Cryptocurrencies, which had a bad start to Fed week, are now recovering as BTC reached $94,000 again. But Bitcoin yet  $86,989.86 It is difficult to be sure of the rise as it cannot even make short-term closes above $94 thousand. Today we will examine 8 major developments of the last 24 hours and 3 important charts in crypto.

$86,989.86 It is difficult to be sure of the rise as it cannot even make short-term closes above $94 thousand. Today we will examine 8 major developments of the last 24 hours and 3 important charts in crypto.

8 Major Developments in Cryptocurrencies

As a bonus, PNC Bank just launched via Coinbase for eligible customers. Bitcoin trading We learned that he allowed it. Today was again full of news flow and although JOLTS was bad, BTC rose, so many investors are afraid that this rise may be a trap. And of course, they are not wrong to be afraid after experiencing the same thing countless times in the last 2 months.

We mentioned 8 major developments, let’s quickly summarize them;

- trump Nvidia’s Approved sales of H200 chips to China and agreed with AMD Intel It was said that the same relaxation step would be taken for the The US will receive 25% of the revenues. China, on the other hand, is currently working on “limiting purchases” since Blackwell is not included in the agreement. So it looks like China will impose an embargo this time to encourage the creation of its own products.

- BlackRock has applied for a Staked ETH ETF. This will be the company’s second ETH ETF after ETHA, and its staking income could entice investors. Earn up to 5% annually in ETH, plus the opportunity to profit from the ETH price increase. Sounds good for risk-loving corporates.

- Circle received an ADGM Money Services Provider license.

- The CEOs of Bank of America, Wells Fargo and Citi met with US senators on Thursday. crypto legislation will meet.

- Standard Chartered expects the Fed to cut interest rates by 25 basis points on Wednesday. BofA also issued a similar forecast, but things aren’t great on the macro front, as discount expectations for 2026 have been revised downwards.

- Gasoline prices in the US fell to $2.95, the lowest level in the last four years. Trump praised this in his recent Politico interview. The decline in energy prices balances inflation and paves the way for interest rate cuts.

- The SEC announced its December 15 roundtable on Financial Oversight and Privacy, featuring Zcash, StarkWare, Aleo, ACLU, and others. Regulations that respect the need for privacy in crypto on a global scale? If this happens, privacy altcoins could explode.

- Hyperliquid Strategies Inc. Announced a $30 million buyback program.

