Bitcoin in the crypto market  $86,989.86While the buying wave that started on Tuesday carried many altcoins up, the picture does not look as bright on the Solana side. Liquidity is declining, volatility is increasing, and “full reset” signals are getting stronger in the market. While on-chain data indicates that Solana may regain momentum in the medium term, short-term challenges remain on the table.

$86,989.86While the buying wave that started on Tuesday carried many altcoins up, the picture does not look as bright on the Solana side. Liquidity is declining, volatility is increasing, and “full reset” signals are getting stronger in the market. While on-chain data indicates that Solana may regain momentum in the medium term, short-term challenges remain on the table.

Liquidity Resets: Analysts Warn

According to data from on-chain analysis platform Glassnode, Solana’s 30-day average realized profit/loss ratio has been below 1 since mid-November. This indicates that investors are predominantly making losses rather than profits and current liquidity levels are approaching bear market conditions.

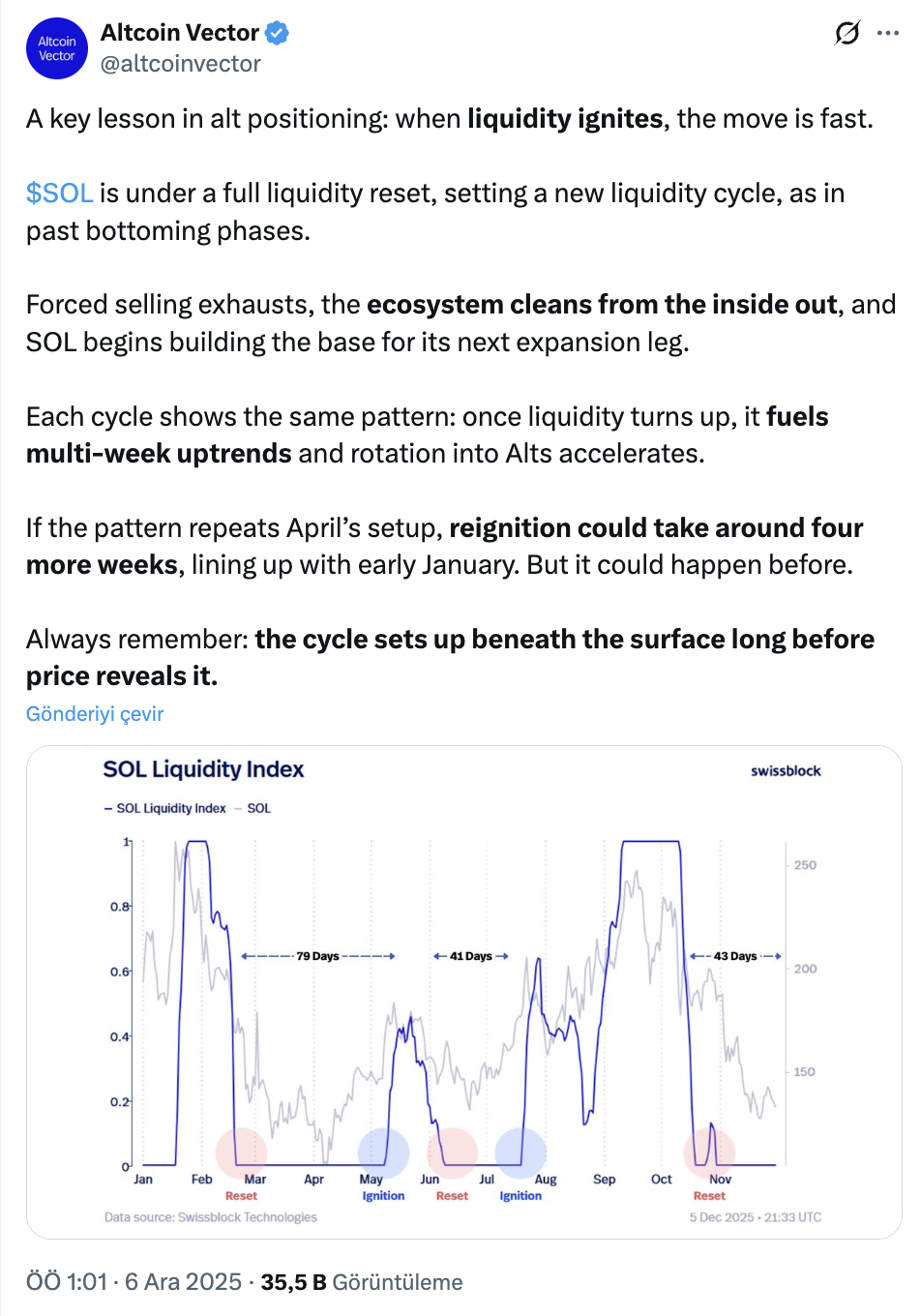

Altcoin Vector, which offers similar analysis, stated in its recent statements that Solana is experiencing a “complete liquidity reset” and reminds that this has signaled the beginning of new cycles in the past. Analysts predict that Solana could rebound in about four weeks if a similar setup in April is repeated.

SynFutures COO Wenny Cai states that this reset process deepened as realized losses triggered sales, a decrease in futures open positions and the withdrawal of market makers. As a result, liquidity is dispersed across various pools, increasing price volatility.

ETF Interest Is Strong, But Leverage Pressure Continues

On the other hand, although macroeconomic uncertainties have partially eased, the short-term outlook is still different. On the one hand, there is a structural support created by investors who collected Solana after the decline, and on the other hand, critical liquidation areas are gradually expanding due to high leverage.

This support materializes in two points:

- Steady Solana exit from stock markets reduces selling pressure,

- Investor appetite remains intact with $17.72 million in net inflows into Spot Solana ETFs during the week.

BitGet Principal Analyst Ryan Lee states that the current activity presents a strategic accumulation opportunity and, together with network upgrades, will increase the long-term resilience of the Solana ecosystem.

However, the density of leveraged positions keeps the risks alive. According to CoinGlass data, while market-wide liquidation worth $432 million took place in the last 24 hours, Solana alone became the third most liquidated asset with $15.6 million. It is stated that if the price drops to 129 dollars, the long position of 500 million dollars will be liquid. According to analyst Lee, such a scenario could actually mean a healthy market reset as it would clear excess leverage.

On the other hand, even just a 3% rise could close $110 million worth of short positions, adding new fuel to Solana’s current rally momentum.

A Different Development on the Solana Front: Validator Updates are Accelerating

In the Solana ecosystem, there is activity not only on price but also on the technical side. The developer team has accelerated validator software updates to improve network performance. The new version is expected to make block production more stable, especially during busy transaction periods. This move is considered an important infrastructure step that can support investor confidence in the long term.