James Butterfill from CoinShares has tackled one of the most controversial topics these days. As Strategy’s MNAV approached 1, concerns arose that the company might start selling its 650 thousand BTC reserves. This is extremely important as it could start one of the biggest bear markets for cryptocurrencies. So, are cryptocurrency reserve companies going bankrupt?

Cryptocurrency Reserve Companies

Its abbreviation is known as DAT and it stands for Digital Asset Treasury In other words, we can think of it as Companies that Accumulate Digital Assets in their Balance Sheets. Increasing its share among cryptocurrency investors in the last 2 years Cryptocurrency Reserve (DAT) companies are buying for the long term and avoiding panic selling.

Therefore, DAT growth is extremely important for the stable continuation of the general rise of cryptocurrencies. In Strategy’s first announcement in August 2020, it announced that it would accumulate BTC as a treasury management strategy. Hundreds of companies subsequently copied his “strategy” over the years. Companies that hold more than 40% of their balance sheet in cryptocurrencies are called DAT.

The DAT strategy has paved the way for companies that were losing money from their old businesses and whose only advantage was being listed on the stock exchange, to make money with crypto. For example, BitMine, the largest ETH reserve company, was a company with operating revenues of just $5 million and today holds over $10 billion in BTC. Or, before Japan-based Metaplanet started holding BTC, it was a very weak company whose shares had constantly seen bottoms, but now it has a size of $ 2.7 billion.

Are Companies Going Bankrupt?

Cryptocurrency reserve companies finance themselves through the issuance of shares. For example Strategy It has $8.2 billion in outstanding debt and has issued preferred stock yielding $7 billion in dividends. Strategy’s liabilities are roughly $800 million annually. Wanting to eliminate the current bankruptcy and bankruptcy discussions, Saylor’s company used the market price (ATM) loan facility again and issued $1.4 billion to be kept as a reserve to cover privileged dividend and coupon payments.

The most important DAT bankruptcy for us is Strategy. Others have a size that can be tolerated by the market, but Strategy has such a large reserve that it should not go bankrupt. Remember the MTGOX crash, the market carries a risk of a crash of magnitude 3-4 (due to the supply it has). And the company has almost 2 years of cash reserves of $1.4 billion against annual expenses of $800 million. In other words, the possibility of going bankrupt due to debt or dividend payments has been largely eliminated for 2 years.

So what happens if MNAV falls below 1? To balance this, the company can use its cash reserves or sell some BTC and buy back shares. But he does not need to sell 650 thousand BTC because his debts and liabilities are much less, so something like complete bankruptcy does not seem possible for Strategy.

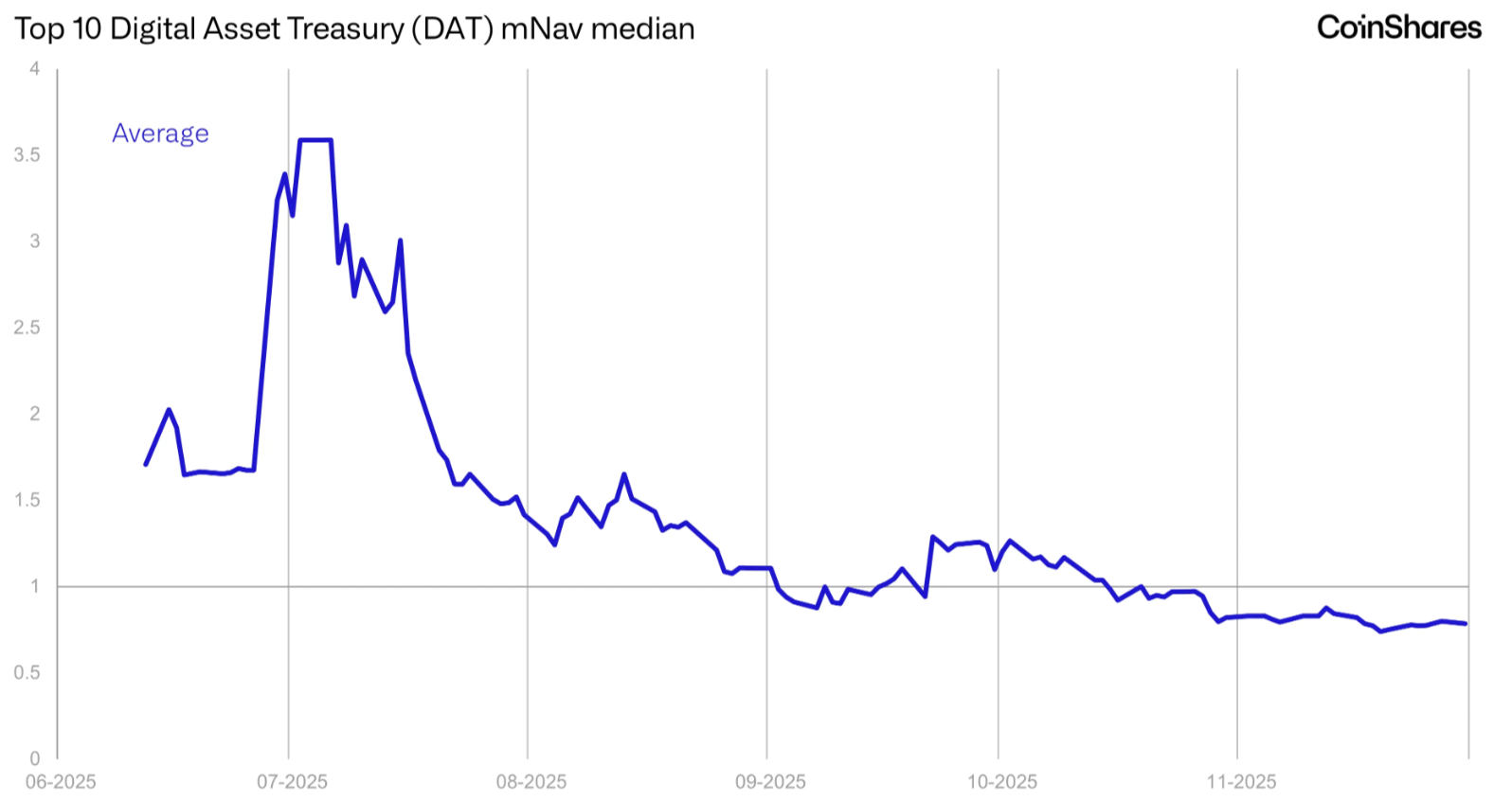

Above you see the MNAV status of the 10 largest cryptocurrency reserve companies, the average is below 1, but Strategy continues to linger at the border. (Source: CoinSharess)

By the summer of 2025, many of these companies were trading at 3, 5 or even 10 times their mNAV. Today Strategy is around 1.1 and some DATs are even below 1. In other words, cryptocurrencies must have bottomed out and recover so that these companies do not fall into even more trouble. Strategy is even considering providing BTC loans to combat such difficult times and become even stronger. As a matter of fact, this move could bring in over $2 billion in cash annually.

In summary yet cryptocurrency reserve companies The bubble did not burst. The risk has not yet reached alarming levels and companies are surviving. But almost a year ago MSTR While its shares had not reached the ATH level, I wrote that the next bear markets would be triggered by the bursting or heavy blow of the cryptocurrency reserve company bubble. It is possible that we may see these companies face devastating consequences as BTC growth slows down, if not now, then in the future. This is today’s version of the VC craze of 2021, and tomorrow we will see tomorrow’s versions of the VC bankruptcies of the 2022 crash.