Bitcoin (BTC) $55,763.36 After the $65,000 test failed, it returned to $52,000 levels. The last major reason for the fluctuation was the rapid losses in US stocks. So what is the latest situation in Bitcoin charts and order book data after the decline? Will we see a recovery?

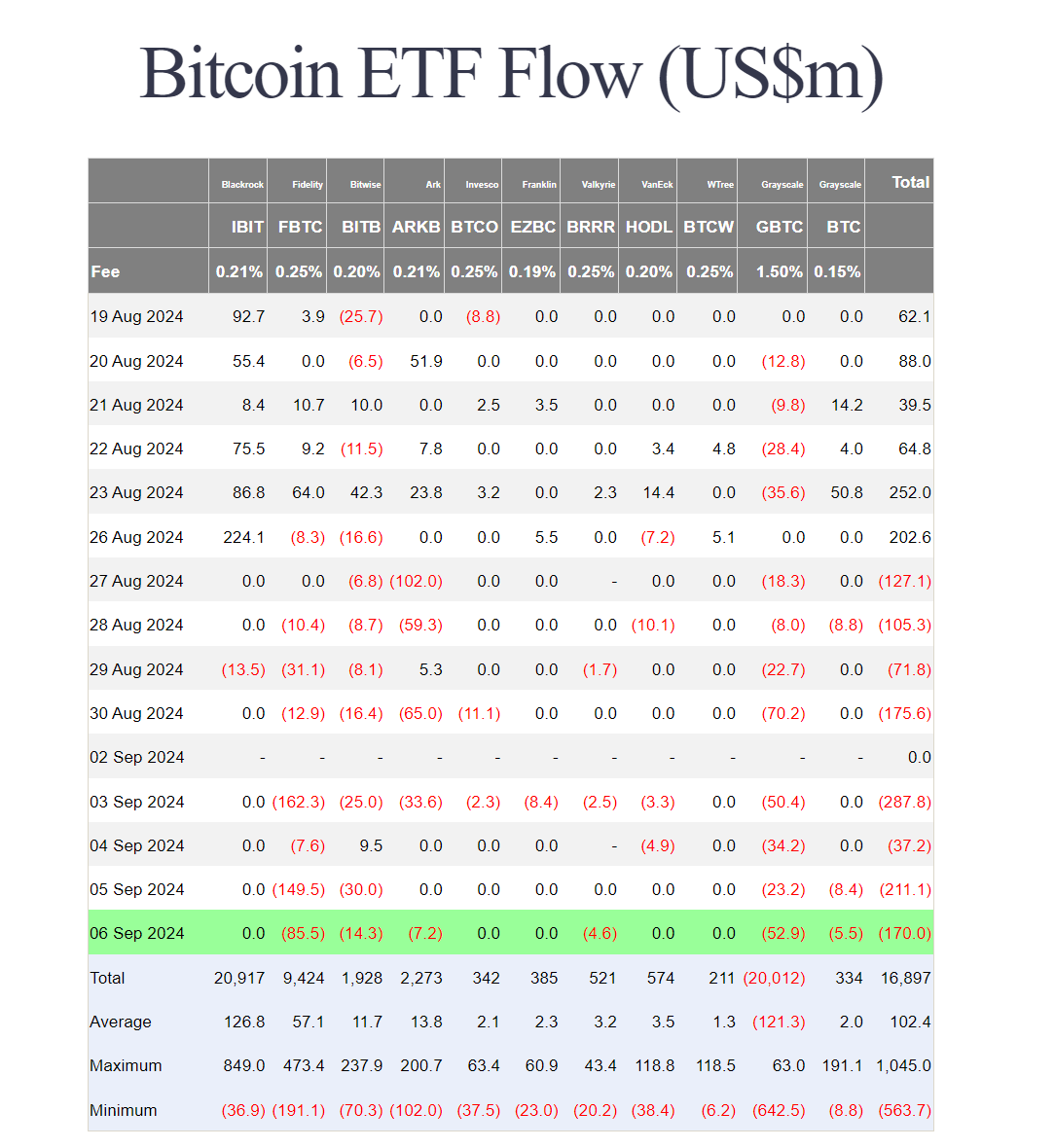

Bitcoin ETF Data

Investors familiar with traditional markets to cryptocurrencies ETF approvals were an extremely important development for investors to be able to invest. Although we saw serious net flows in the first quarter, total net inflows on the BTC ETF side turned flat afterwards. The sales have been continuing in a demoralizing way for a while. A user named WhalePanda discussed the current situation on the ETF channel and wrote the following; A Prize Pool Worth 21 Million TL Awaits You from BinanceTR! Participating and winning has never been easier.. You can sign up to BinanceTR from this link. Get your first crypto!

