The cryptocurrency market was shaken by a new wave of sales on December 11. The market, which quickly reversed the optimism at the beginning of the week, experienced a sharp retreat, especially with the deterioration in expectations regarding the forward-looking interest path of the US Federal Reserve (Fed). Bitcoin  $86,989.86The fall of below 90 thousand dollars triggered even deeper losses on the altcoin front.

$86,989.86The fall of below 90 thousand dollars triggered even deeper losses on the altcoin front.

Selling Wave Got Stronger After Fed Decision

The Fed’s interest rate decision and statements were at the center of the market deterioration. Although the bank cut interest rates and signaled a return to monetary easing by starting short-term bond purchases of $40 billion per month, the published dot chart predicted only one interest rate cut for 2026, disappointing investors. Analysts expected a more aggressive easing cycle.

This picture triggered the “news selling” reflex of investors. Bitcoin and major altcoins, which rose with Fed expectations at the beginning of the week, retreated rapidly after the decision. While the XRP price decreased by 3.6% in the last 24 hours, Solana, Dogecoin  $0.135787Cardano

$0.135787Cardano  $0.390406 and Chainlink

$0.390406 and Chainlink  $12.11 Similar decreases were observed in large projects such as The CoinMarketCap 20 Index, which tracks the crypto market’s 20 largest assets, lost approximately 3% of its value.

$12.11 Similar decreases were observed in large projects such as The CoinMarketCap 20 Index, which tracks the crypto market’s 20 largest assets, lost approximately 3% of its value.

Another important development on the Fed front was that Donald Trump started Fed Chairmanship talks for the new term. Kevin Hassett, who is seen as the favorite of analysts, is one of those who argue that interest rates “must fall significantly”. For this reason, it is said that there may be serious changes in the Fed’s forward-looking policies as of 2025.

Index is at its lowest point of the year

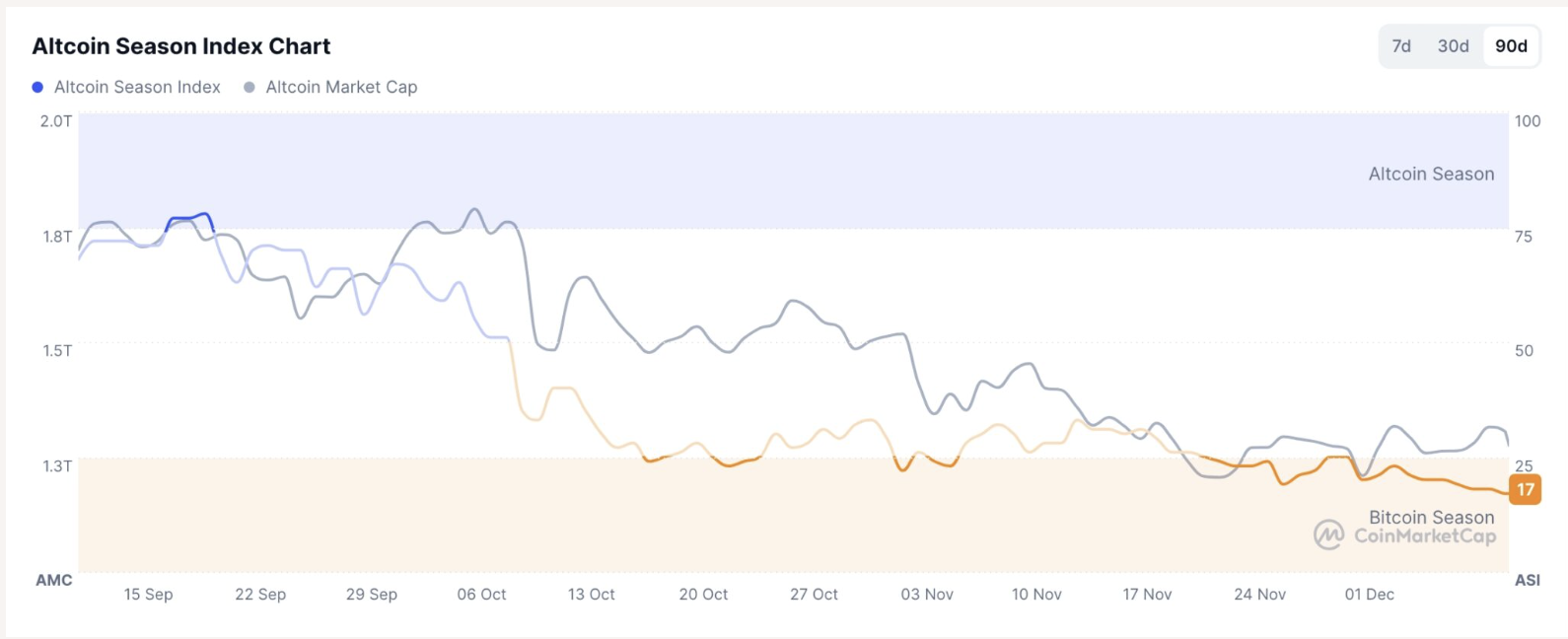

On the altcoin front, not only prices but also indicators measuring market interest are alarming. According to CoinMarketCap data, the Altcoin Season Index has been in free fall in recent months, falling to 17, the lowest level of the year. The fact that the index, which reached over 60 during the year, fell to this level shows that investors are clearly turning to Bitcoin.

The fact that projects such as DoubleZero, Story, MYX Finance, Pudgy Penguins, Celestia, Ethena, Worldcoin and Pyth Network have lost more than 62% in the last 90 days reveals the extent of the dissolution in altcoins.

Another factor that deepened the decline in the markets was increasing liquidations. According to CoinGlass data, a $175 million position was closed in Bitcoin alone in the last 24 hours. Ethereum  $2,804.64More than 170 million dollars were liquidated in , and over 25 million dollars were liquidated in Solana. Leveraged positions in altcoins such as XRP, Dogecoin, Chainlink and Zcash also appear to be liquidated rapidly.

$2,804.64More than 170 million dollars were liquidated in , and over 25 million dollars were liquidated in Solana. Leveraged positions in altcoins such as XRP, Dogecoin, Chainlink and Zcash also appear to be liquidated rapidly.

On the other hand, a remarkable picture emerges on the ETF side: Solana funds added assets of $4.85 million and Chainlink funds added $2.5 million in assets in recent days. This indicates that the current sales wave may be a “sudden reaction”.