Investors who hold small amounts of BTC are called shrimps on-chain. This investor group attracts attention with its activity, which has become weaker recently. Although at first glance it reminds us of the days of the FTX crash, CryptoQuant analyst believes that the reading here is not done correctly. Why should it be treated differently today when the chart resembles the FTX crash?

Bitcoin Shrimps

Having assets under 1 BTC Bitcoin  $86,989.86 investors “shrimps” is called. The activity of this group of investors has fallen to its lowest levels ever. In other words, ATL has become a closely watched important indicator, and this was previously considered a bottom signal in cryptocurrencies. Under normal circumstances, today should be seen as a strong signal pointing to a definitive bottom.

$86,989.86 investors “shrimps” is called. The activity of this group of investors has fallen to its lowest levels ever. In other words, ATL has become a closely watched important indicator, and this was previously considered a bottom signal in cryptocurrencies. Under normal circumstances, today should be seen as a strong signal pointing to a definitive bottom.

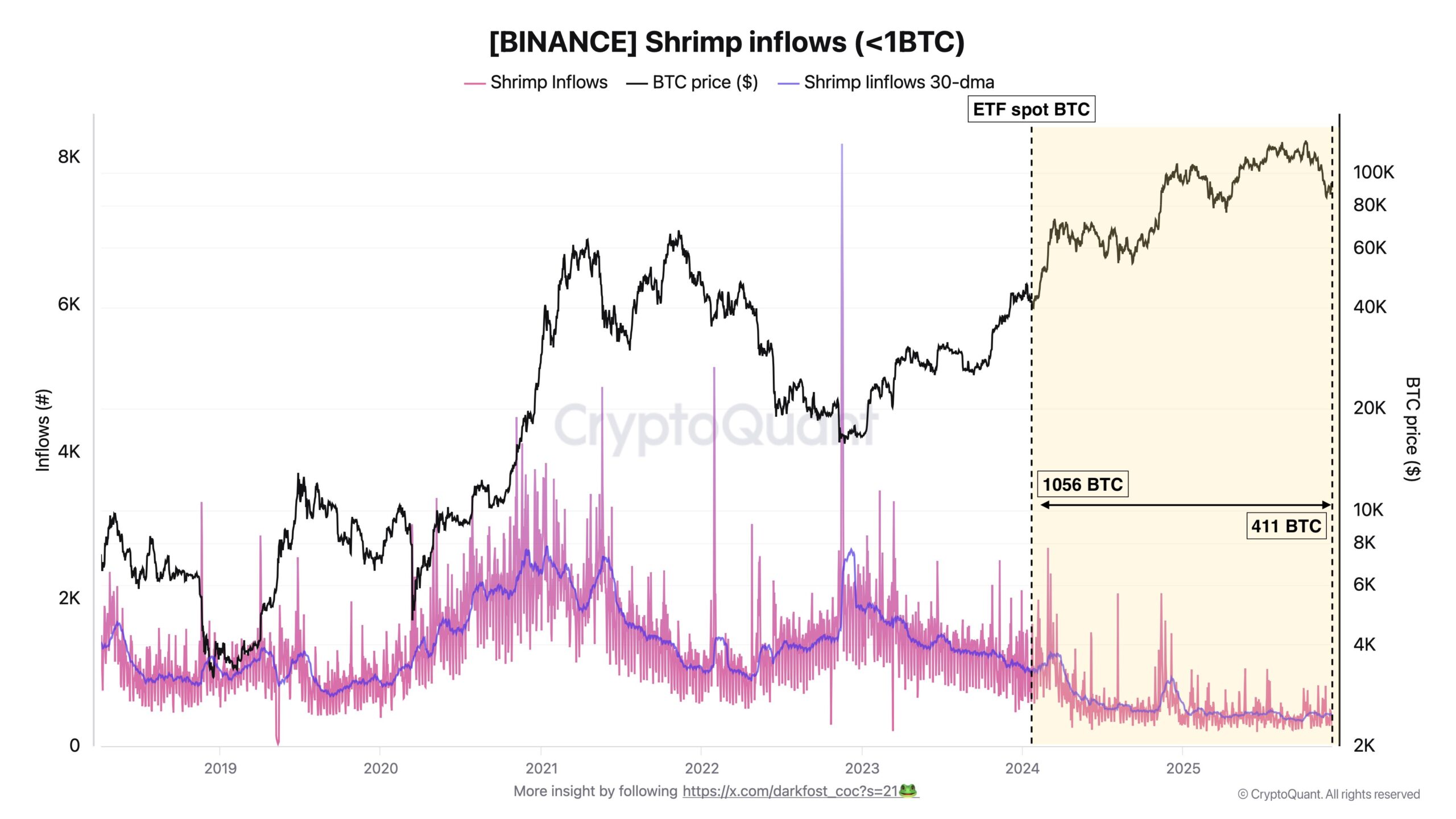

The analyst nicknamed Darkfost shared the chart below today and wrote:

“In the chart, this behavior is measured by Bitcoin flows to Binance and illustrated with a 30-day moving average to smooth out noise and short-term volatility. In December 2022, at the end of the post-FTX panic, these small investors were still sending approximately 2675 BTC to Binance. Today, these flows have dropped to only 411 BTC, reaching one of the lowest levels ever observed. This is not a simple pullback, but a structural decline.”

Historically, these individual investors tend to become more active when the market is rising. For example, during the 2020-2021 rally, they flocked to stock markets as prices rose. However, in this cycle, the opposite situation occurs. Bitcoin is on the rise, but small investors are becoming less visible on exchanges. Their absence is strikingly conspicuous compared to past cycles.”

So what is the reason for the change here? Darkfost comes into our lives at the beginning of 2024 spot BTC ETF He thinks he has products. Since then, small investors’ inflows to Binance have decreased from 1056 BTC to 411, that is, a 60% decrease. This tells us that ETFs are doing their job. So it’s a way to hold Bitcoin without dealing with private keys, wallet security, exchange accounts, or custody risks. ETFs have seen net inflows of tens of billions of dollars to date, driven by this very motivation.

Change in Individual Investors

According to Darkfost, the new ATL, which reflects the radical change in the participation of individual investors in the market, should be read and understood from this framework. So, has the appetite of individuals decreased?

“This does not mean that the interest of small investors has diminished. On the contrary, it may reflect a more mature attitude. Instead of following short-term price movements through the stock markets, many people of Bitcoin “He may prefer long-term positions that can strengthen the market structure.”

A few minutes ago WSJ Nvidia He shared details about his chips. Accordingly, H200 chips produced by Nvidia and allowed to be exported to China can be sent to China with special examinations by the USA. It will be something outside the normal procedure. There is no information about the details of the security review, but it is stated that direct export of chips produced in Taiwan will first go to the USA and then to China after the inspection there.

The news flow is quite intense and there are constantly new developments to stay up to date. CryptoAppsy The news section can make your job easier.