Important Cryptocurrency Charts

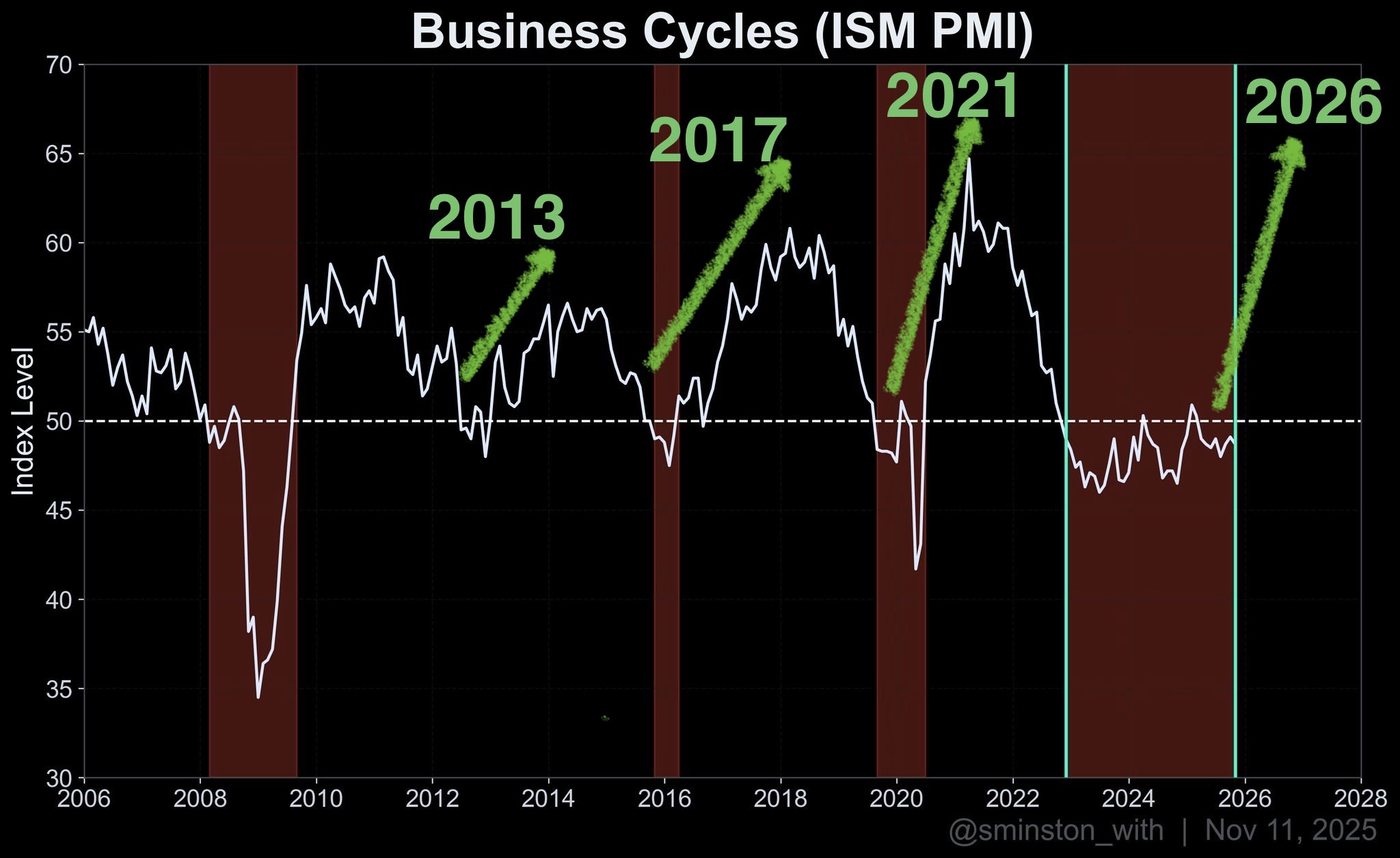

There are those who say that the four-year cycle story is over. But Quinten says more, and he’s not wrong about what he points out. With the business and liquidity cycle 4 year crypto cycle Reminding that the situation is progressing in parallel, the analyst shares the chart below and underlines that we are not yet close to the peak. And yes, while interest rates are decreasing of cryptocurrencies It would be ridiculous to experience a bear market. Even CZ is talking about a super cycle for 2026.

Poppe shared the chart below and said that risk appetite increased with the start of closings above 92 thousand dollars. If 92 thousand dollars remains as support on the Fed evening, its basic scenario is 100 thousand dollars as follows.

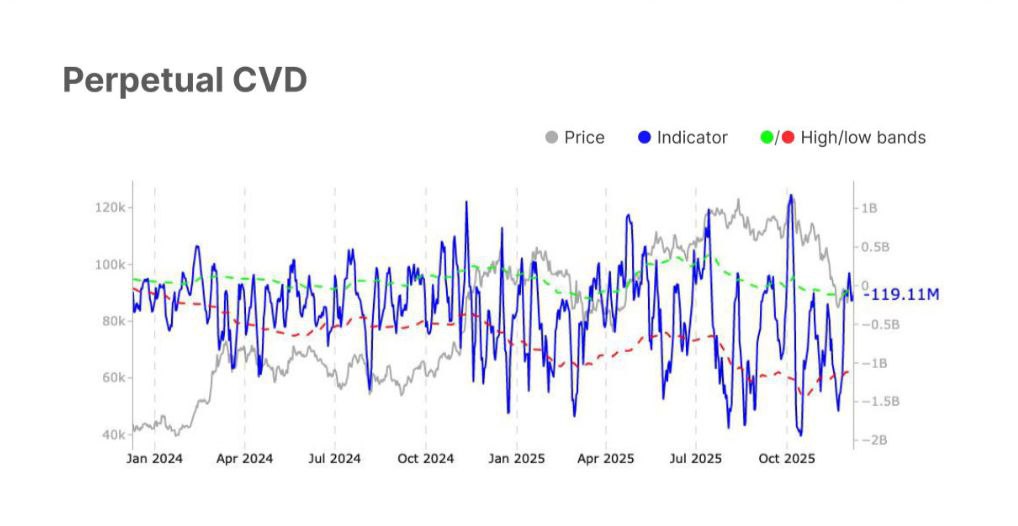

Focusing on the Perpetual CVD shift, Kyle says buyers are now starting to become dominant again. If this continues steadily, we may see the rise continue.

“After falling to -$139.3 million, it bounced back to +$119.1 million, indicating that aggressive selling pressure is easing and buyers are starting to lean in again. Since it is still within the normal historical range, this looks more like a balanced futures environment rather than a trend reversal. Constructive… but not yet a breakout signal.”