Dogecoin, whose market value decreased to 23.28 billion dollars  $0.135787 (DOGE) is facing sharp selling pressure due to the weakening risk appetite in the crypto market. The popular memecoin, which lost approximately 67% of its value throughout the year, made its investors nervous by recording a new decline of 5% in the last 24 hours.

$0.135787 (DOGE) is facing sharp selling pressure due to the weakening risk appetite in the crypto market. The popular memecoin, which lost approximately 67% of its value throughout the year, made its investors nervous by recording a new decline of 5% in the last 24 hours.

Is Demand Increasing? Spot Market Data Provides a Critical Detail

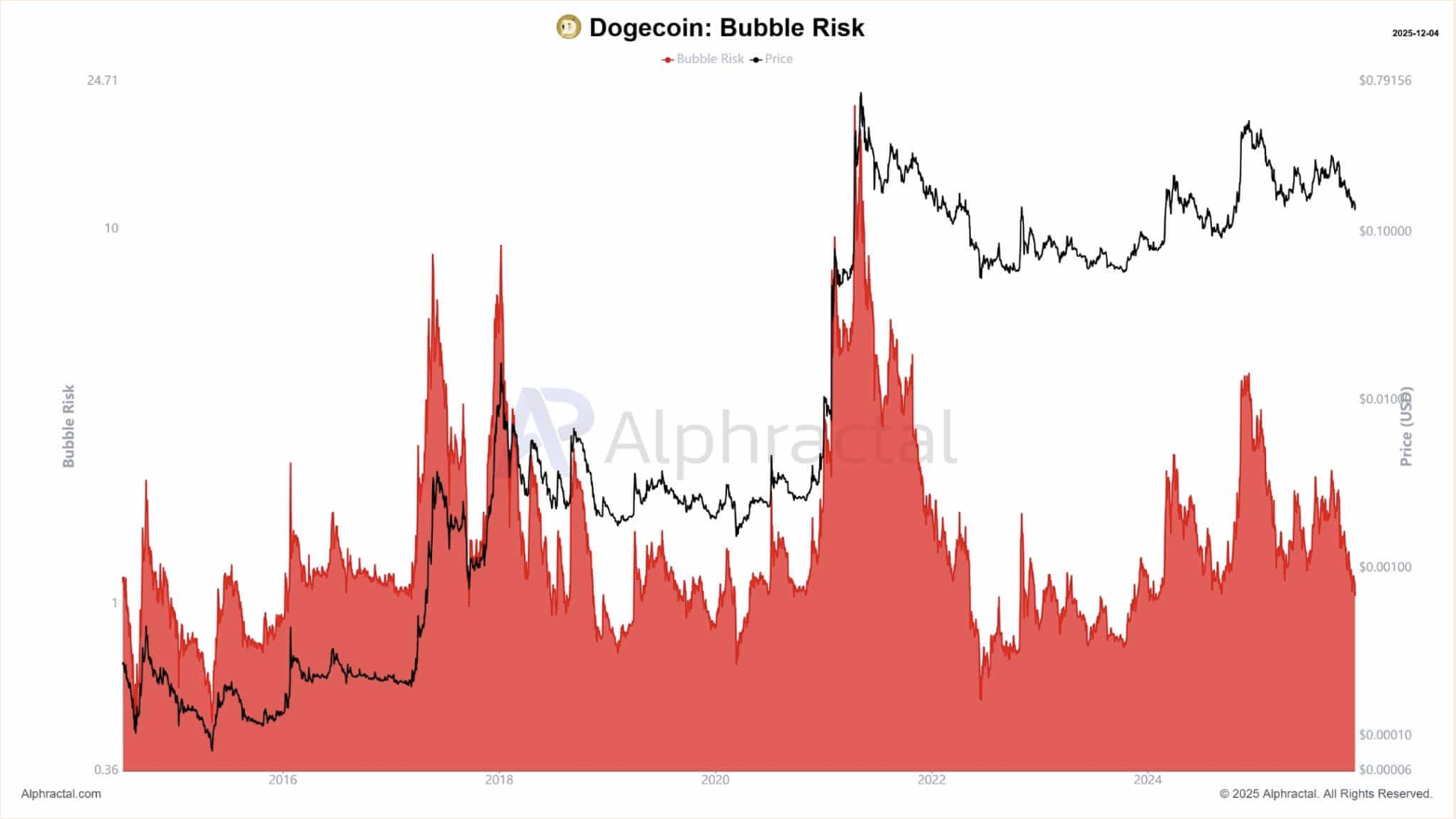

However, on-chain data reveals an interesting picture for DOGE. According to analysts’ analysis, the asset does not currently indicate any bubble risk within the scope of the “Bubble Risk Model”. Normally this pattern produces a bearish signal on overvalued assets; However, the downward trend in metrics for DOGE indicates that the accumulation process in the market is strengthening.

Centiment data also confirms this trend. Daily active addresses reached 73,560 in the last measurement, reaching one of the highest levels in recent weeks. In other words, investors continue to trade intensively on the network despite the price drop.

The real question for Dogecoin is: “Is there a real increase in demand that will pave the way for the rise?” Latest data show that small investor interest is strengthening, especially on the spot market side.

The Exchange Netflow metric monitored by stock exchanges reveals that buyers have maintained their superiority for a week. In recent days, approximately $3 million worth of DOGE has been collected in the spot market, and the weekly net purchase amount has increased to $50 million. This figure corresponds to approximately 2% of DOGE’s market cap and indicates a remarkable accumulation.

However, there is an important contradiction here: Transaction volume continues to decline. This shows that the weakening confidence in the market continues to exist. Still, increased demand on the spot side could create room for DOGE to rise above $0.14 in the short term.

The Biggest Threat to Dogecoin: The $0.20 Wall

Although there is a possibility of an increase in the short term, a strong sell wall is also on the agenda for DOGE. Liquidation maps show that 11.72 billion DOGE is concentrated at $0.20. This ratio increases the possibility of a sharp reversal when the price approaches that level.

Therefore, the $0.20 region on the DOGE chart is seen as the “last stop of the rise”. If the price moves towards this level, intense selling pressure may come into play and Dogecoin may face a downward trend again.

As a result, both hope and risk are growing at the same time in Dogecoin. On the one hand, on-chain data and spot market demand indicate that investors consider declines as buying opportunities. On the other hand, weakening volume and the huge sell wall at $0.20 suggest that the price may be curbed at every attempt to rise. DOGE’s fate will be shaped depending on whether investor interest continues in the coming days.