After the sharp activity in global markets on the first day of the week, the waiting period has begun. Bitcoin  $86,989.86 It recovered about 5 percent from its recent declines and found balance in the $90,000-95,000 range. Stocks and foreign exchange markets are also worried that the Fed’s interest rate decision will be announced next week. Federal Open Market Committee It maintains its horizontal course before the (FOMC) meeting. Markets are united in the view that the main factor that will determine the next direction will be the leadership change at the Fed.

$86,989.86 It recovered about 5 percent from its recent declines and found balance in the $90,000-95,000 range. Stocks and foreign exchange markets are also worried that the Fed’s interest rate decision will be announced next week. Federal Open Market Committee It maintains its horizontal course before the (FOMC) meeting. Markets are united in the view that the main factor that will determine the next direction will be the leadership change at the Fed.

Careful Waiting Before Fed Leadership Change

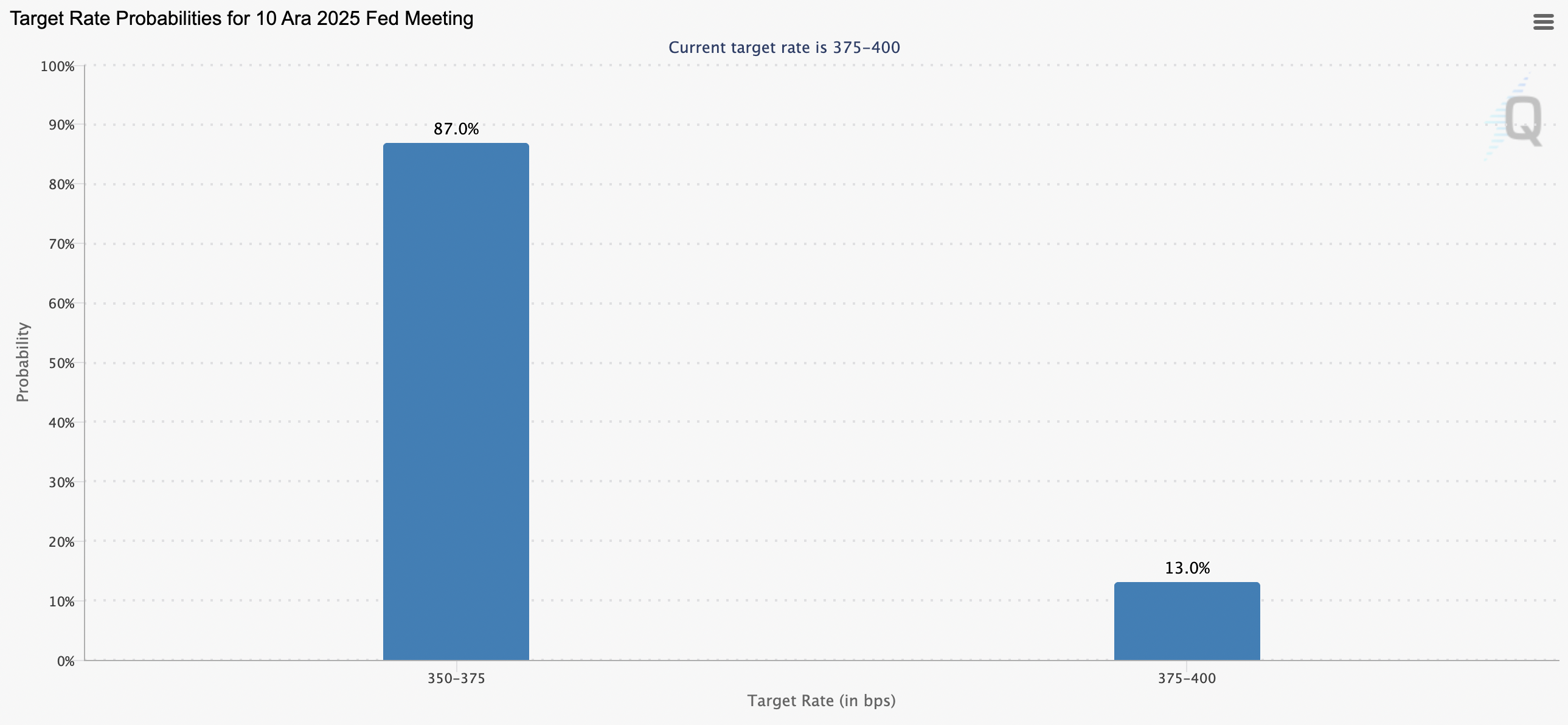

QCPAccording to ‘s latest market assessment, investors are considering both the possibility of a rate cut and the potential for the Fed chairmanship. Kevin HassettHe started to price the possibility of being appointed. Hassett’s new developments in betting markets Fed While the probability of him becoming president has increased to 85 percent, it is said that this change may move the FOMC’s direction to a more “dovish” line. CME FedWatch It puts the probability of a 25 basis point interest rate cut at next week’s meeting as 90 percent.

cryptocurrency marketThe fact that prices have stabilized after the volatility in recent weeks shows that investors tend to protect their positions. According to QCP, ahead of a politically charged FOMC process, market participants think that the internal leadership transition as well as the interest rate decision will be decisive in monetary policy directions.

Strategy Shares Soar As Bitcoin Consolidates

With the reaction from the low levels of $ 86,000, Bitcoin exceeded the $ 90,000 band and settled above this band, strengthening the perception of stability in the short term. Despite the cautious outlook of the market, there is a limited increase in investors’ risk appetite. QCP analysts state that the price movement being stuck around $95,000 can be read as a “pre-decisional lull”.

On the other hand, there is an important development on the institutional front. StrategyIt happened with the $1.4 billion share issuance of . This move alleviated short-term liquidity concerns and brought the company’s net asset value (mNAV) to 1.14 levels. However, it is considered that the MSCI index review that will take place on January 15 may create a new wave of volatility.