The professional investment arm of US-based cryptocurrency exchange Coinbase Coinbase Institutionalpredicts that market conditions may reverse in December, following the sharp declines in November. The company’s monthly report released Wednesday in the report It was emphasized that the return of the US Federal Reserve (Fed) to the bond market after the end of quantitative tightening was a positive signal for risky assets.

November Crash That Hit Cryptocurrencies

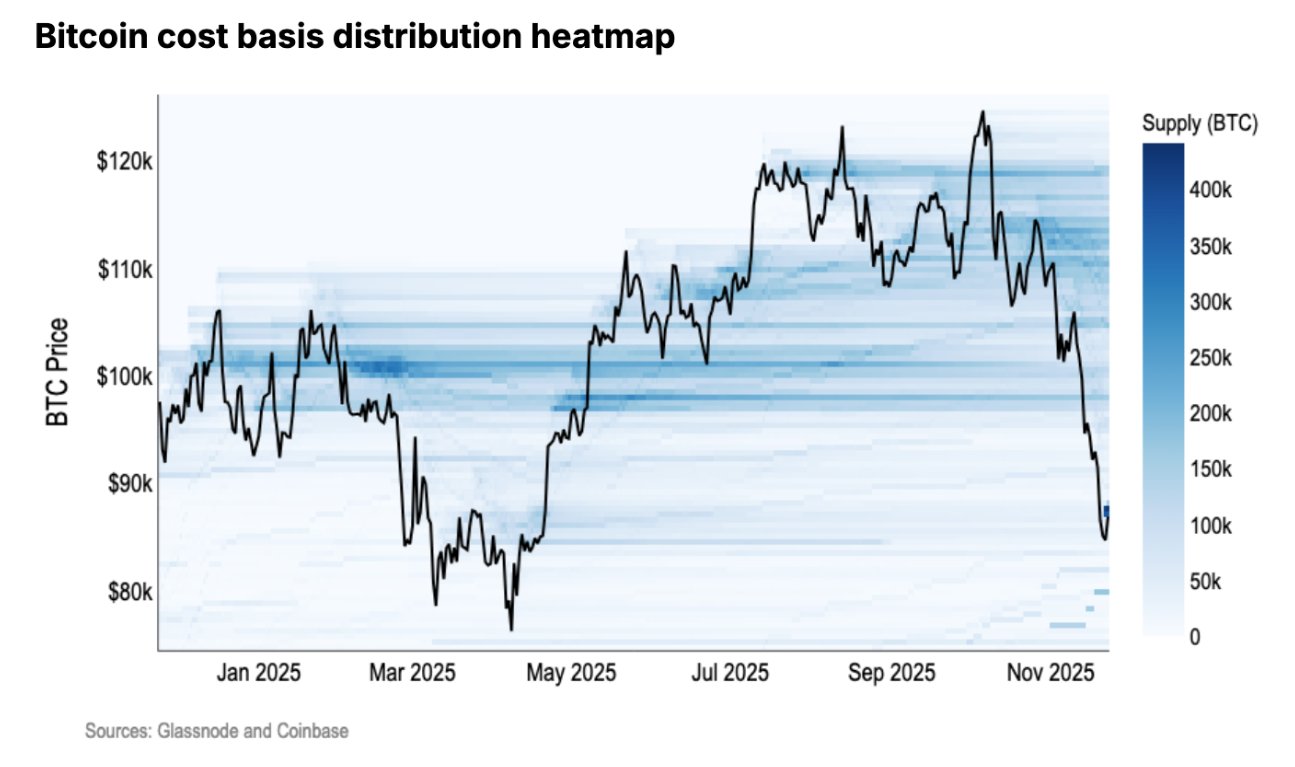

According to Coinbase’s analysis, November was one of the weakest periods of the last three years for the cryptocurrency market. Bitcoin  $86,989.86which has significantly outperformed stocks, trading three standard deviations below its 90-day average. However S&P 500 index it decreased by only one standard deviation. The company said outflows in spot ETFs reached a record level. stablecoin He stated that the supply had the lowest 30-day acceleration since 2023.

$86,989.86which has significantly outperformed stocks, trading three standard deviations below its 90-day average. However S&P 500 index it decreased by only one standard deviation. The company said outflows in spot ETFs reached a record level. stablecoin He stated that the supply had the lowest 30-day acceleration since 2023.

Long-term investors switch to selling instead of accumulating BTC, cryptocurrency It was noted that focused treasury companies also started to trade below their net asset values. Coinbase argued that after these developments, the market was still in the fear phase, but the conditions became suitable for recovery in December.

The report also discussed the “K-shaped” economic outlook, where AI-induced workforce losses could increase corporate profitability while hurting individual income stability. However coinbaseHe stated that the impact of this imbalance on the cryptocurrency market has not yet become evident.

Fed’s Stance and Liquidity Return

According to Coinbase, the Fed’s interest rate cut and increased liquidity may provide capital inflow to the cryptocurrency market again in December. The report stated that with this expectation, it may take a few months for the markets to gain full stability, but the conditions are ripe for a change of direction in December.

former hedge fund manager James Lavish He also expressed a similar opinion, saying that the Fed’s policies were eroding the value of the dollar. The US Dollar Index (DXY) has fallen more than 10 percent since the beginning of the year. This decline is expected to deepen as the Fed moves to quantitative easing (QE).

St. According to St. Louis Fed data, the central bank injected $13.5 billion into the banking system through short-term repo transactions. The amount in question was recorded as the second largest liquidity increase since the COVID-19 period and indicated that the abundance of money in the markets began to return.