Quiet day for cryptocurrencies and yesterday’s Vanguard move Bitcoin  $86,989.86It enabled to overcome the resistance of 93 thousand dollars. BTC, which could not stay above the resistance for a long time, is waiting for today’s market opening. On the other hand, interest in BlackRock’s Bitcoin Option product is increasing. Poppe published his SEI Coin analysis and analysts updated their BTC predictions.

$86,989.86It enabled to overcome the resistance of 93 thousand dollars. BTC, which could not stay above the resistance for a long time, is waiting for today’s market opening. On the other hand, interest in BlackRock’s Bitcoin Option product is increasing. Poppe published his SEI Coin analysis and analysts updated their BTC predictions.

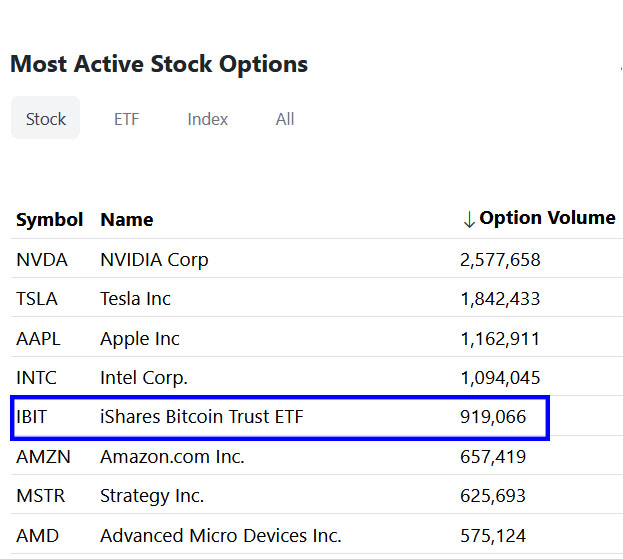

Bitcoin Ranks Fifth

Although interest appears to have waned, option volume data is still of Bitcoin It shows that he continues to be the center of attention. Moreover, next year new players will begin to offer cryptocurrency products, and the size of passive investment will increase by billions of dollars as pension funds include cryptocurrencies in their portfolios.

As you can see above, Bitcoin ranks fifth among the most popular options. NVIDIA is ahead of BTC and at the top, as predicted. The fact that it is getting 3x more attention is related to the $5 trillion market cap and AI hype. But BTC It also attracts a lot of attention, and MSTR is right below it, after Amazon. It is a big thing that there are 2 Bitcoin products among the 8 most popular options.

“Options tied to BlackRock’s Bitcoin ETF are the 5th most active of ALL options by volume. Just 1 year after launch, they have already outperformed some of the most popular options names on the market. Notably, they have outperformed options on Gold ETFs.” -Nic

Yes, although gold has seen new ATH levels recently, it is much lower.

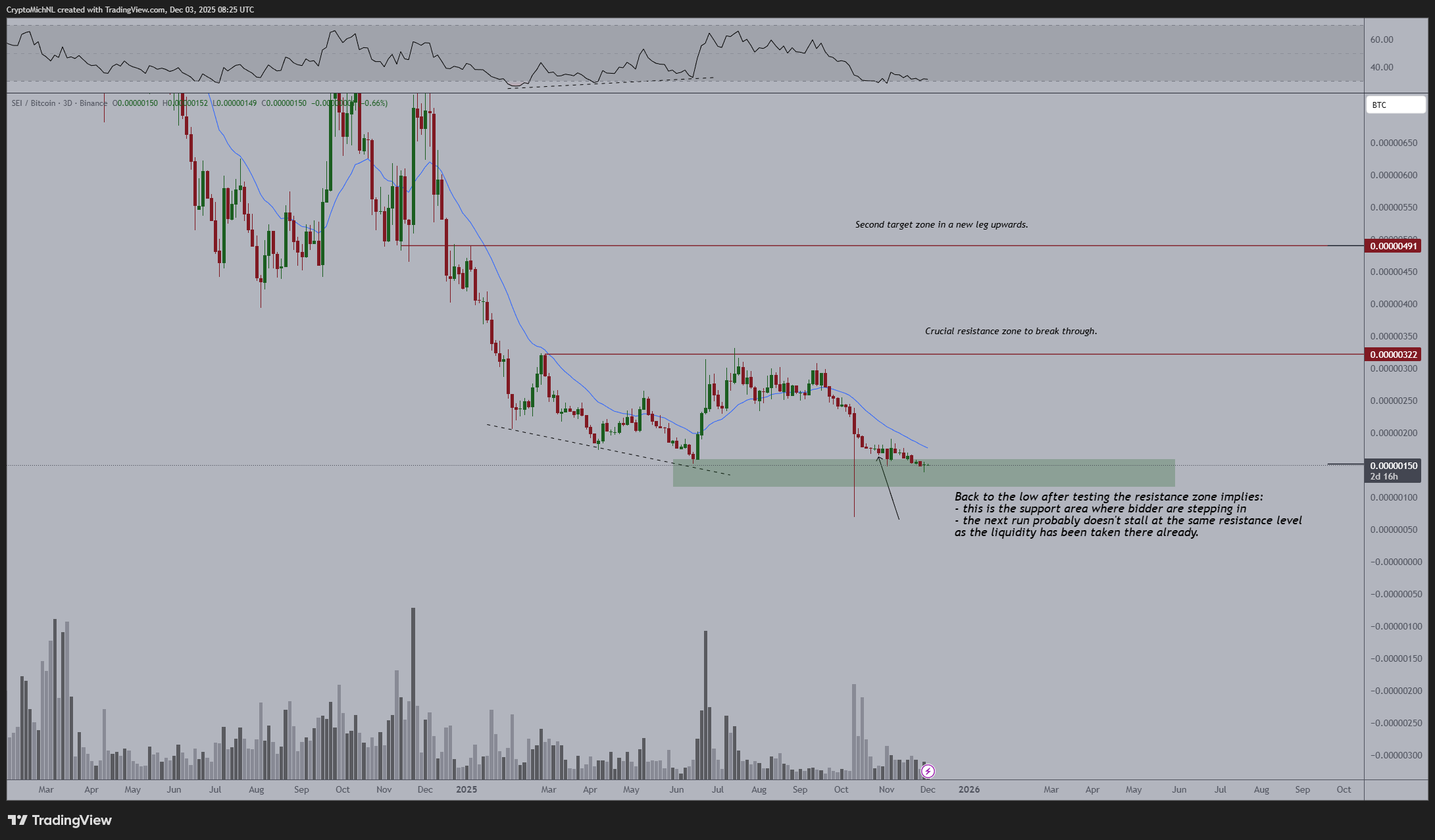

SEI Coin Forecast

Following the recovery in BTC price, altcoins that experienced rapid losses started double-digit increases. Many major altcoins continue the day with gains over 10%. Michael Poppe also has one of his favorite altcoins. to SEI drew attention.

Change in market sentiment SEI Coin The analyst sees the current levels as attractive, saying that it means further rise for .

“One of the strongest bounces yesterday was in SEI. I think we will gain more strength as market sentiment may be changing.

There is still a large bullish divergence and a new bullish divergence may be forming on lower time frames. “This shows that we are accumulating, and considering we are at an all-time low, it is not a bad area to accumulate positions.”