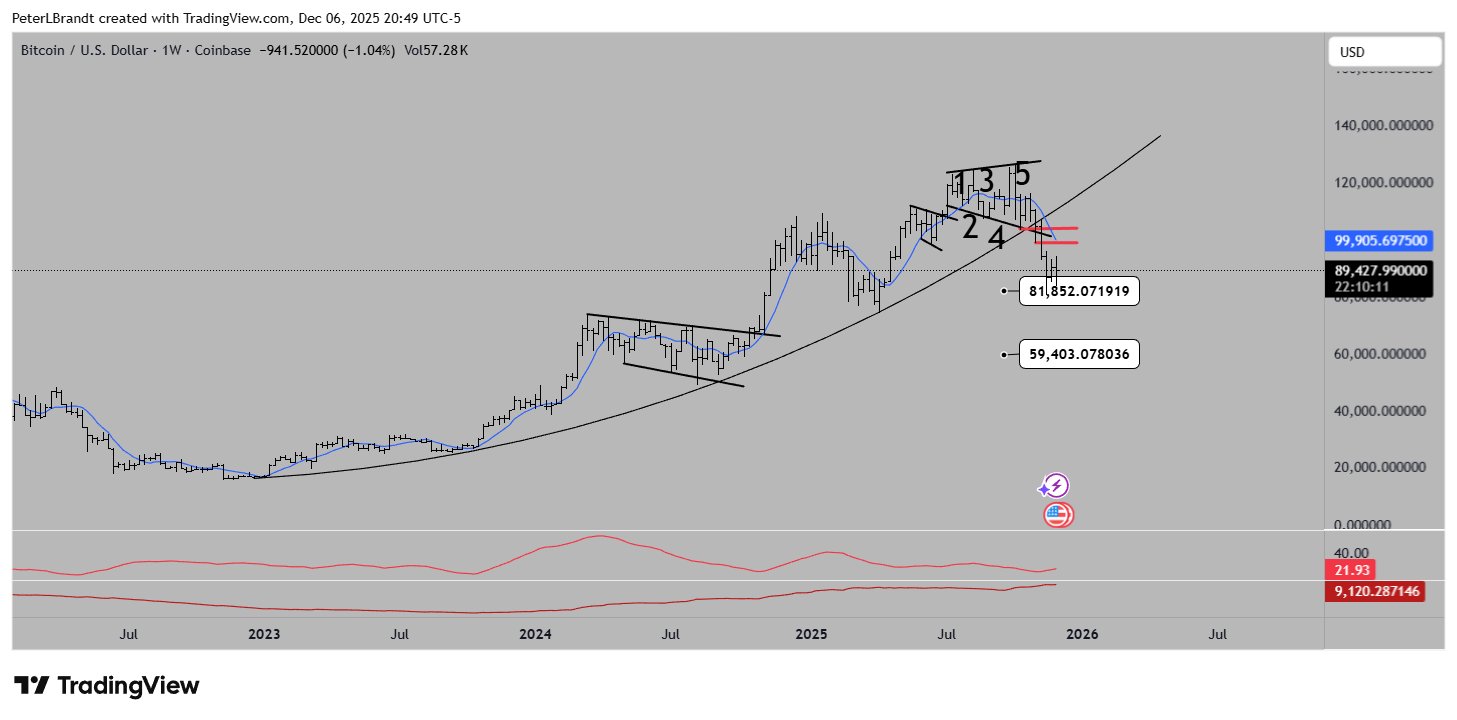

Master analyst known for his 50 years of market experience Peter Brandtlatest Bitcoin (BTC)  $86,989.86 A chart that will make investors uneasy presented. The weekly outlook shows a broken curve following a five-wave rise and two possible downside zones well below current levels. According to Brandt, the first of these regions is around $81,852 and the other is around $59,403.

$86,989.86 A chart that will make investors uneasy presented. The weekly outlook shows a broken curve following a five-wave rise and two possible downside zones well below current levels. According to Brandt, the first of these regions is around $81,852 and the other is around $59,403.

The Price of Excessive Optimism in the Fed’s Shadow

Experienced analyst Brandt describes his bearish targets not as an indication of panic, but as a natural “cleanup” following an overextended rally. According to him, the market is an endless interest rate reduction He rushed too far when pricing his story. Brandt’s assessment is that the last period of 2025 presents a similar picture to the end of 2021, but this time the roles have changed. While expectations of tightening were discussed at that time, the discourse of loosening comes to the fore today.

Many assets are currently trading at high prices on the assumption that interest rates will fall rapidly. cryptocurrency market Acting with the same logic, it has already reflected future discounts on prices. According to Brandt, this may make a correction inevitable if the Fed adopts a “cold” tone at its next meeting.

Corporate Moves Can Speed Up Sales

Another factor that supports Brandt’s prediction is the possibility that institutional investors may change their strategies. For example big Bitcoin Companies such as Strategy, known for their reserves, have the possibility of rearranging their positions in case liquidity shrinks. Such a step could accelerate the downward process already determined in the analyst’s chart.

S&P 500 Although the index fell by over 20 percent during the year, it recovered in a short time. Bitcoin continued its climb in the opposite direction, along an overheated curve. According to Brandt, it is clear that this curve no longer provides support. Therefore, a retreat to the $ 81,000-59,000 range may not be an exaggerated scenario, but a process of the market letting off too much air.