“Good morning,

Yesterday’s Bitcoin ETF “flows were negative once again at $170 million, for a total weekly outflow of $706.1 million. Fidelity had outflows of $85.5 million, GBTC $52.9 million, and Bitwise $14.3 million. The price dropped below $53,000 and is stalling at $54,000.”

Above you can see the day-by-day details of the recent outbursts with Farside data.

Bitcoin Extensive Analysis

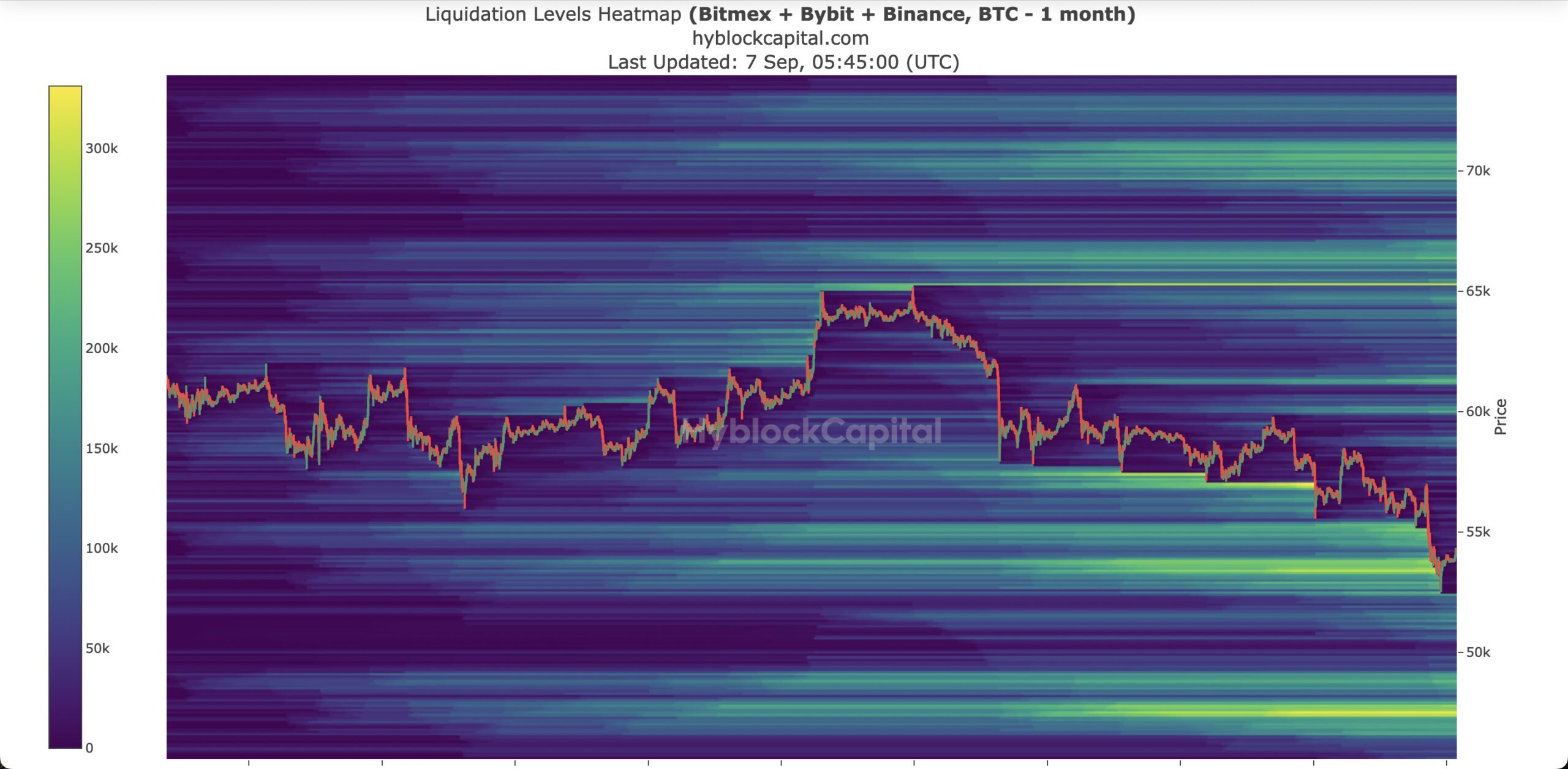

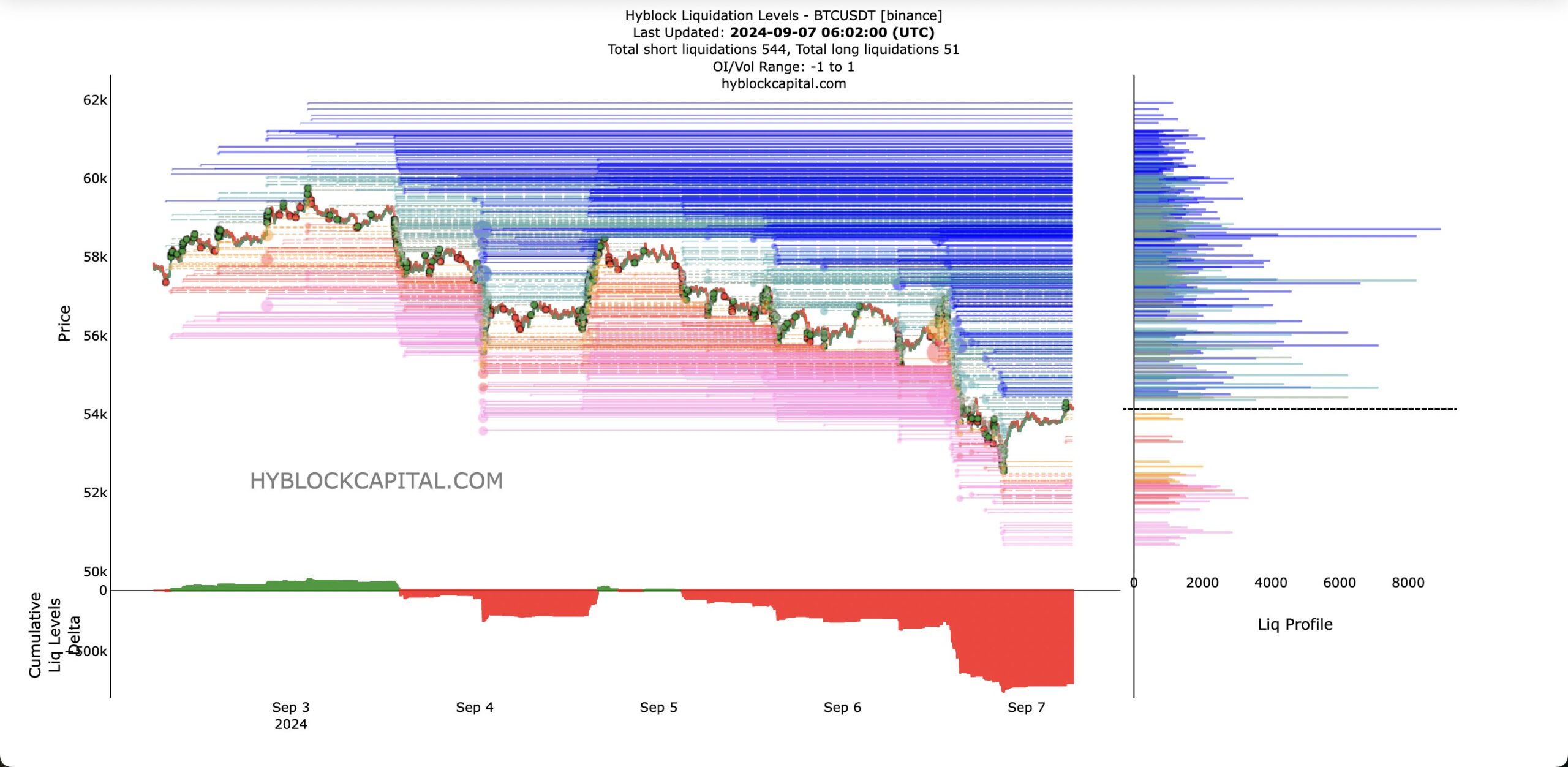

Marco Johanning is Bitcoin price He was trying to understand the current perspective of investors by sharing the heat map with his chart. We mentioned how important the 0.786 point is in Fib levels, Marco underlines this. The analyst, who draws attention to the risk of $ 49,000 and $ 44,000 under $ 52,000, draws attention to the potential for a new bottom in possible oversales.

With the loss of the area between $44,000 and $49,000, which is noted as the next liquidity cluster, BTC There is also the potential for a drop to $40,000.

“And the next batch of liquidity is at the next logical point: below the Black Monday low, of course. So could “Rektember” theoretically go lower and touch the 40s again? Yes.

But that may only be 0.786, which is a very deep pullback, but nothing out of the ordinary in crypto. I have stated many times, including yesterday, why I believe we are near the bottom and that “September” will begin in 1-2.5 weeks. I will stick to my plan: my limit orders around the Black Monday Bottoms are ready and waiting for a better Q4!”

The analyst points out the potential for a new bottom in the next 48 hours and states that it may be logical to enter buy orders at satisfactory levels, and that he expects an increase in the last quarter.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.