Today was a surprising exception and JOLTS data Despite the bad performance, BTC exceeded 93 thousand dollars. Movements in cryptocurrencies are mainly related to their internal dynamics, and we saw this once again today. Although Trump’s statements about the economy today seem to have triggered the rise, the only big reason is that people are buying Bitcoin.  $86,989.86 to take. Now let’s take a look at today’s evaluations of well-known names in crypto.

$86,989.86 to take. Now let’s take a look at today’s evaluations of well-known names in crypto.

Crypto Oracle’s Latest Prediction

Just now BLS December inflation He announced that the report will be announced on January 13. BTC It is above $93,500, but what we need is convincing closes above $94,000. There are about 24 hours left until the Fed’s interest rate decision and cryptocurrency oracle Roman Trading drew attention to the bear flag formed on the daily chart.

The analyst says that since the MACD and RSI are at the oversold level, he expects a temporary rise before the downtrend continues, and that the price increase experienced with the volume decrease confirms this. He had previously written that we would move below 80 thousand dollars after the formation of a lower peak that could reach 104 thousand dollars.

If such a rise occurs, it would be surprising if big buyers come into play and turn them around, as everyone is prepared for the top to sell.

Bitcoin Prediction of 3 Analysts

Let’s quickly look at what other analysts are saying. Jelle mentioned today that he expects a rapid move to $100,000 before the rise accelerates. When he wrote that the $91-93 thousand range was targeted again, BTC had not yet exceeded this region, but Jelle was right. For now, BTC needs to close above $94,000 and prove to investors that this is not another selling opportunity. However, most investors expect the same thing to happen again, “the price will return to its previous position with sales above 93 thousand dollars” and yes, this is what they expect.

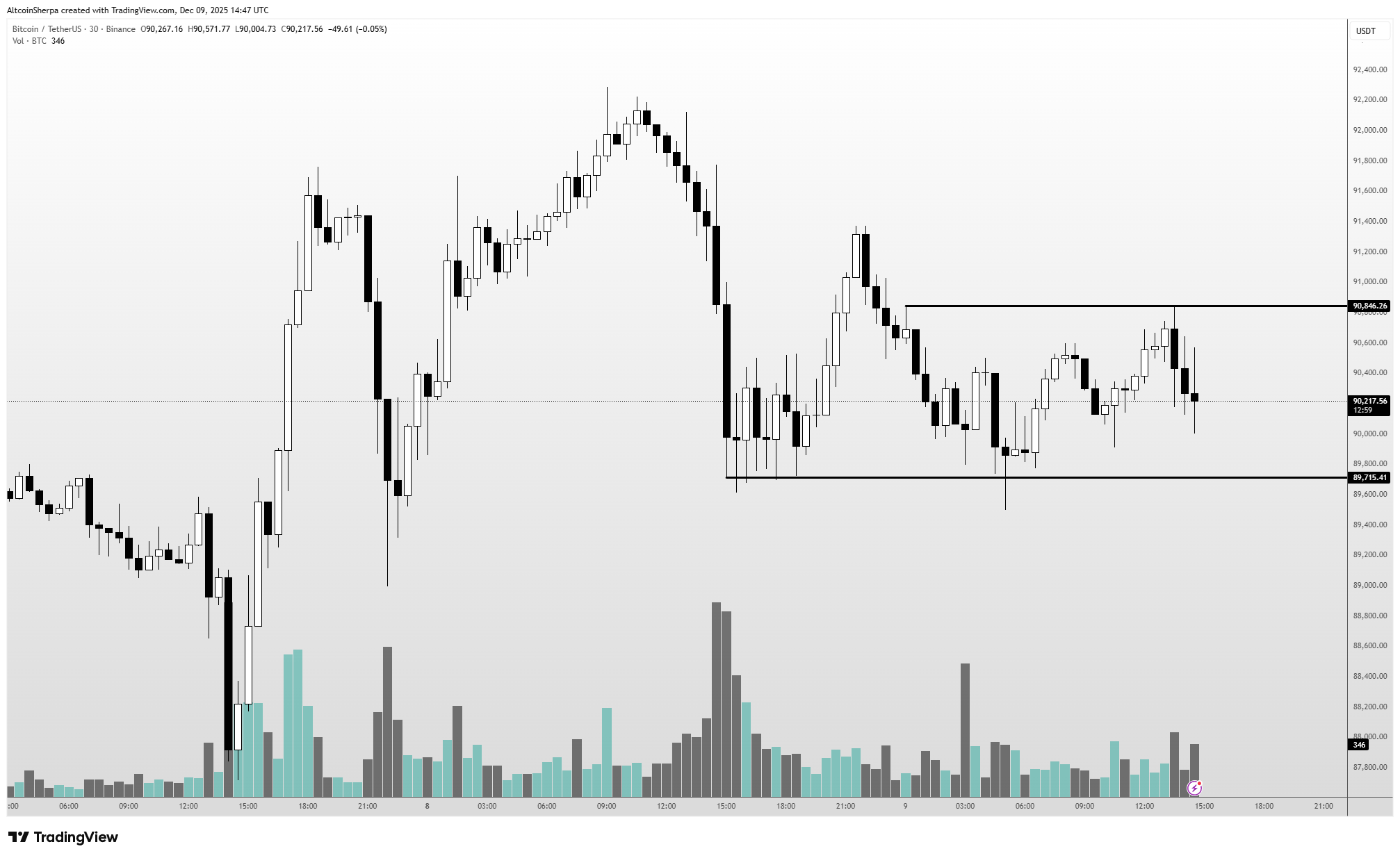

The analyst nicknamed Sherpa said that the extremely wavy chart did not reflect a trend environment. Saying that the next big move is 95 thousand dollars, Sherpa is waiting for the boring narrow range movements to end.

Michael Poppe said that what we should really focus on is of Bitcoin He says it’s the situation against gold.

“Given that gold is on a parabolic path, this raises the ceiling of Bitcoin’s potential price level before it becomes overvalued.

The current valuation of BTC/USD in terms of gold is at 300 -Moving Average. Is this important? It could be. Am I looking for confirmation bias data? Honestly, that could happen too. Anyway, the data I get from this chart basically revolves around the following:

– Markets usually bottom at BTC/USD’s 300-SMA level against gold. This means that the current correction should be low (given that the cost of production is also not far off).

– Current value is ’21’. The highest value in recent times is ’40’. This means that if gold stalls at these price levels and Bitcoin rises to $150,000 or even $175,000, we still won’t reach a new high.

So I think this cycle is not over yet.”