US JOLTS data was just released and the Fed’s interest rate decision Before this was the last major economic report we saw. Data pointing to weakening employment of cryptocurrencies is in its favor because it is expected to further accelerate monetary easing. The Fed has to step up, especially as other central banks are now coming to the end of easing.

US Data Breaking News

White House Senior Advisor just before the data envy made important statements. His words are important because his name is mentioned as the strongest candidate for Fed Chairman. Let me quickly summarize for you what he said just before moving on to the JOLTS report.

“It is very important for the Fed chairman to look at the data. trump If he pressures the Fed on interest rates, do the right thing. Interest rate decisions will be made with my judgment, and Trump is counting on that. A lot of the Fed’s behavior seems political. I was right to question those who said there was no need for a rate cut.

Labor force growth is slightly lower than before. Underlying GDP growth is well above 3%, perhaps above 4%. Trump will reveal the facts about the economy.

I don’t think AI will lead to mass job losses. AI will be a good thing, like computers. In a striking move, US imports from China dropped to pre-WTO levels. We can obtain customs revenue of $400 billion this year. “There is now more fiscal space to take stimulus measures.”

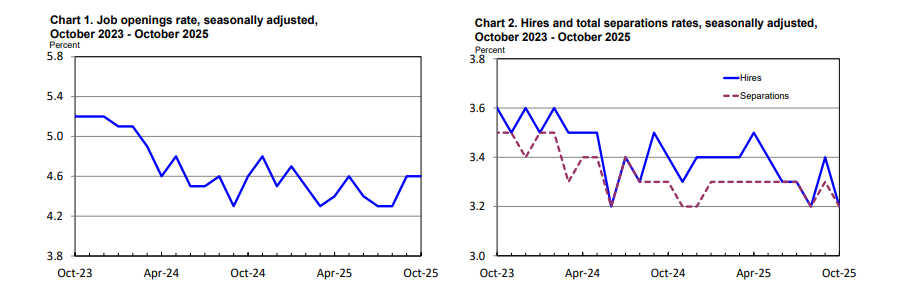

- USA JOLTS Announced: 7.67M (Expected: 7.117M Previous: 7.22M) (Source)

If we look at the JOLTS report, it exceeded expectations. Both hiring and total turnover during the month were little changed at 5.1 million. Among job departures, resignations (2.9 million) were little changed. The fact that job postings are above expectations may strengthen the hand of Fed hawks, as it indicates that the job supply is increasing. In this respect, the report is negative.