The recovery in risk appetite can be seen from the charts, but it is difficult to be certain about its permanence. For now, with the employment figures coming bad, BTC is over 93 thousand dollars. Vanguard was the rabbit that came out of the hat for cryptocurrencies this week and changed the balances. So what is the situation on the US side? What awaits investors?

Appetite of US Crypto Investors

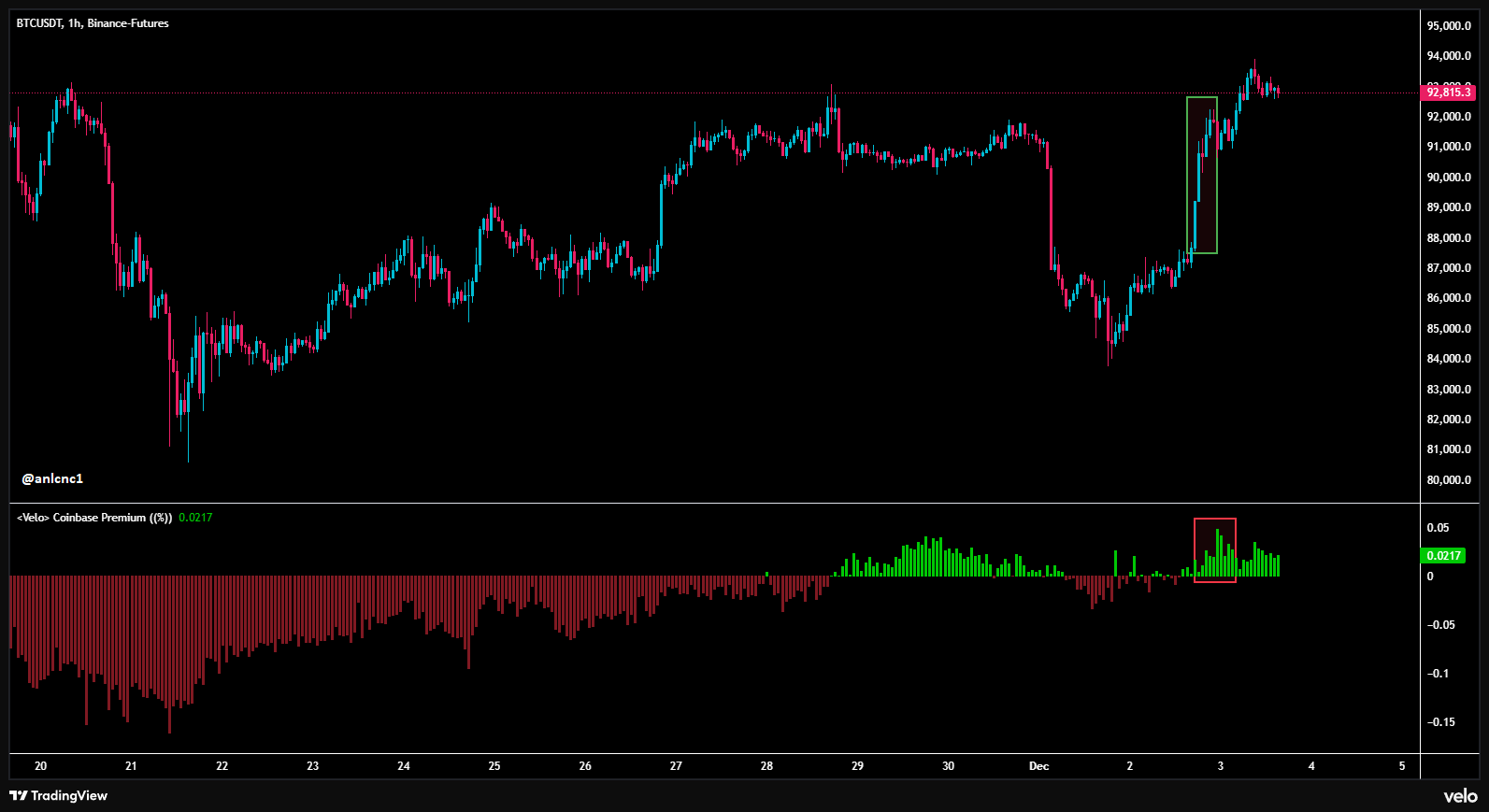

With the market opening yesterday BTC ETFs It saw net entry, albeit weak. This is positive because long-standing sales now turning into stable net inflows could pave the way for hundreds of millions of dollars in inflows again. Moreover, showing the appetite of US cryptocurrency investors Coinbase Premium index (below) is free of negative territory.

Anlcnc1 regards the current situation extremely positively and says that if it continues, the price may normalize further.

“With the opening of the markets yesterday, Vanguard customers’ Bitcoin

$86,989.86 With its inclusion in ETF volumes, Coinbase Premium bars had risen along with the price. The bars were very low in volume before the opening and turned positive after the opening, I think it is the Vanguard effect.

