cryptocurrency has fallen below $90 thousand again and the volatility in altcoins continues. The key support is at $88,000 as challenging days for investors continue at full throttle, with the Fed undermining optimism for the coming year. Today we will discuss the current status of the on-chain alarm that correctly predicted the last 3 major movements.

Major Cryptocurrency Signal

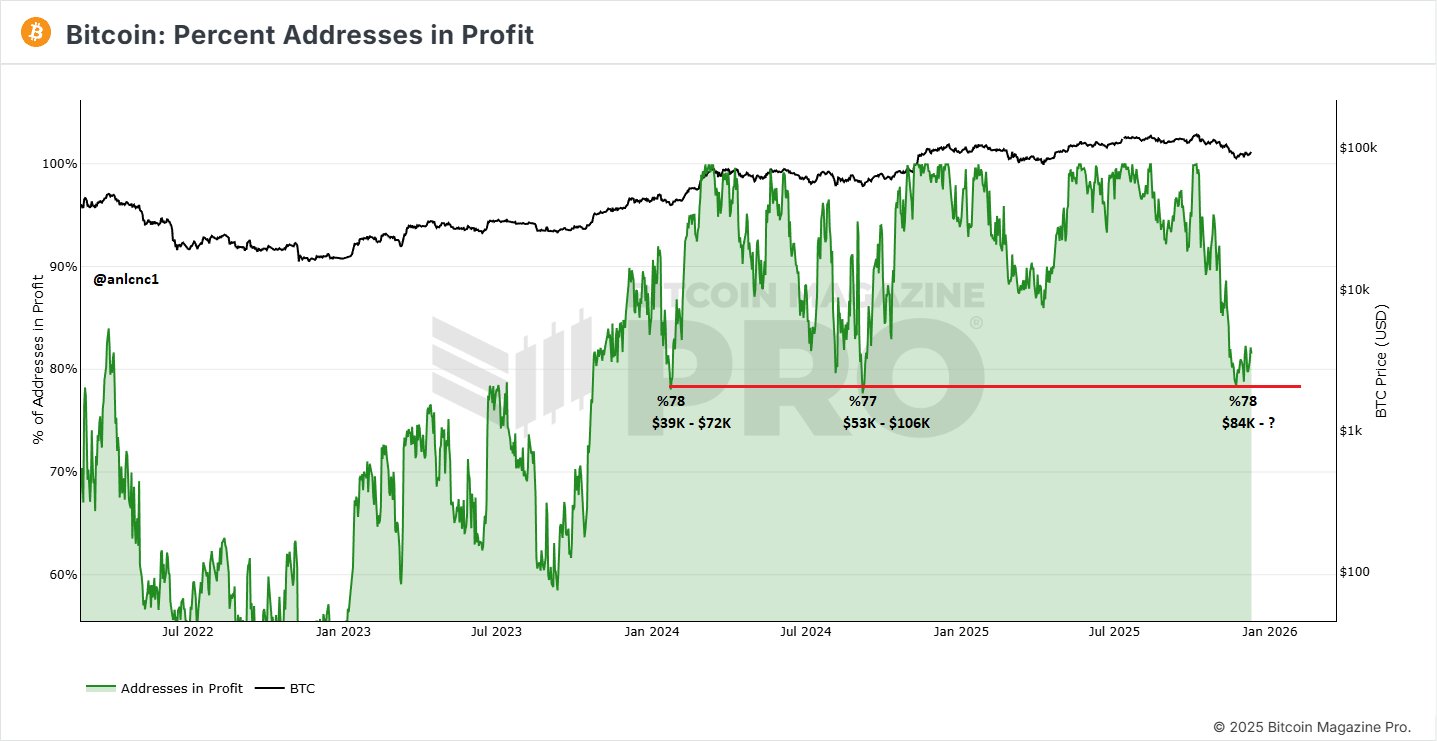

Bitcoin  $86,989.86 When the indicator that monitors the profitability of investors dropped to 80% for the last 3 times, a local bottom was formed. in bitcoin In this respect, the status of addresses in profit is a useful signal in terms of determining the local bottom. Today anlcnc1 said the following about the current situation;

