The institutional investor segment has been increasing in importance for cryptocurrencies for a long time. Institutional capital in this area both affects overall sentiment and fluctuates the charts. CoinShares compiled the data of the past week and published its report that helps us understand the current situation.

Cryptocurrency Report

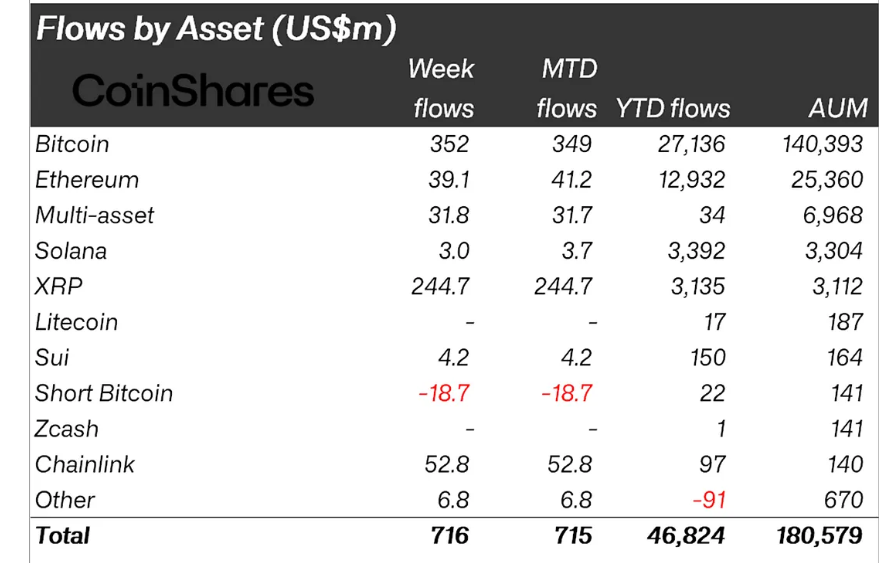

The institutional cryptocurrency report tracking institutional investors’ interest in cryptocurrencies has just been released. It was published. The report contains important details. There was a total net inflow of $716 million across all crypto products over the past week. While the total asset value of all investment products reached 180 billion dollars, it is still below the ATH level. AUM reached an all-time record of $264 billion. Still, the nearly 8% rise from the bottom in November is positive.

The improvement in sentiment is positive and it is good to enter the Fed week with a clear entry. Daily figures indicate some outflow due to macroeconomic developments on Thursday and Friday. The most important detail is that we see net entry from almost all regions. The USA hosted an inflow of 483 million dollars, Germany 96.9 million dollars and Canada 80.7 million dollars.

BTC ETF While its products saw a net inflow of 352 million dollars, the total net inflow since January is 27.1 billion dollars. Considering that there was an inflow of over 41 billion dollars last year, it is clear that the general momentum has weakened.

Short Bitcoin  $86,989.86 Their products give us another good news. BTC short selling products, which have experienced the biggest outflow since March, amounted to $18.7 million, and this indicates that fear and panic have reached their peak and the negative atmosphere will begin to end.

$86,989.86 Their products give us another good news. BTC short selling products, which have experienced the biggest outflow since March, amounted to $18.7 million, and this indicates that fear and panic have reached their peak and the negative atmosphere will begin to end.

XRP and LINK Coin

LEFT, XRP We have seen stable net inflows despite the overall spot market decline in products such as This momentum continued last week. While XRP Coin saw a weekly net inflow of 245 million dollars, its total net inflow for the year reached 3.1 billion dollars. Last year, XRP investment products attracted only $608 million from institutional and professional investors.

Chainlink  $12.11 The entrances are striking. Although it has just launched, it attracted a total of $52.8 million in inflows last week. Although the number may seem small, it is the largest entry on record when compared to AuM. Withdrawing 54% of total assets (AuM) LINK Coin launched a highly successful ETF.

$12.11 The entrances are striking. Although it has just launched, it attracted a total of $52.8 million in inflows last week. Although the number may seem small, it is the largest entry on record when compared to AuM. Withdrawing 54% of total assets (AuM) LINK Coin launched a highly successful ETF.