I think the Vanguard effect will last a little longer, and after a while, the fomo buyers of existing companies will come back and watch the price rise another 4-5 thousand dollars. If it is as I think it will be, there is a possibility that we will go up a little more after the opening.

The only unchanging fact is; If ETFs return to normal, the price will return to normal. As long as it doesn’t turn negative again, the image on the CB Premium side is good for now. “It is in a much better position than in the past.”

Today’s ETF data will be even more important, especially as the employment report offsets concerns about the Fed meeting. BTC is over $93 thousand and at the time of writing, the US market opening is about 1 hour away. If the stock market also responds positively to the latest report, this will be supportive for crypto.

Bitcoin Charts

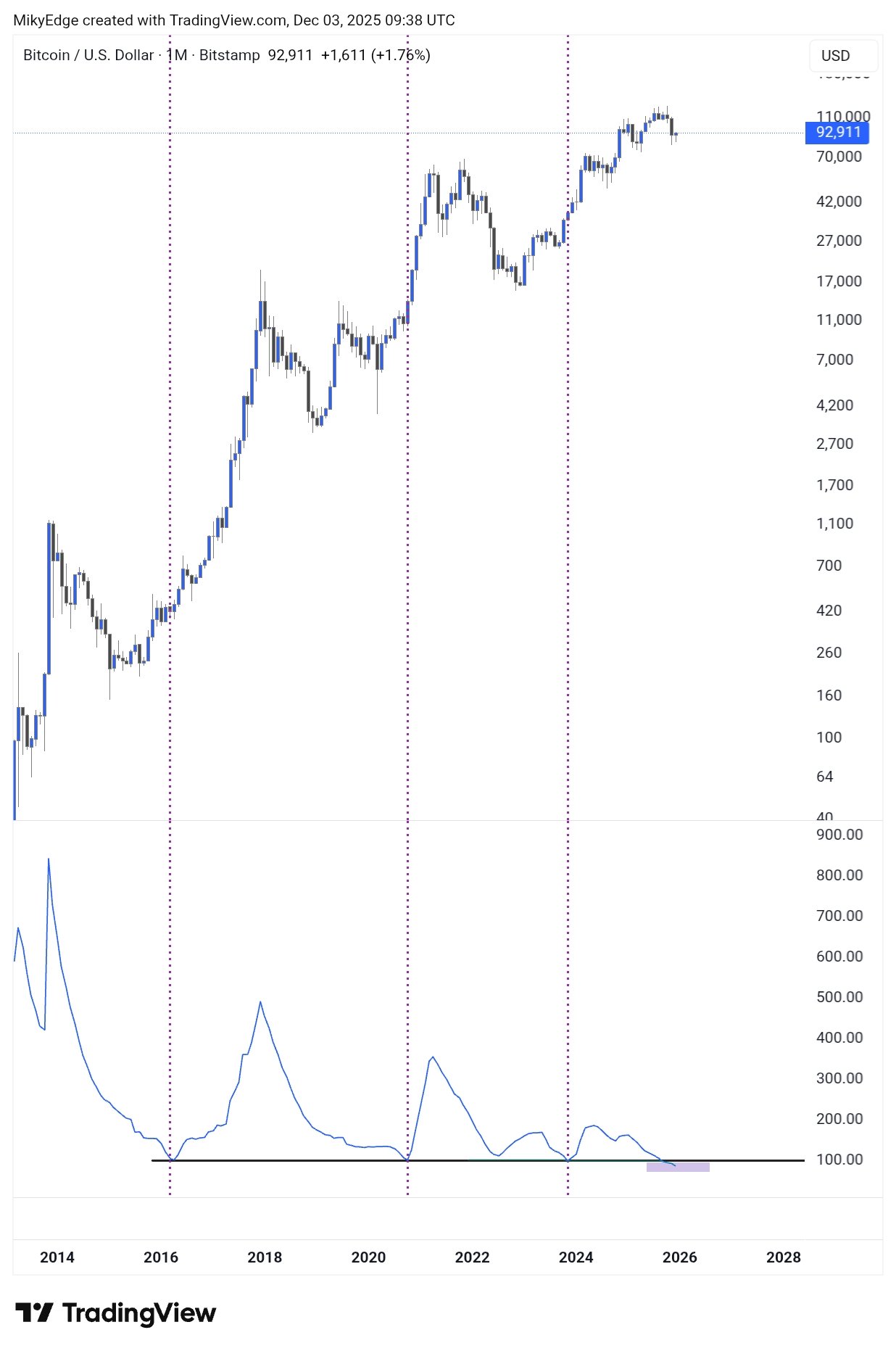

The last quarter did not give cryptocurrency investors what they wanted. Vanguard This is why the return experienced with the effect excites most investors more. Sharing the chart below, Jelle mentioned that he is extremely hopeful as we start to see higher lows and higher highs.

Although Mikybull was among the analysts who shared their net decline forecast weeks ago, he is hopeful for an increase today.

“BTCfell below the lowest BBW contraction in its history. (Chart above) This contraction level usually triggers a big rise. Will it be different this time?