DAT is used as the abbreviation for Digital Asset Treasury and the community explains it as Crypto Reserve Companies. Although the concept of Digital Asset does not exactly evoke crypto in the community, the equivalent of crypto in traditional markets is “Digital Asset” and this is where the name of DAT comes from. So what are these DAT companies, what strategies do they follow, what do they do, what are their risks?

What is DAT?

Digital Asset Treasury (DAT) This year, especially in June, Ethereum  $2,804.64 It became popular with the entry of reserve companies into our lives. With the decline in cryptocurrencies, it started to be called a ticking time bomb. This company holds cryptocurrency directly on its balance sheet, and the company’s shares become a proxy ETF of the relevant crypto asset.

$2,804.64 It became popular with the entry of reserve companies into our lives. With the decline in cryptocurrencies, it started to be called a ticking time bomb. This company holds cryptocurrency directly on its balance sheet, and the company’s shares become a proxy ETF of the relevant crypto asset.

For example, people buy MSTR stock because of BTC He believes it will rise. nowadays MSTR It is oversold because cryptocurrencies have fallen too much. MSTR is traded with leverage, meaning that it has the potential to experience larger-scale movements in both rises and falls than BTC rises or falls.

DAT and Strategy

In 2020, MicroStrategy started accumulating BTC. There were no BTC spot or futures ETFs in those days. People started buying MSTR shares because they couldn’t buy BTC on the stock market. The company subsequently changed its name to Strategy because other companies followed this “strategy” and built new DATs.

