the month of november cryptocurrency market It was recorded as one of the weakest months of the last three years. Bitcoin amid prolonged government shutdown in the US  $86,989.86 and Ethereum

$86,989.86 and Ethereum  $2,804.64While ‘s monthly performances declined dramatically, investor confidence weakened rapidly. Altcoins also remained under significant selling pressure. Only a few projects were able to maintain the upward trend.

$2,804.64While ‘s monthly performances declined dramatically, investor confidence weakened rapidly. Altcoins also remained under significant selling pressure. Only a few projects were able to maintain the upward trend.

Weakening Momentum in Bitcoin

Economic outlook of November US governmentIt took shape in the shadow of the long closure of . Real economic activity contracted as public employees were placed on unpaid leave, which suppressed the appetite for risky assets. While stocks are showing signs of recovery Bitcoin It lost more than 18 percent in value, showing its second worst performance in the last three years.

Gold It regained its safe haven status, rising by 7 percent. In contrast, Bitcoin’s increasing correlation with stock markets has raised concerns that a possible S&P 500 correction could trigger steeper declines in cryptocurrencies. The negative perception on social media also supported this picture. Investors describe the market as having entered a “boring phase” due to a lack of new stories.

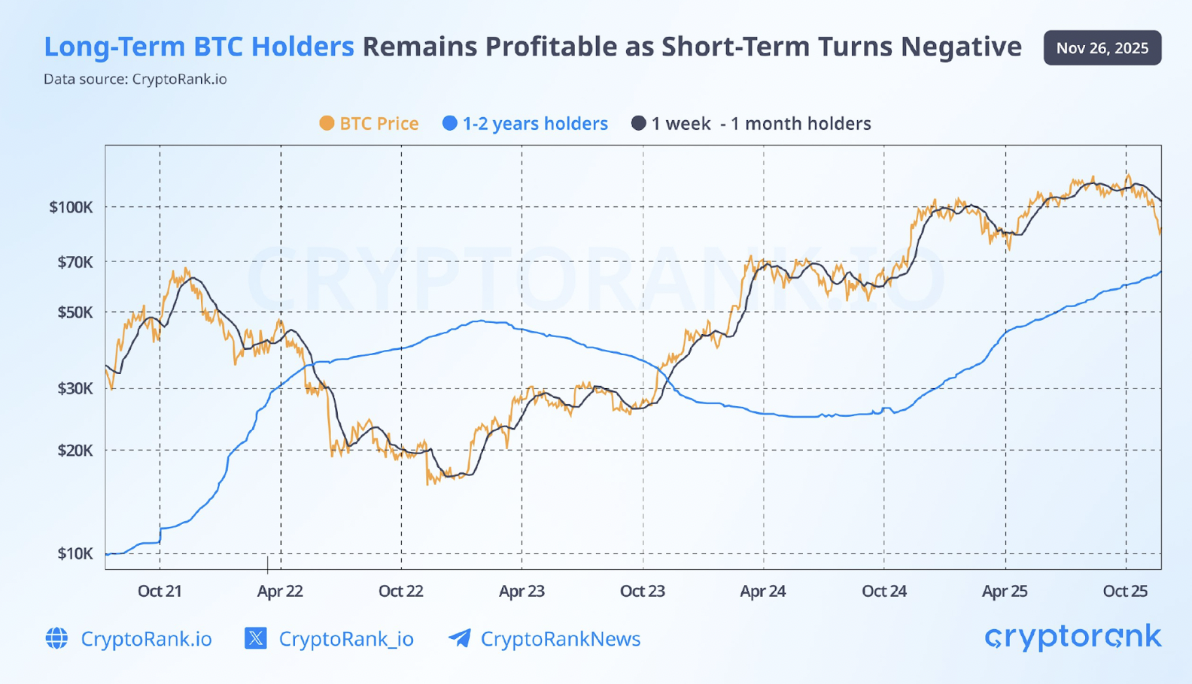

In-blockchain data shows that long-term investors accelerated their profit sales, while short-term wallets suffered losses. Analysts point out that the level of $ 66,000, which is the average cost threshold of 1-2 year investors, may create an accumulation zone again.

Stagnation Predominates in Ethereum and Other Networks

Ethereum It also had the second worst month of the year. It recorded only three positive closes throughout the year. The question of what kind of asset class ETH will be positioned as is still unanswered. It can neither be considered as a store of value like digital gold nor as a classic technology stock. This uncertainty increases price fluctuations.

BNB ChainThe number of transactions decreased by 32 percent, falling to the lowest level in the last three years. Transaction fees, which reached $71 million in the third quarter, fell to $17 million in November. solana With the decline of memecoin activities on the side, DEX volume decreased to 104 billion dollars. By contrast, spot Solana ETFs attracted net inflows for 21 consecutive days, reaching $619 million.

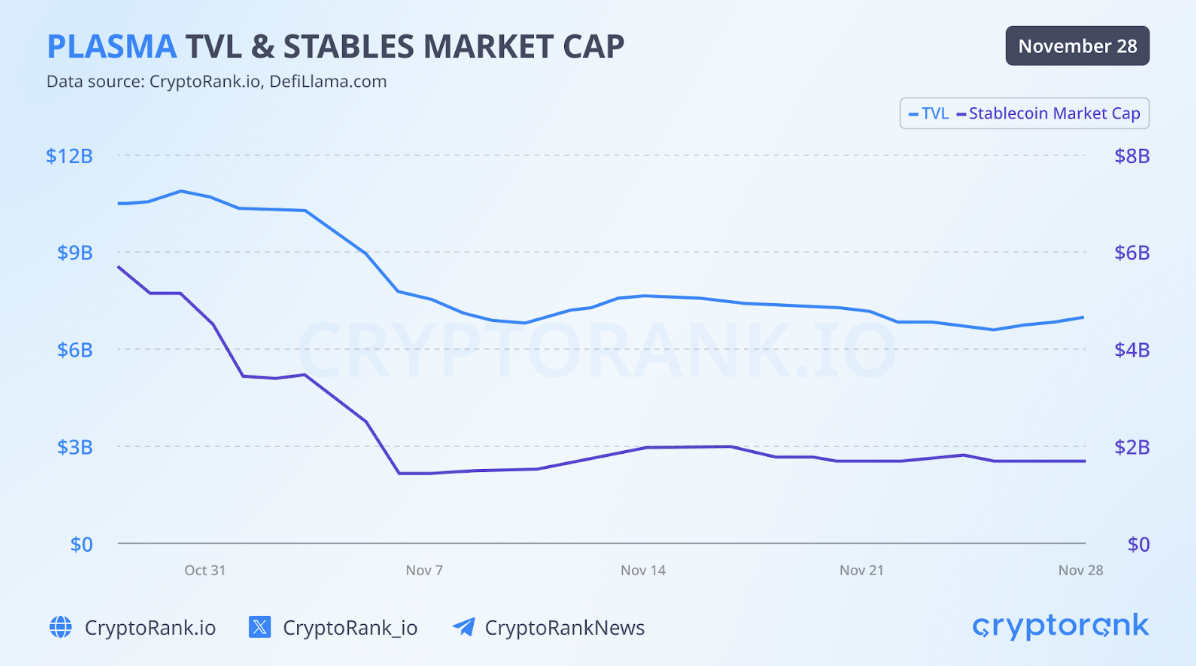

tronWhile , remains strong compared to other networks with the high income it generates from USDT transfers, base Although the network broke the transaction record, it saw the lowest level of the year in the number of active addresses. From new projects plasma lost investor confidence with a 68 percent stablecoin volume loss and a 90 percent coin collapse.