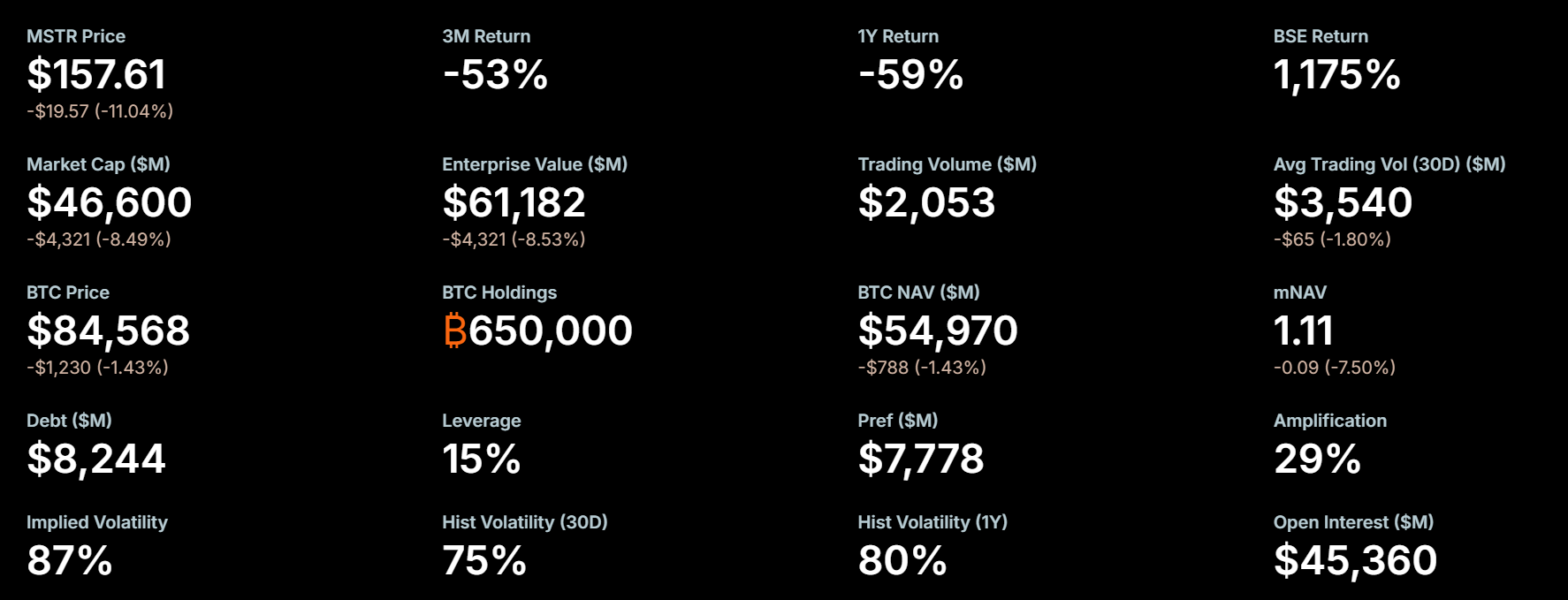

Cryptocurrencies turned downwards and the bottom deepened as feared after the stock market opened. Strategy and Japan are at the root of the decline today. While BTC pulled its daily bottom at $83,822 a few minutes ago, MSTR is rushing to new lows. Hundreds of millions of dollars in liquidations were triggered. Strategy MNAV is getting closer and closer to 1.

Strategy (MSTR)

The company, which holds 650 thousand BTC, announced today that it received 130 more BTC in the last week. They also announced $1.44 billion in cash reserves to guarantee dividend payments and dissipate FUD. While doing this, they revised their 2025 earnings targets downward due to BTC negativity, accelerating the MSTR decline.

Strategy’s MNAV continues the day at 1.11, down 7 percent. On Friday it was at 1.2.

Bitcoin  $86,219.53losing value faster than of MSTR The volatility it is experiencing will make it difficult for the company to access borrowing in the near future. If MNAV falls below 1, a scenario is possible in which the company will have to sell BTC and buy back shares. Last month ETHZilla We mentioned that when he sold ETH and announced a share buyback, this paved the way for crypto reserve companies (DAT) in an extremely bad way.

$86,219.53losing value faster than of MSTR The volatility it is experiencing will make it difficult for the company to access borrowing in the near future. If MNAV falls below 1, a scenario is possible in which the company will have to sell BTC and buy back shares. Last month ETHZilla We mentioned that when he sold ETH and announced a share buyback, this paved the way for crypto reserve companies (DAT) in an extremely bad way.

On Friday, the company’s CEO Le mentioned that if MNAV falls below 1 and they have to, they may sell BTC as a last resort. We also shared this as an important development. Today’s decline is largely fueled by the FUD fueled around Strategy, creating interesting conditions that we didn’t even see in the FTX crash. If the bottom is something seen when fear reaches its peak, it must be near now.

Cryptocurrency Drop

MSTR has fluctuated between $166 and $457 over the past 52 weeks, with the stock falling over 40% in November. The company, which made losses beyond Bitcoin, predicted in October that BTC would reach $150 thousand before the end of the year. A price estimate between 110 thousand dollars and 85 thousand dollars was shared today. Operating income has also been revised, targeting a range of minus $5.5 billion to +$6.3 billion.

When the hawkish statements of the Bank of Japan were added to all this, cryptocurrencies were negatively affected by the negativity in the risk markets. While gold and silver are making good gains, crypto, which is in the risk assets group, caryy trade collapse He is experiencing sales with anxiety. Last month, we wrote that Japan signaled this with its 100 billion dollar measure package and that bond interest rates were based on the peak in 2008, and we mentioned that the Japanese effect on crypto may become more noticeable as the December 18 meeting date approaches.

In his latest statements, Bank of Japan Governor Kazuo Ueda said that the pros and cons of the possible increase will be evaluated at the December 18-19 interest rate meeting. This fed concerns that the possibility of an interest rate increase would increase. If Powell does not signal that they will stabilize the fluctuation in global liquidity with more dovish-toned statements, this could be a harbinger of greater losses.