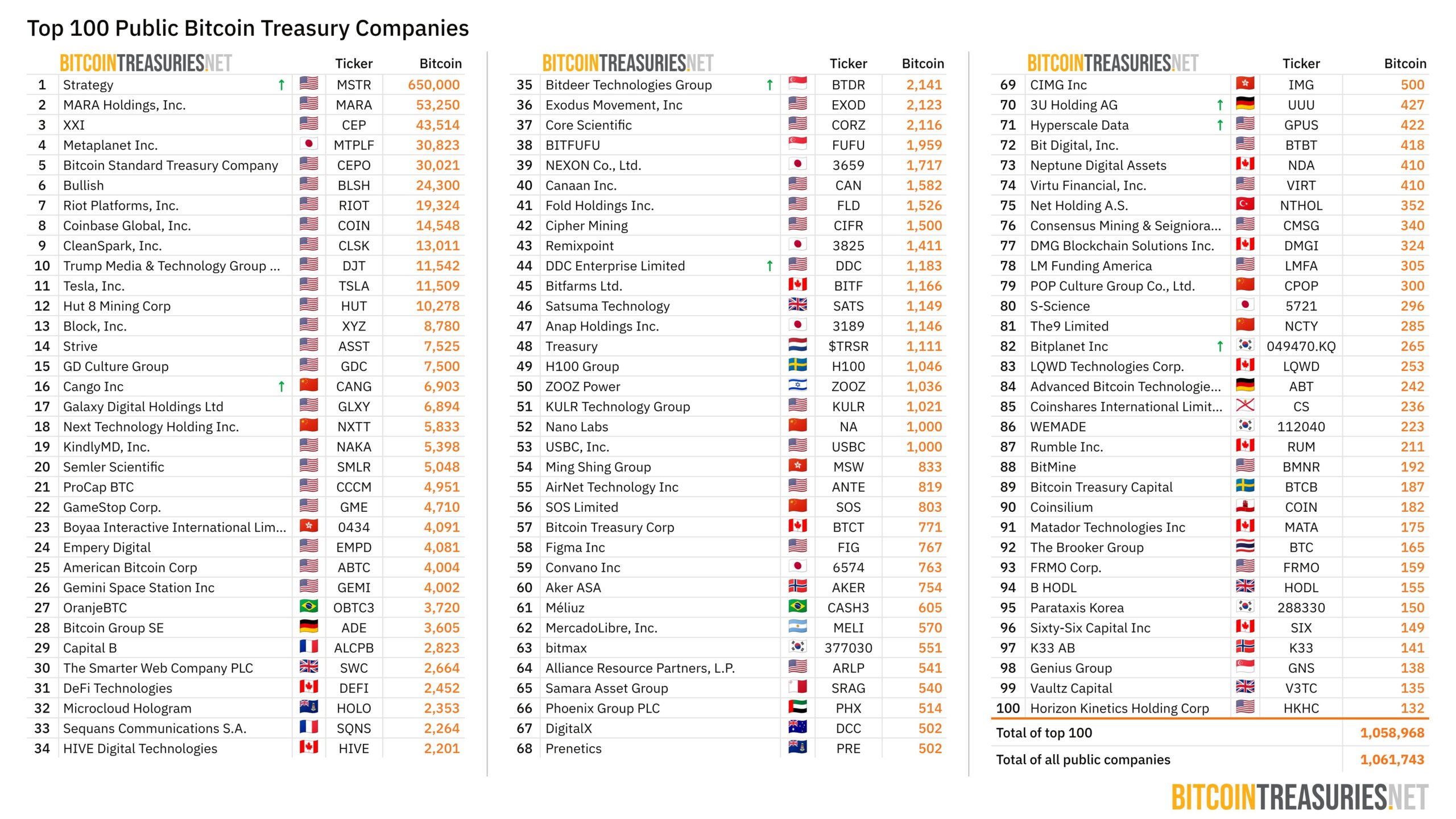

By 2021, less than 10 companies had BTC in their treasury. That number has since surpassed 190. Not to mention ETFs, ETPs and other things. All these companies cryptocurrency It buys and creates reserves, creates demand for its shares, issues more debt and expands its reserves, and in such a cycle, it lives the dream of reaching a size of tens of billions of dollars like MSTR.

According to The Block data, the total crypto reserve size of all DATs is over $100 billion. MSTR alone holds 650 thousand BTC, which means 65 billion dollars. BitMine alone is worth more than $10 billion ETH it keeps. So when we look at it, there are a few companies that stand out.

Why is DAT advantageous?

It is profitable for the company to create crypto reserves, increase its share value, issue debt and grow. So why do investors buy MSTR shares instead of buying BTC from the stock market? Or why not buy on-chain ETH instead of buying BitMine stock? Macquarie’s report at the end of November points to investors’ motivation for regulatory certainty.

Investment bank analysts said;

“They package crypto assets into securities regulated by the SEC. This removes regulatory uncertainty and guarantees the same public reporting, disclosures and investor protections as any publicly traded stock.”

And of course there is no 1:1 balance. Shares traded at a premium bring more profit than investing in the relevant cryptocurrency, especially during the rise period. For example, MSTR rose so much in the last year that it surpassed its peak in the dot-com bubble and reached the new ATH level. We are talking about a wave of demand that exceeds even the 20-year historical bubble peak.

mNAV and Cryptocurrency Reserve Companies (DAT)

DATs follow various strategies to increase investors’ returns. The indicator followed to monitor their performance is called mNAV. We mentioned above that the lack of 1:1 equality is a situation in favor of investors. Investors want this indicator to stay above 1 because the metric measures a company’s enterprise value against the value of its crypto assets. Above 1 means a premium transaction.

It can be thought of as leverage income. When the share price exceeds the net asset value of crypto assets, companies issue more shares and grow their reserves. For years, Michael Saylor’s company has been generating cash and receiving more BTC through its ATM program. Macquarie analysts say this;

“This creates a feedback loop that leads to an increase in crypto value per share: the issuer increases its capital, accumulates tokens, and sees its net asset value per share increase, which further increases the premium, leading to an increase in value.”

DATs in Crypto Crash

Just like the last 2 months cryptocurrencies What happens to DATs when they crash? The mNAV we mentioned above may fall below 1. This means that company shares are at a discount, that is, a negative premium, compared to crypto assets. If they have cash reserves, they can make stronger purchases during the decline and persevere for greater profits.

But those who have problems with debt, convertible bonds and equity issuance, that is, those who cannot access cash, need to meet their liquidity needs (for example, cash is required for dividend payments, no one wants their money regardless of the market decline). For this reason, they either sell their shares or assets. cryptocurrency sells. ETHZilla had to sell ETH, while Strategy sold shares and created a cash reserve that guarantees medium-term dividend payments.

CoinShares head of research James Butterfill said the following about yesterday’s Strategy cash reserve move:

“This situation is not very reassuring: it reveals both their dependence on a recovery in token prices and their expectations for that recovery. (It could force other DATs to follow suit.) We expect token prices to rise again, especially if the Federal Reserve cuts interest rates in December. This will help prevent the forced liquidation of these companies. However, this incident highlights the inherent fragility of the DAT model.”