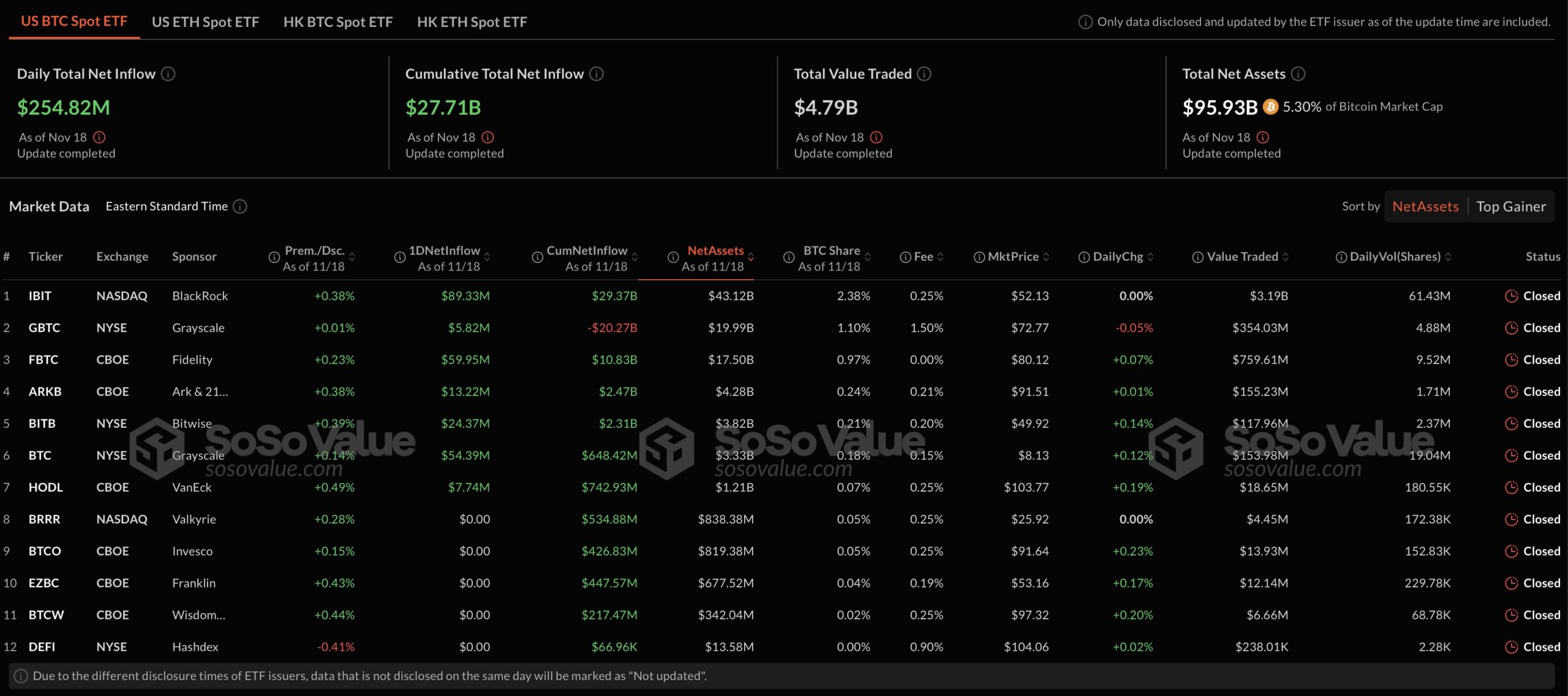

Bitcoin  $91,409The fact that the price of (BTC) maintained its strong stance at the level of 91 thousand dollars led investors to expect a new rise towards the level of 92 thousand dollars. With these optimistic expectations, there was a total net inflow of $255 million into spot Bitcoin ETFs in the USA on November 18. Highest entry with 90 million dollars BlackRockIt happened to ‘s iBit ETF. Introduce him to his ETF with $60 million. Fidelity followed. Spot Ethereum on the other hand

$91,409The fact that the price of (BTC) maintained its strong stance at the level of 91 thousand dollars led investors to expect a new rise towards the level of 92 thousand dollars. With these optimistic expectations, there was a total net inflow of $255 million into spot Bitcoin ETFs in the USA on November 18. Highest entry with 90 million dollars BlackRockIt happened to ‘s iBit ETF. Introduce him to his ETF with $60 million. Fidelity followed. Spot Ethereum on the other hand  $3,107 Their ETFs failed to perform as well, resulting in a net outflow of $39 million from these ETFs.

$3,107 Their ETFs failed to perform as well, resulting in a net outflow of $39 million from these ETFs.

BlackRock and Fidelity Led Entries

Entries following exits spot Bitcoin ETFIt shows that investor interest in currencies has increased again and investors are turning to BTC. BlackRock’s iBit fund took the leadership seat with a net inflow of $90 million. Fidelity’s fund follows BlackRock closely with a net inflow of $60 million. Other funds also painted a positive picture in this process.

Experts think that continued inflows will have a positive impact on the market. The increase in inflows to ETFs reveals that institutional investors’ interest in Bitcoin continues and investor confidence continues.

Ethereum On the other hand, the situation is quite different. On November 18, 12,700 ETH were sold from spot Ethereum ETFs. This corresponds to a net outflow of approximately $39 million. Experts state that Ethereum is losing interest among institutional investors. It is also stated that there is a serious difference between Bitcoin and Ethereum in terms of demand.

The Gap in BTC and ETH Demand Grows

The fact that Bitcoin is holding above the $91,000 threshold shows that investors are optimistic about the price. Strong inflows into spot ETFs also support this. Spot Bitcoin ETFs total 2 thousand 830 BTC While it attracts attention with its purchase, there is an opposite trend in spot Ethereum ETFs. Approximately 12 thousand 700 units on November 18 ETH The realization of the sale also confirms this situation.

Market analysts note that demand for Bitcoin is fueled by larger-scale institutional investments. It seems that Ethereum has lost its competitive advantage at this point. According to experts, the increasing dominance of the largest cryptocurrency will shape price movements in the coming period.

While investors’ focus is on spot Bitcoin ETFs, which are seeing strong demand, Ethereum’s situation stands out as a development worth monitoring. This situation cryptocurrency marketIt proves once again that Bitcoin is still in the leading position.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that crypto currencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.