$86,989.86 When the indicator that monitors the profitability of investors dropped to 80% for the last 3 times, a local bottom was formed. in bitcoin In this respect, the status of addresses in profit is a useful signal in terms of determining the local bottom. Today anlcnc1 said the following about the current situation;

“in bitcoin A local bottom occurred when in-profit addresses fell below 80% for the last three times. In the first one, there was a strong rise between 39-72K at a level of 78%, and in the second one, a movement of 53-106K came at a level of 77%.

In the current situation, the profitability rate has decreased to 78% again and has received criticism again. This percent corresponds to the 84K level. Since the profitability rate of the addresses is generally still high, this should not be read as a bear market bottom area. Bear market bottoms generally go down to 50%. In the past, these levels were areas where the price formed only local bottoms, that is, we can think of them as intermediate bottoms that resulted in new tops in the current cycle. The 80% – 78% range seems to work well for now. “If this percentage works again, we can say that the price has formed another local bottom in the current cycle.”

Latest Situation in Cryptocurrencies

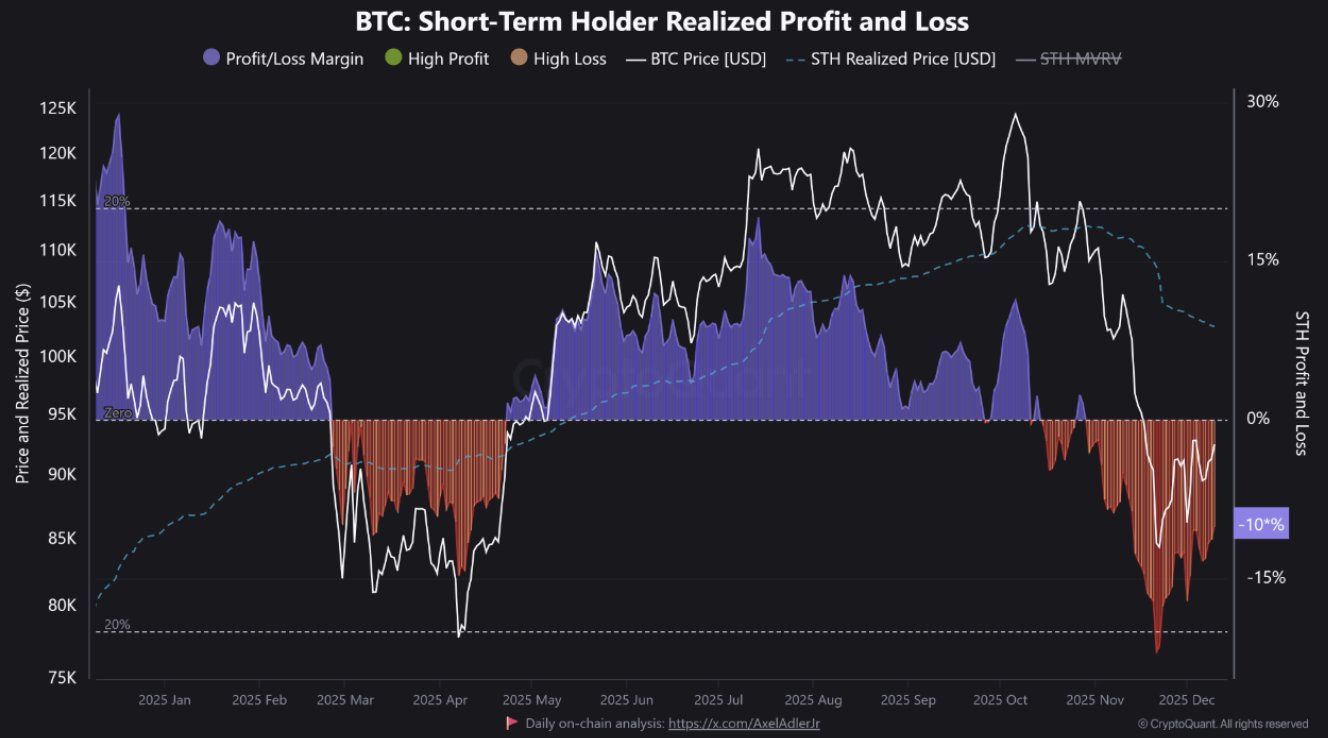

The latest CryptoQuant analysis highlights the current situation for short-term investors. Short-term investors who made huge gains a few months ago are now experiencing one of the deepest periods of losses of 2025. Since the price is trading below the realized price, end buyers are at a loss on average.

“In the short term, this excess continues to pressure the market as weak hands can still sell on each bounce. But structurally, these deep pockets of loss often occur closer to the late than early stages of the correction.”

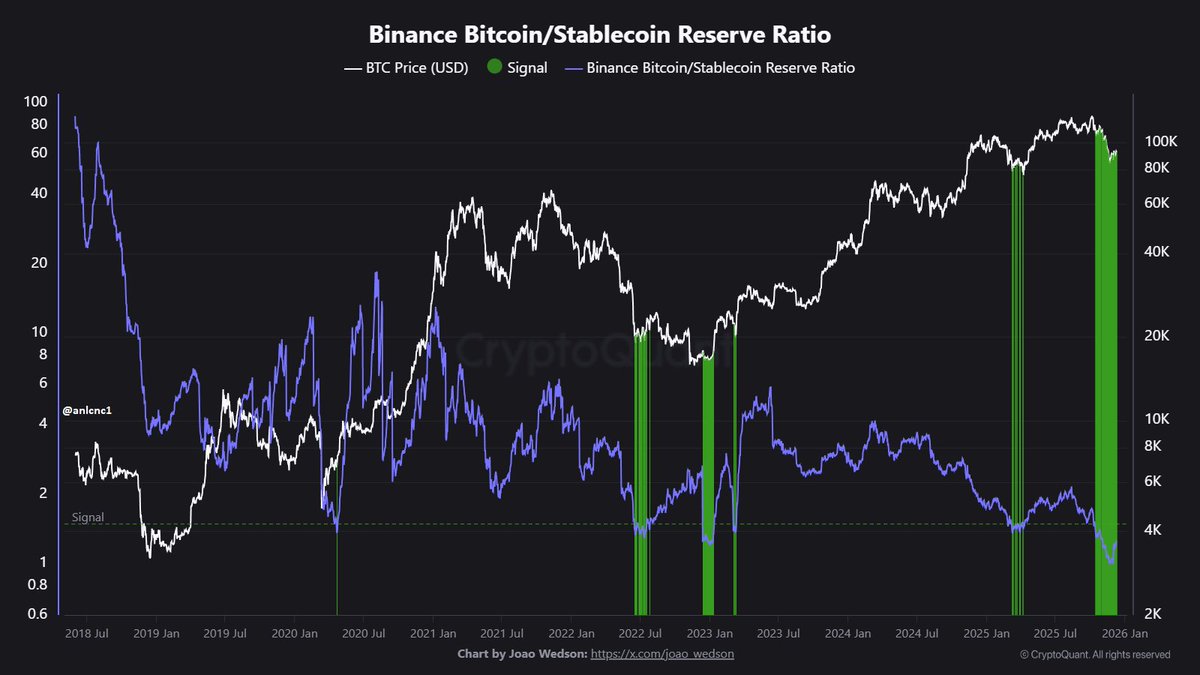

Shared recently as a return signal Binance Discussing the current outlook for the BTC/Stablecoin Reserve Ratio, anlcnc1 says there is still hope.

“As I mentioned recently, this return is negative Bitcoin > stablecoin It showed that the flows were weakening and the Stablecoin > Bitcoin transitions were starting to come into play again. This positive image still continues for now. The ratio is currently around 1.23. If it rises above 1.50, we can say that it has formed a bottom. “It has given an upward turn for now, but it is still in the bottoming phase.”